Online banking has revolutionized the way we manage our finances. Gone are the days of waiting in long queues at the bank, filling out forms and wasting precious time. With online banking, you can access your account anytime, anywhere, and make transactions at the click of a button.

Apart from the obvious convenience, there are many advantages to online banking. From saving time and money to enhanced security measures and better financial management, online banking has plenty to offer. In this article, we will explore some of the benefits of online banking and why it’s becoming increasingly popular among consumers.

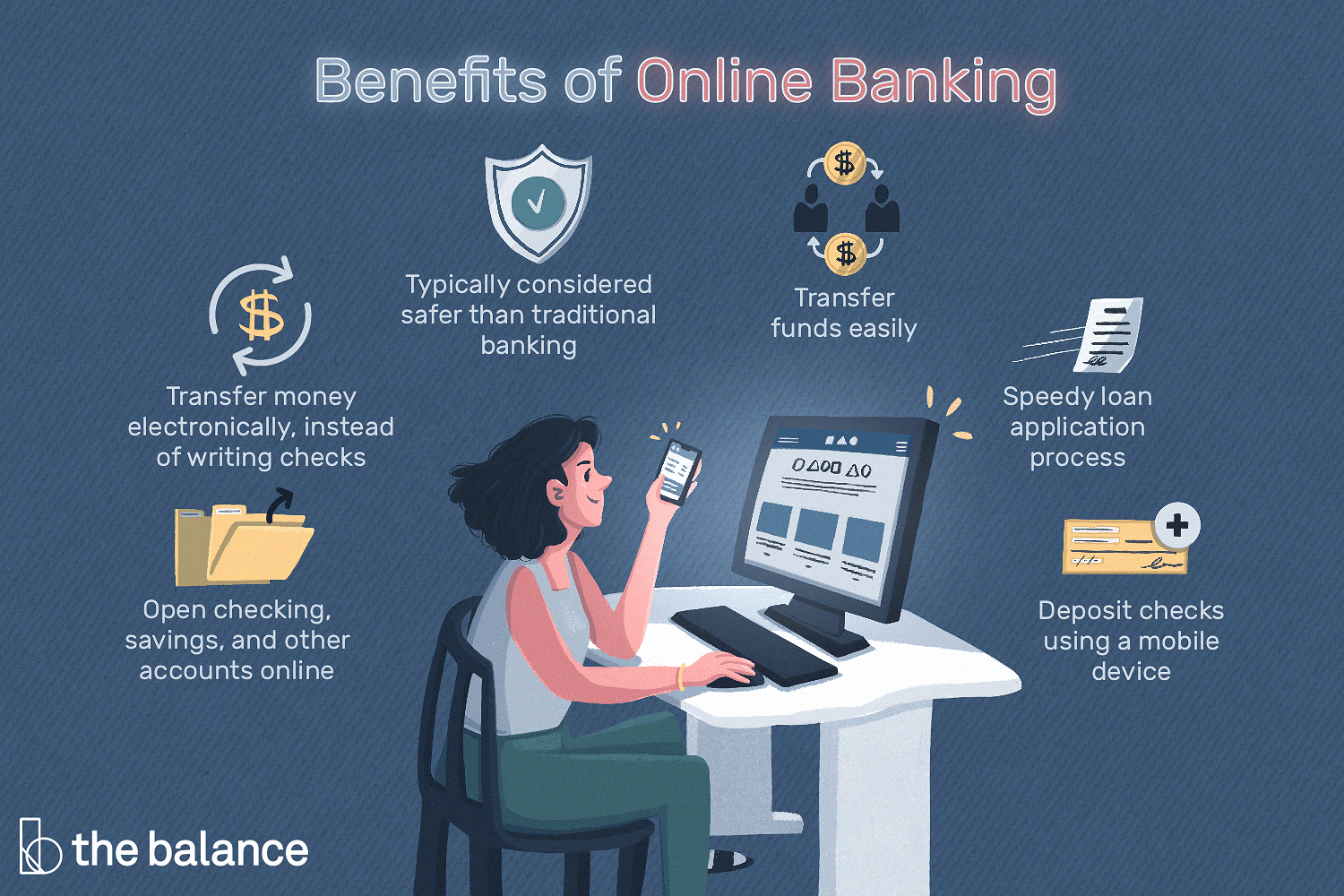

Online banking offers several advantages such as convenience, accessibility, and cost savings. With online banking, you can easily check your account balances, transfer funds, pay bills, and access your transaction history from anywhere, at any time. You can also save money on fees and charges associated with traditional banking methods. Additionally, online banking provides enhanced security features that protect your personal information and transactions.

The Advantages of Online Banking

Online banking has become increasingly popular over the years, with more and more people choosing to manage their finances through digital platforms. There are many benefits to this approach, which we will explore in this article. From convenience to security, we will examine why online banking is such a valuable tool for modern consumers.

Convenience

One of the biggest advantages of online banking is convenience. With online banking, you can access your account information from anywhere, at any time. This means you no longer have to visit a physical bank branch during business hours to complete transactions or check your balance. You can easily transfer funds between accounts, pay bills, and deposit checks with just a few clicks.

Online banking also allows you to set up automatic payments and transfers, which can save you time and ensure that your bills are always paid on time. Additionally, many banks offer mobile apps that allow you to manage your account information on the go, making it even easier to stay on top of your finances.

Security

Another major advantage of online banking is security. While some people may be wary of using digital platforms to manage their finances, online banking is actually incredibly secure. Banks use advanced encryption technology to protect your sensitive information, such as your account number and password. Additionally, many banks offer two-factor authentication, which provides an extra layer of protection by requiring a code sent to your phone or email in addition to your password.

