Personal loans and credit play a crucial role in our financial lives. They can help us achieve our goals, manage unexpected expenses, and build a stronger credit history. However, understanding the ins and outs of these financial tools can be overwhelming. That’s why we’ve created this comprehensive guide to help you navigate the world of personal loans and credit with ease. Whether you’re a seasoned borrower or new to the game, this guide will provide you with the knowledge and tools you need to make informed decisions about your finances. So, let’s dive in and explore the world of personal loans and credit together!

Personal loans and credit can be confusing, but this comprehensive guide will help you understand the ins and outs. Learn about the different types of personal loans, how to improve your credit score, and what to look for in a lender. Whether you’re looking to consolidate debt or make a big purchase, this guide has everything you need to know.

Contents

- Understanding Personal Loans and Credit: a Comprehensive Guide

- Frequently Asked Questions

- What is a personal loan?

- What is the difference between a personal loan and a credit card?

- How does my credit score affect my ability to get a personal loan?

- What is the difference between a secured and an unsecured personal loan?

- What should I consider before applying for a personal loan?

- Understanding Personal Loans A Comprehensive Guide

Understanding Personal Loans and Credit: a Comprehensive Guide

Personal loans can be a great way to finance your dreams or cover unexpected expenses. However, before you sign on the dotted line, it’s important to understand the ins and outs of personal loans and credit. In this guide, we’ll walk you through everything you need to know to make an informed decision about personal loans and credit.

What is a Personal Loan?

A personal loan is a type of loan that you can use for any purpose, such as consolidating debt, making home improvements, or financing a big purchase. Unlike a secured loan, like a mortgage or auto loan, a personal loan is unsecured, meaning it doesn’t require collateral. Personal loans typically have fixed interest rates and fixed repayment terms, so you know exactly how much you’ll pay each month and for how long.

There are many different types of personal loans, including:

– Traditional personal loans from banks and credit unions

– Online personal loans from alternative lenders

– Peer-to-peer loans from individuals

How Do Personal Loans Work?

When you apply for a personal loan, the lender will review your credit score, income, and other factors to determine if you’re eligible. If you’re approved, you’ll receive a lump sum of money that you can use for your intended purpose. You’ll then make monthly payments to the lender over a set period of time, typically two to five years.

Personal loans can be a good option if you need to borrow a large amount of money and want a fixed repayment schedule. However, they’re not always the best choice. Here are some pros and cons to consider:

Benefits of Personal Loans:

– Fixed interest rates and repayment terms

– No collateral required

– Can be used for any purpose

Drawbacks of Personal Loans:

– May have higher interest rates than secured loans

– May have origination fees or prepayment penalties

– Can be difficult to qualify for if you have poor credit

Understanding Credit Scores

Your credit score is a three-digit number that represents your creditworthiness. It’s based on your credit history, including your payment history, credit utilization, length of credit history, and more. Your credit score is used by lenders to determine if you’re eligible for credit and what interest rate you’ll pay.

There are several different credit scoring models, but the most commonly used is the FICO score. FICO scores range from 300 to 850, with higher scores indicating better creditworthiness. Here’s how FICO scores are typically classified:

– Excellent: 800+

– Very Good: 740-799

– Good: 670-739

– Fair: 580-669

– Poor: 579 and below

How Do Personal Loans Impact Your Credit?

When you apply for a personal loan, the lender will check your credit report and score. This is known as a hard inquiry, and it can temporarily lower your credit score. However, if you’re approved for the loan and make your payments on time, it can have a positive impact on your credit by showing that you’re a responsible borrower.

On the other hand, if you miss payments or default on the loan, it can have a negative impact on your credit. This can make it harder to qualify for credit in the future and may result in higher interest rates.

