Do you want to know the difference between active and passive investing? Investing can be a complicated and daunting process, but it doesn’t have to be. Understanding the difference between active and passive investing can be the key to making informed decisions when it comes to your finances. In this article, we’ll look at the key differences between active and passive investing, and how each approach can be used to achieve your financial goals. By the end of this article, you’ll have a better understanding of the two investing styles and be able to make informed decisions when it comes to your finances.

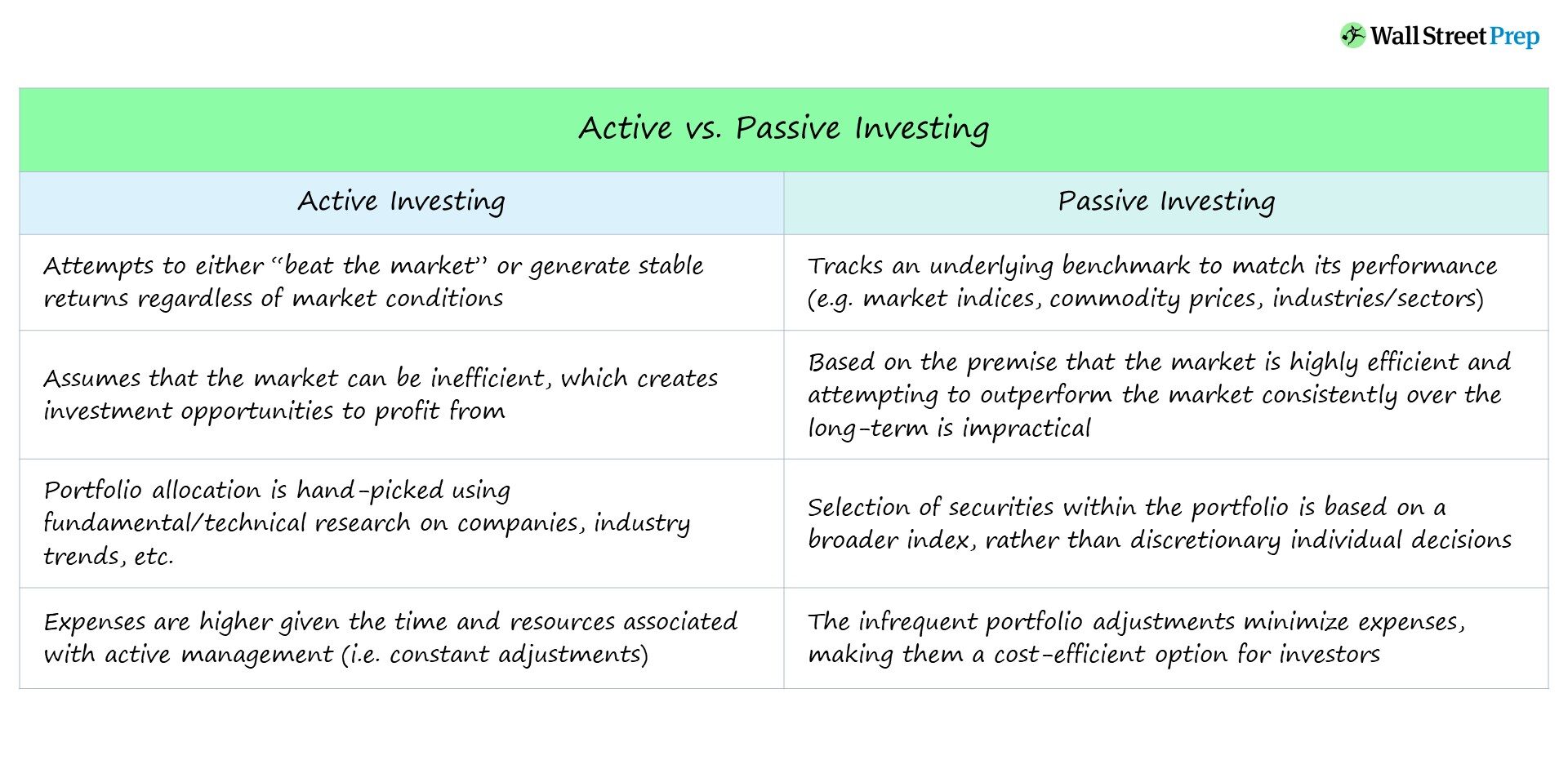

| Active Investing | Passive Investing |

|---|---|

| Active investing involves buying and selling of securities with the goal of outperforming the market. | Passive investing involves buying and holding securities for the long-term with the goal of matching the market. |

