Diversification is a term that is frequently used in the field of finance and investment. It refers to the practice of spreading one’s investments across a range of different assets in order to minimize risk. In other words, rather than putting all of your eggs in one basket, diversification involves investing in a variety of different assets to ensure that you are not overly exposed to any one type of risk.

There are many reasons why diversification is important. First and foremost, it can help to protect your investments from market volatility and sudden changes in the economy. By investing in a range of different assets, you can spread your risk and minimize the impact of any one asset’s performance on your overall portfolio. Additionally, diversification can help to increase your overall returns over time, as it allows you to take advantage of a variety of different investment opportunities.

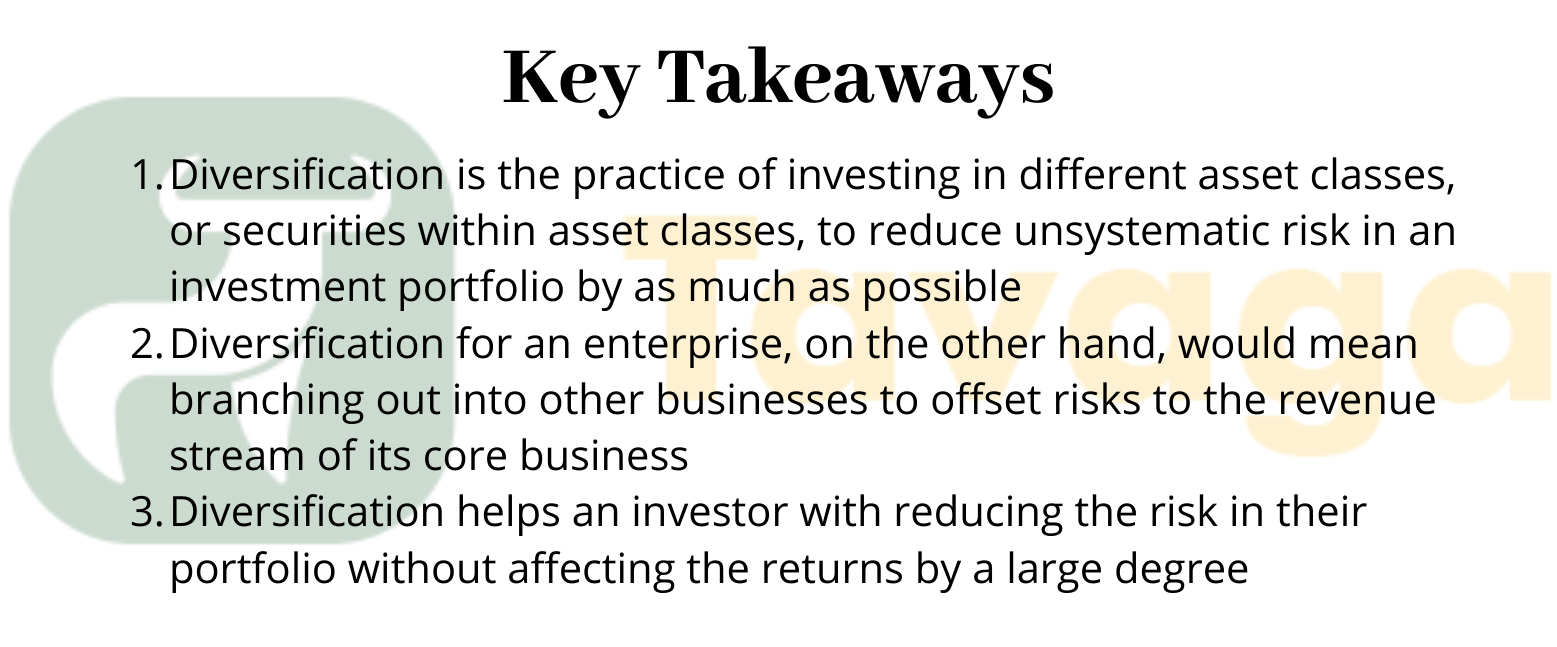

Diversification is the process of investing in a variety of assets to reduce risk and increase potential returns. By spreading your investments across different asset classes, industries, and geographies, you can minimize the impact of market fluctuations on your portfolio. Diversification is important because it helps you achieve a balance between risk and reward, and it can help protect against losses in any one area of your portfolio.

What is Diversification and Why is It Important?

Diversification is an investment strategy that involves spreading your money across different asset classes, such as stocks, bonds, and real estate, to minimize risk and maximize returns. The goal of diversification is to reduce the impact of any single investment on your portfolio. By diversifying your investments, you can protect yourself from market volatility, inflation, and other risks that can affect your wealth.

Benefits of Diversification

Diversification offers many benefits that can help you build a solid investment portfolio. One of the most significant advantages of diversification is that it can help you manage risk. By investing in a variety of assets, you can reduce the impact of any single investment on your overall portfolio. This means that if one investment underperforms, you won’t lose all your money. Instead, you’ll have other investments that can help offset any losses.

