Are you in need of some extra cash? If so, a personal loan could be the answer. Regions Bank offers personal loans with competitive interest rates and flexible repayment options. But how exactly do you go about getting one? Keep reading to learn more about the process and what you’ll need to do to secure the funds you need.

With a Regions Bank personal loan, you can borrow up to $35,000 for whatever expenses you have. Whether it’s for a home renovation project or to consolidate debt, the process is relatively simple. By following a few steps and providing the necessary documentation, you can be on your way to receiving the funds you need in no time. So, let’s dive into the details of how to get a personal loan from Regions Bank.

To get a personal loan from Regions Bank, you need to meet their minimum credit score requirement of 580 or higher. You also need to provide proof of income, employment status, and other personal information. The application process can be done online or in person at a Regions Bank branch. Once approved, the funds will be deposited into your account within a few business days.

How to Get a Personal Loan From Regions Bank?

If you’re in need of a personal loan, Regions Bank may be just the lender to help you out. With a variety of loan options and competitive rates, it’s no wonder that Regions Bank is a popular choice for borrowers. In this article, we’ll walk you through the process of getting a personal loan from Regions Bank.

Step 1: Check Your Credit Score

Before you apply for a personal loan, it’s a good idea to check your credit score. Your credit score will determine whether or not you’re eligible for a loan and what interest rate you’ll be offered. Regions Bank typically looks for borrowers with a credit score of at least 660.

If your credit score is lower than 660, you may still be able to get a loan from Regions Bank, but you’ll likely be offered a higher interest rate. It’s important to remember that the higher your credit score, the better your chances of getting approved for a loan with a lower interest rate.

Benefits of Checking Your Credit Score

Checking your credit score before applying for a loan can help you:

- Identify any errors or inaccuracies on your credit report

- Get an idea of what interest rate you’ll likely be offered

- Take steps to improve your credit score if it’s lower than you’d like

Step 2: Gather Your Documents

Once you’ve checked your credit score and determined that you’re eligible for a personal loan from Regions Bank, it’s time to gather your documents. You’ll need to provide Regions Bank with:

- Proof of income

- Proof of identity

- Proof of address

You may also be asked to provide additional documentation, depending on the type of loan you’re applying for.

Types of Personal Loans Offered by Regions Bank

Regions Bank offers a variety of personal loans, including:

- Unsecured personal loans

- Secured personal loans

- Lines of credit

- Student loans

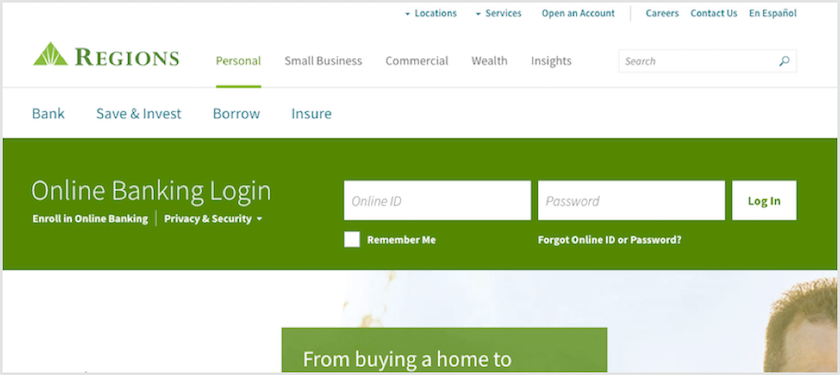

Step 3: Apply for a Loan

Once you’ve gathered your documents, it’s time to apply for a loan. You can apply online or in person at a Regions Bank branch. The application process typically takes less than 30 minutes.

When you apply for a loan, you’ll need to provide Regions Bank with information about:

- Your income

- Your employment status

- Your credit history

- The amount you’re looking to borrow

Benefits of Applying for a Loan with Regions Bank

There are many benefits to applying for a personal loan with Regions Bank, including:

- Competitive interest rates

- Flexible repayment terms

- Fast application process

- Excellent customer service

Step 4: Wait for Approval

After you’ve applied for a loan, you’ll need to wait for approval. Regions Bank typically makes a decision within 24-48 hours.