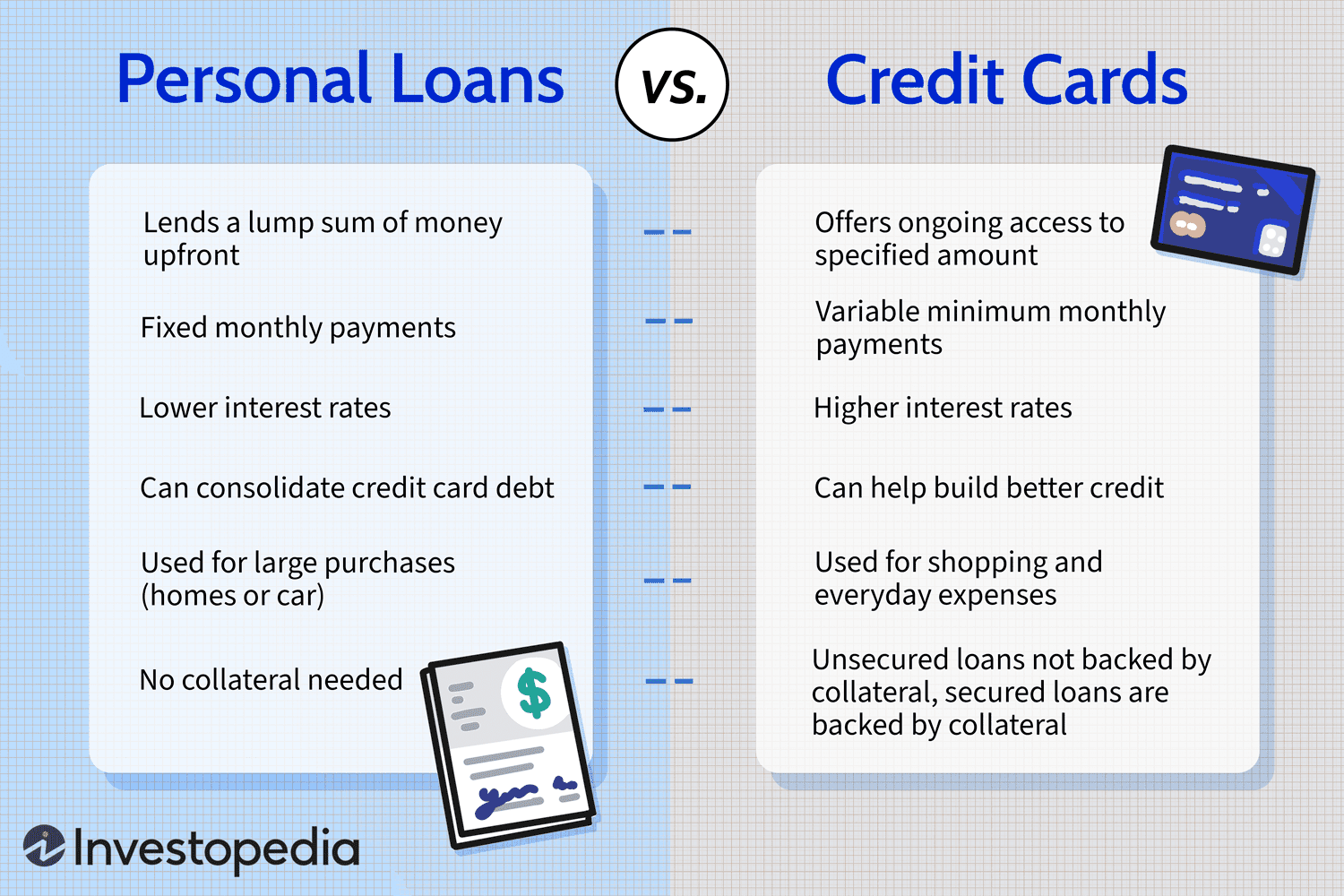

Personal Loans vs. Credit Cards

Personal loans and credit cards are both forms of unsecured credit, but they work differently. With a personal loan, you receive a lump sum of money and make fixed payments over a set period of time. With a credit card, you have a revolving line of credit that you can use and pay off as needed.

Here are some pros and cons to consider when deciding between a personal loan and a credit card:

Benefits of Personal Loans:

– Fixed interest rates and repayment terms

– May have lower interest rates than credit cards

– Can borrow larger amounts of money

Drawbacks of Personal Loans:

– May have origination fees or prepayment penalties

– Can be difficult to qualify for if you have poor credit

Benefits of Credit Cards:

– Revolving line of credit

– May offer rewards or cash back

– May have lower fees than personal loans

Drawbacks of Credit Cards:

– May have higher interest rates than personal loans

– Can be easy to overspend and accumulate debt

How to Get a Personal Loan

If you’re interested in getting a personal loan, here are some steps to take:

1. Check your credit score and report: Before applying for a personal loan, check your credit score and report to make sure there are no errors or issues that could affect your eligibility.

