When it comes to investing, there are two primary options: stocks and bonds. Both offer the opportunity for financial gain, but they differ in several key ways. Understanding the differences between the two can help you make informed decisions about your investment portfolio. In this article, we’ll explore the basics of stocks and bonds, and help you determine which may be right for you.

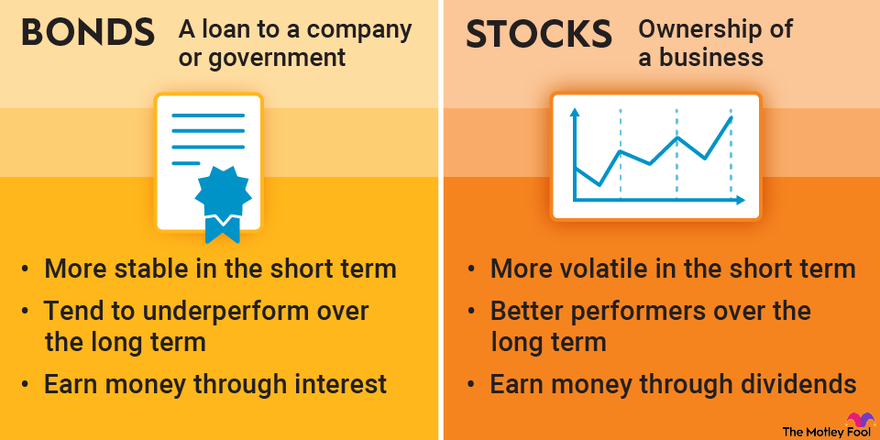

A stock represents ownership in a company and provides the holder with the potential for capital gains and dividends, while a bond represents a debt obligation and provides the holder with a fixed income stream and return of principal at maturity. Stocks are generally considered riskier than bonds but offer higher potential returns over the long term.

Understanding the Difference Between Stocks and Bonds

Investing can be a great way to build wealth, but it’s important to understand the different types of investments available. Two of the most common investment types are stocks and bonds. While they both offer the potential for growth and income, they are very different in terms of risk and return. In this article, we’ll explore the difference between stocks and bonds, and how they fit into a well-diversified investment portfolio.

What is a Stock?

Stocks, also known as equities, represent ownership in a company. When you buy a stock, you become a shareholder in that company and have a claim on its earnings and assets. Stocks are traded on stock exchanges, and their prices are determined by supply and demand. If a company is doing well and investors believe its future prospects are bright, the stock price will likely rise. On the other hand, if a company is struggling or there is negative news, the stock price may fall.

Investing in stocks can be a great way to build long-term wealth, but it’s important to remember that stocks can be volatile. Prices can fluctuate wildly in the short term, and there is no guarantee of a positive return. However, over the long term, stocks have historically provided higher returns than other types of investments.

The Basics of Bonds

Bonds are debt securities issued by companies, governments, or other organizations. When you buy a bond, you are essentially lending money to the issuer. In exchange, the issuer promises to pay you a fixed rate of interest and return your principal at a specified date in the future.

Bonds are generally considered less risky than stocks, as they provide a fixed income stream and return of principal at maturity. However, there is still some risk involved, particularly if inflation erodes the purchasing power of the bond’s interest payments. Bond prices also fluctuate based on changes in interest rates, with prices typically falling as interest rates rise.

Stocks vs. Bonds: Which is Right for You?

When it comes to choosing between stocks and bonds, there is no one-size-fits-all answer. It really depends on your individual financial goals and risk tolerance. If you’re looking for long-term growth and are willing to accept some short-term volatility, stocks may be a good choice. On the other hand, if you’re looking for a more stable income stream and want to preserve your capital, bonds may be a better option.

It’s also important to consider diversification. A well-diversified portfolio will include a mix of stocks and bonds, along with other types of investments like real estate and commodities. This can help reduce risk and ensure that your portfolio is better able to weather market volatility.