When you use online banking, you also have access to detailed transaction histories, which can help you identify any fraudulent activity quickly. You can set up alerts to notify you of any unusual activity, and many banks offer zero-liability policies to protect you in the event of unauthorized transactions.

Cost Savings

Online banking can also save you money. Many banks offer lower fees for online banking transactions, such as transferring funds or paying bills. Additionally, you can save money on paper checks and stamps, as many banks offer online bill pay services that are free or low-cost.

Furthermore, online banking can help you avoid overdraft fees by providing real-time account information. You can easily check your balance before making a purchase or transferring funds, ensuring that you always have enough money in your account to cover your expenses.

24/7 Access

With online banking, you have 24/7 access to your account information. This means you can check your balance, review transactions, and transfer funds at any time of day or night. This can be especially helpful if you have a busy schedule or live in a different time zone than your bank.

Easy to Use

Online banking is also incredibly easy to use. Most banks provide user-friendly interfaces that are easy to navigate, even for those who are not tech-savvy. You can easily view your account information, make transactions, and set up alerts with just a few clicks.

Environmentally Friendly

Online banking is also environmentally friendly. By using digital platforms to manage your finances, you can reduce your use of paper checks and statements, which can help to conserve natural resources and reduce waste.

Increased Transparency

When you use online banking, you have access to detailed transaction histories, which can help you track your spending and manage your finances more effectively. You can easily see where your money is going, and identify areas where you may be overspending.

Easy to Budget

Online banking can also make it easier to budget. With real-time account information, you can easily track your spending and ensure that you are staying within your budget each month. You can set up alerts to notify you when you are getting close to your spending limit, which can help you avoid overspending.

Access to Additional Services

Many banks offer additional services through their online banking platforms, such as financial planning tools, credit monitoring, and investment services. By using online banking, you may have access to these services at no additional cost, which can help you manage your finances more effectively.

Comparison to Traditional Banking

Compared to traditional banking, online banking offers many advantages. Traditional banking requires you to visit a physical branch during business hours to complete transactions, which can be inconvenient for those with busy schedules. Additionally, traditional banking may have higher fees for certain transactions, such as transferring funds or paying bills.

Online banking, on the other hand, offers 24/7 access to your account information, lower fees for certain transactions, and the ability to manage your finances from anywhere. Online banking also provides increased security features, such as two-factor authentication and real-time transaction monitoring.

In conclusion, online banking offers many advantages over traditional banking. From convenience to security, cost savings to increased transparency, there are many reasons to consider managing your finances through digital platforms. By taking advantage of these benefits, you can save time and money, while also ensuring that your finances are secure and well-managed.

Frequently Asked Questions

Can I access my bank account anytime with online banking?

Yes! One of the biggest advantages of online banking is that you can access your account anytime, anywhere. As long as you have an internet connection, you can check your account balance, transfer funds, pay bills, and more. This means you don’t have to wait for your bank to open or rush to get there before it closes. With online banking, you have the convenience of banking on your own schedule.

However, it is important to note that some banks may have maintenance or downtime that can affect your access to online banking. Be sure to check with your bank for any scheduled maintenance or service interruptions.

How secure is online banking?

Online banking is generally very secure. Banks use advanced encryption technologies to protect your personal and financial information. This means that your account information and transactions are encrypted and can only be accessed by you or authorized personnel at the bank.

However, it is important to take precautions to ensure the security of your online banking account. This includes creating a strong password, not sharing your login information with anyone, and being cautious of phishing scams. By following these guidelines, you can help ensure the security of your online banking account.

What are the advantages of paying bills online?

Paying bills online has several advantages. First, it is convenient. You can pay your bills from anywhere, at any time, as long as you have an internet connection. This means you don’t have to worry about mailing checks or going to a bill payment center.

Second, paying bills online can save you time and money. You don’t have to spend time writing checks or buying stamps, and you don’t have to pay for postage. Additionally, some banks offer bill pay services for free, which can save you money on fees charged by bill payment centers.

Can I transfer money between accounts with online banking?

Yes, you can transfer money between accounts with online banking. This includes transferring money between your own accounts, as well as transferring money to other people’s accounts. This can be a convenient way to pay friends or family members or to move money between your checking and savings accounts.

However, it is important to note that some banks may have limits on the amount of money you can transfer at one time or per day. Be sure to check with your bank for any transfer limits or fees.

How can I keep track of my transactions with online banking?

Online banking makes it easy to keep track of your transactions. You can view your account balance and transaction history at any time, which can help you monitor your spending and budget your finances. Additionally, some banks offer alerts and notifications that can be sent to your email or mobile device, which can help you stay on top of your account activity.

It is important to check your account regularly to ensure that all transactions are accurate and authorized. If you notice any unauthorized transactions, be sure to contact your bank immediately to report the issue.

In conclusion, online banking has numerous advantages that make it a preferable choice for many people. Firstly, it offers convenience as customers can easily access their accounts from anywhere and at any time. Secondly, online banking is time-saving as customers can avoid long queues and waiting times at physical bank branches. Lastly, online banking is cost-effective as it eliminates the need for paper-based transactions and reduces the overhead costs for banks.

Overall, online banking has revolutionized the way people manage their finances. With its numerous benefits, it’s no wonder that more and more people are opting for online banking. From the convenience it offers to the cost savings it provides, online banking is undoubtedly the future of banking. So, if you haven’t already, it’s time to make the switch to online banking and experience the advantages for yourself.