Personal loans can be a useful tool for those looking to consolidate debt, finance large purchases, or cover unexpected expenses. However, before taking out a personal loan, it’s important to understand the interest rates that come with them.

Typically, interest rates on personal loans can vary depending on a variety of factors such as credit score, income, and loan amount. So, what is the typical interest rate on a personal loan? Let’s dive in and explore this topic further.

The typical interest rate on a personal loan varies depending on several factors, including the borrower’s credit score, the loan amount, and the loan term. However, the average interest rate for a personal loan ranges from 6% to 36%. It’s important to shop around and compare offers from multiple lenders to find the best interest rate and terms for your personal loan.

Contents

- What is the Typical Interest Rate on a Personal Loan?

- Frequently Asked Questions

- 1. What factors determine the interest rate on a personal loan?

- 2. Are personal loan interest rates fixed or variable?

- 3. What is the average interest rate on a personal loan?

- 4. How can I lower the interest rate on my personal loan?

- 5. What happens if I can’t make my monthly payments on my personal loan?

- About Interest Rates on Personal Loans

What is the Typical Interest Rate on a Personal Loan?

Personal loans are a popular choice among people who are in need of quick cash. Whether it’s for a medical emergency, home renovation, or debt consolidation, personal loans can provide the necessary funds. However, before applying for a personal loan, it is important to understand the interest rates involved. In this article, we will discuss the typical interest rates on personal loans and what factors affect them.

Factors Affecting Personal Loan Interest Rates

There are several factors that affect personal loan interest rates. Some of these include:

- Credit score: Your credit score plays a significant role in determining the interest rate on your personal loan. A higher credit score usually means a lower interest rate.

- Income: Your income is also a factor that lenders consider when determining your interest rate. A higher income may mean a lower interest rate.

- Debt-to-income ratio: Lenders also look at your debt-to-income ratio, which is the amount of debt you have compared to your income. A lower debt-to-income ratio may result in a lower interest rate.

- Loan amount and term: The amount and term of the loan can also affect the interest rate. Generally, shorter loan terms and smaller loan amounts have lower interest rates.

- Type of loan: The type of personal loan you choose can also affect the interest rate. Secured loans, which require collateral, usually have lower interest rates than unsecured loans, which do not require collateral.

Overall, the interest rate on a personal loan can vary depending on your financial situation and the lender’s requirements.

Average Interest Rates on Personal Loans

The average interest rate on a personal loan can vary depending on several factors, including the lender’s requirements and the borrower’s creditworthiness. Here are some average interest rates for personal loans:

| Credit Score | Average Interest Rate |

|---|---|

| Excellent (720-850) | 10.3% |

| Good (690-719) | 14.5% |

| Fair (630-689) | 19.2% |

| Poor (300-629) | 28.2% |

Keep in mind that these are just average interest rates and your rate may be higher or lower depending on your financial situation and the lender’s requirements.

Benefits of Personal Loans

Personal loans can provide several benefits, including:

- Flexible use of funds: You can use personal loans for a variety of purposes, including debt consolidation, home improvements, and medical expenses.

- No collateral required: Most personal loans are unsecured, which means you don’t have to put up any collateral.

- Fixed interest rates: Personal loans usually have fixed interest rates, which means your monthly payments will remain the same throughout the life of the loan.

- Quick access to funds: Personal loans can provide quick access to cash, which can be especially helpful in emergencies.

Personal Loans vs. Credit Cards

Personal loans and credit cards are both options for borrowing money, but they have some key differences. Here are a few things to consider when choosing between a personal loan and a credit card:

- Interest rates: Personal loans usually have lower interest rates than credit cards, which can save you money in the long run.

- Repayment terms: Personal loans have fixed repayment terms, which can help you budget your payments. Credit cards have minimum payments that can vary from month to month.

- Credit score impact: Personal loans can have a positive impact on your credit score if you make your payments on time. Credit cards can have a negative impact if you carry a high balance.

Ultimately, the choice between a personal loan and a credit card depends on your individual needs and financial situation.

Conclusion

Personal loans can provide quick access to cash for a variety of purposes. However, it is important to understand the interest rates involved and what factors can affect them. By considering your financial situation and the lender’s requirements, you can find a personal loan that works for you.

Frequently Asked Questions

Here are some commonly asked questions about personal loan interest rates:

1. What factors determine the interest rate on a personal loan?

The interest rate on a personal loan is determined by several factors, including your credit score, income, and debt-to-income ratio. Lenders also consider the loan amount and the length of the loan term when determining the interest rate. Generally, borrowers with higher credit scores and lower debt-to-income ratios are offered lower interest rates.