| Requires frequent monitoring and adjusting. | Does not require frequent monitoring and adjusting. |

| Higher expenses. | Lower expenses. |

| Involves more risk. | Involves less risk. |

What Is The Difference Between Active And Passive Investing?: In-Depth Comparison Chart

| Active Investing | Passive Investing |

|---|---|

| Active investing is a strategy where investors actively manage their investments by making decisions based on research, analysis and predictions about the movement of the stock market. | Passive investing is an investment strategy that tracks a market index. Investors purchase securities that match the index to maintain a certain level of risk and return. |

| Active investors try to beat the market by making educated guesses on the direction of the stock market. | Passive investors don’t try to beat the market, instead they invest in the same securities as the market index. |

| Active investors often buy and sell securities frequently, which can incur trading costs. | Passive investors usually buy and hold, meaning they incur fewer trading costs. |

| Active investors must do their own research and make their own decisions. | Passive investors rely on existing market indices, so they don’t need to do any research. |

| Active investors may be able to achieve higher returns than the market. | Passive investors may achieve returns that match the market’s performance. |

| Active investing requires a lot of time and effort. | Passive investing is a much simpler and less time-consuming process. |

Contents

What is the Difference Between Active and Passive Investing?

Active investing and passive investing are two of the most popular methods of investing today. Each approach carries its own unique set of pros and cons, and understanding the differences between the two can help investors make the best possible decisions when it comes to investing their money.

Active Investing

Active investing, also known as active management, is a strategy that involves actively selecting and trading securities in order to achieve a specific investment goal. It involves a certain degree of research, analysis and decision-making, and is typically employed by professional investment managers. Active investors seek to outperform the market by taking advantage of short-term market inefficiencies and attempting to time the markets.

The main advantage of active investing is the potential for higher returns. By actively seeking out undervalued stocks and other investments, active investors can potentially make a higher return than if they had simply invested in an index fund or a similar passive investment. Active investors also have the potential to minimize losses if they are able to identify when a stock is overvalued or when a market is trending downwards.

The main disadvantage of active investing is that it carries a higher degree of risk. Active investors must constantly monitor their investments and make decisions that could potentially cause them to lose money. Additionally, active investing can be time-consuming and costly, as there are often transaction costs associated with buying and selling securities.

Passive Investing

Passive investing is a strategy that focuses on holding onto investments for the long-term and minimizing transaction costs. This type of investing does not involve actively selecting stocks or other investments, but rather simply investing in an index fund or a similar passive investment vehicle.

The main advantage of passive investing is that it is a low-cost, low-risk approach to investing. By holding onto investments for the long-term, investors can avoid the costs associated with trading, and can also avoid taking on the risk associated with actively selecting and trading securities. Additionally, passive investing can be a less time-consuming approach to investing.

The main disadvantage of passive investing is that it has the potential to produce lower returns than active investing. Because passive investors are not actively seeking out undervalued investments or attempting to time the markets, they may not be able to take advantage of short-term market inefficiencies and can therefore miss out on potential returns.

Tax Implications

The tax implications of active and passive investing can vary depending on the type of investments and the specific situation. Generally speaking, active investors are typically subject to higher taxes due to the nature of their transactions. Active investors are subject to capital gains taxes when they sell investments for a profit, and may be subject to taxes on dividends and interest income.

Passive investors, on the other hand, typically face fewer taxes. Because passive investors are not actively buying and selling investments, they are typically not subject to capital gains taxes. Additionally, passive investors may be able to take advantage of tax-deferred accounts, such as IRAs and 401(k)s.

Risk Tolerance

The level of risk tolerance is another important factor to consider when deciding between active and passive investing. Active investors typically take on a higher level of risk, as they must constantly monitor the markets and make decisions that could potentially cause them to lose money. Passive investors, on the other hand, typically take on a lower level of risk, as they are not actively selecting and trading securities.

The level of risk an investor is willing to accept should be considered when deciding between active and passive investing. Investors who are more risk-averse may be better off choosing passive investing, while investors who are willing to take on more risk may be better off choosing active investing.

Investment Horizon

The length of time an investor intends to hold onto investments, or the investment horizon, is another important factor to consider when deciding between active and passive investing. Active investors typically have a shorter investment horizon, as they are actively buying and selling securities in an attempt to take advantage of short-term market inefficiencies. Passive investors, on the other hand, typically have a longer investment horizon, as they are not actively buying and selling securities.

The investment horizon should be considered when deciding between active and passive investing. Investors who plan on holding onto investments for the long-term may be better off choosing passive investing, while investors who are looking to take advantage of short-term market inefficiencies may be better off choosing active investing.