The Benefits of Stocks

There are several benefits to investing in stocks. First and foremost, stocks have historically provided higher returns than other types of investments over the long term. This is because companies can grow their earnings over time, which can lead to higher stock prices. Stocks also offer the potential for dividend income, which can provide a steady stream of cash flow.

Another benefit of stocks is their liquidity. Stocks can be bought and sold on stock exchanges at any time during market hours, which means you can quickly and easily access your investment funds if needed.

The Benefits of Bonds

While bonds may not offer the same potential for growth as stocks, they do offer several benefits of their own. First and foremost, bonds provide a fixed income stream, which can be an attractive option for investors who are looking for a stable source of cash flow. Bonds also have a lower volatility than stocks, which can make them a good choice for investors who are more risk-averse.

Finally, bonds can provide diversification benefits, as they tend to have a lower correlation with stocks than other types of investments. This means that adding bonds to a portfolio can help reduce overall portfolio risk.

Stocks vs. Bonds: The Bottom Line

Ultimately, the decision to invest in stocks or bonds (or both) depends on your individual financial goals and risk tolerance. Both investments have their pros and cons, and a well-diversified portfolio will include a mix of both.

When investing in stocks or bonds, it’s important to do your research and understand the risks involved. This may involve consulting with a financial advisor or conducting your own analysis of individual companies or bonds. By taking a thoughtful and informed approach to investing, you can help ensure that your portfolio is well-positioned to achieve your financial goals.

Frequently Asked Questions

Here are some common questions and answers about the difference between stocks and bonds.

What is a stock?

A stock represents ownership in a company. When you buy a stock, you are buying a piece of the company. This means you have a right to a portion of the company’s profits and assets. Stocks are traded on stock exchanges, and their prices can change based on supply and demand.

Stocks are generally considered a riskier investment than bonds because their prices can fluctuate more. However, they also have the potential for higher returns over the long term.

What is a bond?

A bond is a debt security issued by a company or government. When you buy a bond, you are essentially loaning money to the issuer. The issuer agrees to pay you back the face value of the bond plus interest over a set period of time.

Bonds are generally considered a less risky investment than stocks because their prices are more stable. However, they also have lower potential returns.

What are the main differences between stocks and bonds?

The main difference between stocks and bonds is that stocks represent ownership in a company, while bonds represent debt. Stocks have the potential for higher returns but are generally riskier, while bonds have lower potential returns but are generally less risky.

Additionally, stock prices are more volatile and can change rapidly based on market conditions, while bond prices are more stable and tend to be less affected by short-term market fluctuations.

Which is a better investment: stocks or bonds?

There is no one-size-fits-all answer to this question, as the best investment strategy will depend on a variety of factors, including your risk tolerance, investment goals, and overall financial situation.

Generally speaking, younger investors with a higher risk tolerance may want to consider investing more heavily in stocks, while older, more conservative investors may want to focus more on bonds. However, it’s always a good idea to consult with a financial advisor to determine the best investment strategy for your individual needs.

Can I invest in both stocks and bonds?

Yes, it is possible to invest in both stocks and bonds. In fact, many investors choose to diversify their portfolios by investing in a mix of different asset classes, including stocks, bonds, and other securities.

A diversified portfolio can help to minimize risk and maximize returns over the long term. However, it’s important to remember that all investments carry some degree of risk, and it’s important to carefully consider your investment goals and risk tolerance before making any investment decisions.

What’s the Difference Between Bonds and Stocks?

In conclusion, understanding the difference between a stock and a bond is crucial for any investor looking to diversify their portfolio. While both investments carry risks, stocks have higher potential for growth and profits in the long run, whereas bonds offer a more stable source of income. It is important for investors to carefully consider their financial goals and risk tolerance before deciding which investment to choose. Whether you decide to invest in stocks or bonds, it is always wise to seek the guidance of a financial advisor to ensure you are making informed decisions and maximizing your returns.