2. Shop around for lenders: Compare rates and terms from multiple lenders to find the best deal. Consider both traditional banks and credit unions as well as online lenders.

3. Gather your documents: You’ll need to provide proof of income, employment, and other personal information to apply for a personal loan.

4. Apply for the loan: Fill out the application and provide any required documentation. The lender will review your application and determine if you’re eligible.

5. Receive the funds: If you’re approved for the loan, you’ll receive the funds in a lump sum. Use them for your intended purpose and start making payments on the loan.

Conclusion

Personal loans can be a useful tool for financing your dreams or covering unexpected expenses. However, they’re not right for everyone. Before applying for a personal loan, make sure you understand how they work, what your credit score is, and what your other options are. With the right information and careful consideration, you can make an informed decision about whether a personal loan is right for you.

Frequently Asked Questions

What is a personal loan?

A personal loan is a type of loan that is borrowed from a bank, credit union, or other financial institution. It is usually an unsecured loan, which means that you do not have to put up any collateral to obtain it. Personal loans can be used for a variety of purposes, such as consolidating debt, paying for home improvements, or covering unexpected expenses.

When you apply for a personal loan, the lender will review your credit score and other financial information to determine your eligibility. If you are approved, you will receive a lump sum of money that you can use as needed. Personal loans typically have fixed interest rates and repayment terms, which means that you will know exactly how much you need to pay each month and for how long.

What is the difference between a personal loan and a credit card?

Personal loans and credit cards are both types of credit, but there are some key differences between them. A personal loan is a lump sum of money that you borrow and then repay over a set period of time, usually with a fixed interest rate. Once you have repaid the loan, it is closed and cannot be used again unless you apply for a new loan.

A credit card, on the other hand, is a revolving line of credit. You are approved for a certain credit limit, and you can use the card to make purchases up to that limit. You are required to make at least the minimum payment each month, but you can continue to use the card as long as you do not exceed the credit limit. Credit cards typically have variable interest rates, which means that the interest rate can change over time.

How does my credit score affect my ability to get a personal loan?

Your credit score is one of the most important factors that lenders consider when you apply for a personal loan. Your credit score is a numerical representation of your creditworthiness, based on factors such as your payment history, credit utilization, and length of credit history.

If you have a high credit score, you are more likely to be approved for a personal loan and receive a lower interest rate. If you have a low credit score, you may still be able to get a personal loan, but you may have to pay a higher interest rate or provide collateral to secure the loan.

What is the difference between a secured and an unsecured personal loan?

A secured personal loan is a loan that is backed by collateral, such as a car or a house. If you default on the loan, the lender can seize the collateral to recover their losses. Secured loans typically have lower interest rates than unsecured loans, because the lender has less risk.

An unsecured personal loan, on the other hand, is not backed by collateral. If you default on the loan, the lender cannot seize any assets to recover their losses. Unsecured loans typically have higher interest rates than secured loans, because the lender has more risk.

What should I consider before applying for a personal loan?

Before you apply for a personal loan, you should consider several factors. First, think about why you need the loan and how much money you need to borrow. Second, review your credit score and financial history to determine your eligibility for a loan. Third, compare interest rates and repayment terms from different lenders to find the best option for your needs. Finally, make sure that you understand the terms and conditions of the loan, including any fees or penalties that may apply.

Understanding Personal Loans A Comprehensive Guide

In conclusion, personal loans and credit can be valuable tools for achieving financial goals, but they should be used responsibly. It’s essential to understand the terms and conditions of any loan or credit agreement before signing on the dotted line. By doing so, you can avoid financial pitfalls and make informed decisions about your money.

Remember, personal loans and credit can impact your credit score, which plays a significant role in your financial future. By managing your finances wisely and making timely payments, you can build a positive credit history and improve your chances of future loan approvals.

Lastly, it’s always a good idea to seek advice from a financial professional before making any major financial decisions. They can help you assess your financial situation and provide guidance on the best course of action for your specific needs. With the right knowledge and guidance, you can make informed decisions about personal loans and credit and achieve your financial goals with confidence.