Costs and Fees

The costs and fees associated with active and passive investing should also be considered when making a decision. Active investing typically carries higher fees, as it involves the cost of research, analysis and decision-making. Passive investing, on the other hand, typically carries lower fees, as it does not involve actively selecting and trading securities.

The costs and fees associated with active and passive investing should be taken into account when deciding between the two strategies. Investors who are looking to minimize costs and fees may be better off choosing passive investing, while investors who are willing to pay higher fees for the potential of higher returns may be better off choosing active investing.

What is the Difference Between Active and Passive Investing? Pros & Cons

Pros of Active Investing:

- Potential higher returns

- More control over investments

- Ability to capitalize on market opportunities

- More personalized advice

Cons of Active Investing:

- Higher transaction costs

- Requires more time and research

- Exposure to more risk

- May not perform better than passive investing

Pros of Passive Investing:

- Lower transaction costs

- Less time and research required

- Lower risk exposure

- May outperform active investing

Cons of Passive Investing:

- Potential lower returns

- Less control over investments

- Cannot capitalize on market opportunities

- Less personalized advice

Which is Better – What is the Difference Between Active and Passive Investing?

Active investing involves actively seeking out investments and managing portfolios in an effort to beat the market. Passive investing involves taking a more hands-off approach and relying on index funds or exchange-traded funds (ETFs) to mirror the performance of the broader markets.

When it comes to investing, it really depends on the individual investor. Active investing can be more suitable for those who have the time, knowledge, and resources to actively manage their portfolio. Passive investing, on the other hand, is more suitable for those who do not have the time or resources to actively manage their portfolio.

Ultimately, the decision between active and passive investing is up to the individual investor. Both approaches have their merits, and selecting the right approach will depend on the investor’s financial goals, risk tolerance, and personal preferences.

For those who are looking to make the most of their investments, here are three reasons why passive investing is the clear choice:

- Lower costs – Passive investing involves fewer fees and expenses than active investing

- Simplicity – Passive investing is simpler than active investing and requires less effort to manage

- Higher returns – Over the long term, passive investing has historically produced higher returns than active investing

Overall, passive investing is the clear winner when it comes to making the most of your investments. With lower costs, simplicity, and higher returns, passive investing is the ideal approach for those looking to maximize their return on investment.

Frequently Asked Questions

Active investing and passive investing are two distinct ways of investing. Active investing involves making decisions about which investments to make, while passive investing involves investing in a diversified portfolio that is managed by professionals. Below are answers to some of the most commonly asked questions about active and passive investing.

What is active investing?

Active investing is an investing strategy where investors make decisions about which investments to make. This strategy is usually done by individual investors, or with the help of a professional financial advisor. Active investors typically research and analyze investments, and make decisions about when to buy and sell investments.

What is passive investing?

Passive investing is an investing strategy that involves investing in a diversified portfolio and leaving the management of the portfolio to a professional. This strategy is typically used by investors who don’t have the time or expertise to actively manage their investments. Passive investors will typically invest in a variety of assets, such as stocks, bonds, and mutual funds, and typically hold those investments for the long-term.

What are the benefits of active investing?

One of the main benefits of active investing is the potential to outperform the market. Active investors, with the help of a financial advisor, can make informed decisions about when to buy and sell investments, and can potentially generate higher returns than a passively managed portfolio. Additionally, active investors may be able to take advantage of market conditions and capitalize on short-term opportunities.

What are the benefits of passive investing?

Passive investing offers investors the advantage of not having to actively manage their investments. This strategy is typically recommended for investors who don’t have the time or expertise to research and analyze investments. Additionally, passive investing is usually less expensive than active investing, since it doesn’t require the services of a financial advisor.

Which investing strategy is best?

The best investing strategy depends on each individual investor’s needs and goals. Active investing may be a good option for investors who have the time and expertise to research and analyze investments, and who are comfortable taking on more risk. Passive investing may be a better option for investors who don’t have the time or expertise to actively manage their investments. Ultimately, the best strategy is the one that best meets each individual investor’s needs.

What is Active and Passive Investing?

The decision of whether to actively or passively invest is a personal one, and it is important to consider your individual goals and objectives when making this decision. Active investing may provide the opportunity for higher returns and greater control over investments, while passive investing requires less time, effort and resources. Ultimately, it is up to the individual investor to decide which method is best suited to their financial goals and objectives. By understanding the differences between active and passive investing, you can make an informed decision that will help you achieve your investment goals.