It’s important to shop around and compare rates from multiple lenders to find the best interest rate for your personal loan. You may also be able to negotiate the interest rate with the lender if you have a strong credit history and financial standing.

2. Are personal loan interest rates fixed or variable?

Personal loan interest rates can be either fixed or variable. A fixed interest rate remains the same throughout the loan term, while a variable interest rate can change based on market conditions. Fixed interest rates provide more stability and predictability in your monthly payments, while variable interest rates can offer lower rates initially but may increase over time.

When choosing between a fixed or variable interest rate on a personal loan, consider your financial goals and risk tolerance. If you prefer a steady monthly payment and want to avoid any surprises, a fixed interest rate may be the better option.

3. What is the average interest rate on a personal loan?

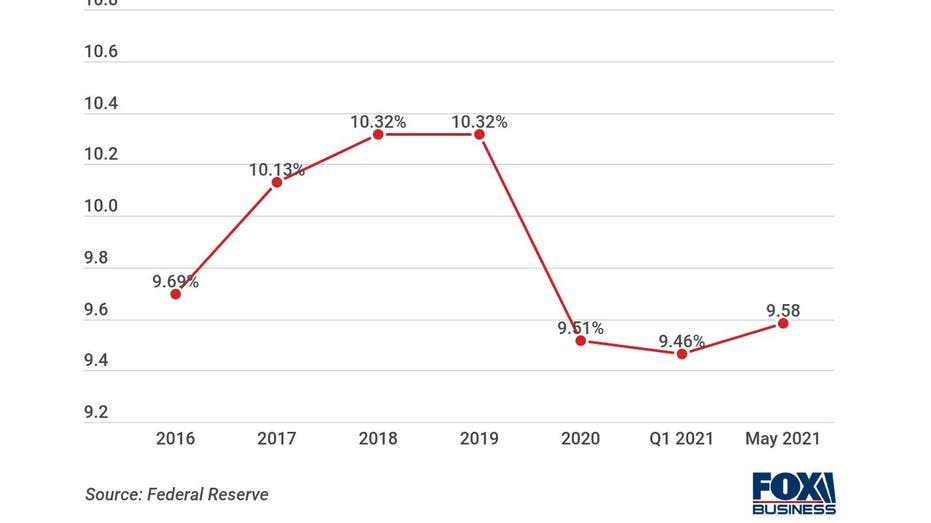

The average interest rate on a personal loan can vary depending on the lender, borrower’s credit score, loan amount, and loan term. According to Experian, as of Q2 2021, the average interest rate on a personal loan was 9.46%. However, borrowers with excellent credit scores may be able to qualify for interest rates as low as 6%.

It’s important to note that interest rates can vary widely among lenders, so it’s important to shop around and compare rates to find the best deal for your personal loan.

4. How can I lower the interest rate on my personal loan?

There are several ways to potentially lower the interest rate on your personal loan. You can improve your credit score by making timely payments on your existing debts and reducing your credit utilization ratio. You can also consider getting a co-signer with good credit to increase your chances of getting approved for a lower interest rate.

If you already have a personal loan, you may be able to refinance it to a lower interest rate. Refinancing involves taking out a new loan to pay off your existing loan, usually with a lower interest rate and better terms.

5. What happens if I can’t make my monthly payments on my personal loan?

If you can’t make your monthly payments on your personal loan, you could face late fees, penalties, and damage to your credit score. Your lender may also take legal action against you to collect the debt. It’s important to communicate with your lender if you’re experiencing financial hardship and explore options such as deferment, forbearance, or loan modification.

Defaulting on a personal loan can have serious consequences, so it’s important to borrow responsibly and only take out a loan that you can realistically afford to repay.

About Interest Rates on Personal Loans

In conclusion, the interest rate on a personal loan varies depending on several factors, such as the borrower’s credit score, loan amount, and loan term. It’s crucial to shop around and compare rates from different lenders to ensure you get the best deal possible. Keep in mind that a lower interest rate can save you thousands of dollars in the long run.

Additionally, it’s important to have a clear understanding of the terms and conditions of the loan before signing on the dotted line. Make sure you know what fees are associated with the loan and whether there are any prepayment penalties.

In summary, taking out a personal loan can be a great way to finance a big purchase or consolidate high-interest debt. But before you apply for a loan, do your research, compare rates, and make sure you understand the terms and conditions. With careful planning and consideration, you can secure a loan with a reasonable interest rate that fits your needs and budget.