Another benefit of diversification is that it can help you maximize returns. By investing in different asset classes, you can take advantage of different market conditions. For example, if stocks are performing well, you can invest more in stocks. If bonds are performing well, you can invest more in bonds. This way, you can capitalize on the strengths of different asset classes and maximize your returns.

Types of Diversification

There are several types of diversification strategies that you can use to build a well-diversified investment portfolio. Some of the most common types of diversification include:

Asset Class Diversification

Asset class diversification involves investing in a variety of different asset classes, such as stocks, bonds, real estate, and commodities. This strategy can help you spread your risk across different types of investments and maximize your returns.

Geographic Diversification

Geographic diversification involves investing in a variety of different countries and regions around the world. This strategy can help you spread your risk across different economies and markets and take advantage of different growth opportunities.

Industry Diversification

Industry diversification involves investing in a variety of different industries, such as healthcare, technology, and energy. This strategy can help you spread your risk across different sectors of the economy and take advantage of different growth opportunities.

Diversification Vs. Concentration

While diversification offers many benefits, some investors prefer to concentrate their investments in a few select assets. Concentration can offer the potential for higher returns, but it also comes with higher risk. If the concentrated investment performs poorly, the investor can lose a significant amount of money. Diversification, on the other hand, spreads the risk across different assets, reducing the potential for losses.

Diversification and Your Investment Strategy

Diversification is an essential part of any investor’s strategy. By investing in a variety of assets, you can reduce your risk and maximize your returns. However, diversification is not a one-size-fits-all strategy. The right mix of investments will depend on your financial goals, risk tolerance, and investment horizon. It’s important to work with a financial advisor who can help you develop a personalized investment strategy that meets your needs.

Conclusion

Diversification is a critical investment strategy that can help you protect your wealth and maximize your returns. By investing in a variety of assets, you can reduce your risk and take advantage of different market conditions. Whether you’re a new investor or a seasoned pro, diversification should be an essential part of your investment strategy.

Frequently Asked Questions

Here are some common questions about diversification and why it’s important:

How do you define diversification?

Diversification is the practice of investing in a variety of assets, such as stocks, bonds, and commodities, in order to lower risk and potentially increase returns. The idea is that by spreading your investment across different types of assets, you minimize the impact of any one asset’s poor performance on your overall portfolio.

For example, if you only invest in stocks and the stock market experiences a downturn, your portfolio will suffer. But if you also have investments in bonds, which tend to perform better during economic downturns, your overall losses may be mitigated.

What are the benefits of diversification?

The primary benefit of diversification is risk reduction. By investing in a variety of assets, you lower your exposure to any one asset’s poor performance. This can help protect your portfolio from significant losses during market downturns.

In addition to risk reduction, diversification can also potentially increase returns. By spreading your investments across different types of assets, you’re more likely to capture gains in different areas of the market. This can result in overall higher returns for your portfolio.

What are some common diversification strategies?

There are a few different diversification strategies you can use when investing. One common strategy is to invest in a mix of stocks and bonds. Another is to invest in a mix of domestic and international assets. You can also diversify by investing in different sectors of the economy, such as technology, healthcare, and energy.

Ultimately, the best diversification strategy for you will depend on your individual investment goals and risk tolerance.

What are some risks of not diversifying your portfolio?

The biggest risk of not diversifying your portfolio is exposure to significant losses during market downturns. If you only invest in one type of asset and that asset performs poorly, you may experience significant losses.

Another risk of not diversifying is missing out on potential gains in other areas of the market. If you only invest in one sector of the economy, for example, you may miss out on gains in other sectors that are performing well.

How can you ensure proper diversification in your portfolio?

The best way to ensure proper diversification in your portfolio is to invest in a mix of assets that align with your investment goals and risk tolerance. This may involve investing in a mix of stocks, bonds, and other assets, such as commodities or real estate.

You can also consider investing in mutual funds or exchange-traded funds (ETFs) that are designed to provide diversification across a variety of assets. These funds often invest in hundreds or thousands of different assets, making it easy to achieve proper diversification with just one investment.

What Is Diversification and Why Is It Important?

In conclusion, diversification is the practice of spreading investments across different asset classes, industries, and geographies to minimize risk and maximize returns. It is a crucial strategy for investors who want to achieve long-term financial goals and build a diversified portfolio. By diversifying your investments, you can reduce the impact of market volatility and ensure that your portfolio is well-balanced.

Furthermore, diversification can help you to avoid putting all your eggs in one basket. It is important to understand that no investment is completely risk-free, and diversification can help to protect your portfolio against unexpected events that could have a negative impact on your investments. By spreading your investments across different asset classes, you can reduce the risk of losing all your money in one investment.

Overall, diversification is a key concept in investing that can help you to manage risk and maximize returns. It is important to work with a financial advisor who can help you to develop a well-balanced portfolio that is tailored to your individual needs and goals. By understanding the benefits of diversification, you can make informed investment decisions and achieve financial success in the long run.