If you’re approved for a loan, you’ll receive the funds in your bank account within a few business days.

Benefits of Getting Approved for a Loan with Regions Bank

Getting approved for a personal loan with Regions Bank can help you:

- Consolidate debt

- Pay for unexpected expenses

- Make home improvements

- Finance a large purchase

Step 5: Repay Your Loan

Once you’ve received the funds from your loan, it’s important to start making payments on time. Regions Bank offers a variety of repayment options, including automatic payments and online payments.

Benefits of Repaying Your Loan on Time

Repaying your personal loan on time can help you:

- Build your credit score

- Avoid late fees

- Improve your chances of getting approved for future loans

In conclusion, getting a personal loan from Regions Bank is a straightforward process. By checking your credit score, gathering your documents, applying for a loan, waiting for approval, and repaying your loan on time, you can get the funds you need to accomplish your financial goals.

Contents

- Frequently Asked Questions

- What are the requirements for getting a personal loan from Regions Bank?

- What are the interest rates for personal loans from Regions Bank?

- What documents do I need to apply for a personal loan from Regions Bank?

- How long does it take to get approved for a personal loan from Regions Bank?

- What are the repayment options for personal loans from Regions Bank?

- REGIONS BANK PERSONAL LOAN: How to Get a Large Amount With Fair or Poor Credit 🔶 CREDIT S2•E579

Frequently Asked Questions

Here are some common questions and answers about getting a personal loan from Regions Bank.

What are the requirements for getting a personal loan from Regions Bank?

Before applying for a personal loan from Regions Bank, you should ensure that you meet the following requirements:

First, you must be at least 18 years old and a legal resident of the United States. Second, you should have a good credit score. Third, you should have a stable income source that can demonstrate your ability to repay the loan. Finally, you should have a valid Social Security number and a government-issued ID.

What are the interest rates for personal loans from Regions Bank?

The interest rates for personal loans from Regions Bank vary depending on several factors, such as your credit score, loan amount, and repayment schedule. Generally, the interest rates range from 7.99% to 17.99% APR. To get an accurate estimate of your interest rate, you should contact a Regions Bank loan officer.

Keep in mind that the interest rate you receive will impact the total amount you will repay over the life of the loan. You should compare the interest rates and terms offered by different lenders to find the best option for your financial situation.

What documents do I need to apply for a personal loan from Regions Bank?

To apply for a personal loan from Regions Bank, you will need to provide the following documents:

First, you will need to provide proof of income, such as your most recent pay stub or tax return. Second, you will need to provide proof of identity, such as a government-issued ID or passport. Third, you will need to provide proof of address, such as a utility bill or lease agreement. Finally, you may need to provide additional documents depending on your loan application and the bank’s requirements.

How long does it take to get approved for a personal loan from Regions Bank?

The time it takes to get approved for a personal loan from Regions Bank varies depending on several factors, such as your credit score, loan amount, and loan application. Generally, it can take anywhere from a few minutes to several days to get approved for a personal loan. To expedite the approval process, you should ensure that you have all the required documents and information before applying.

Keep in mind that the approval process may also involve a credit check. If you have a low credit score or a history of missed payments, your application may be denied or take longer to process.

What are the repayment options for personal loans from Regions Bank?

Regions Bank offers several repayment options for personal loans, including:

First, you can choose a fixed repayment schedule, where you make equal payments each month until the loan is paid off. Second, you can choose a variable repayment schedule, where your payments may change over time depending on the interest rate and other factors. Third, you may be able to choose a deferment or forbearance option if you experience financial hardship. Finally, you can make extra payments or pay off your loan early without incurring any prepayment penalties.

REGIONS BANK PERSONAL LOAN: How to Get a Large Amount With Fair or Poor Credit 🔶 CREDIT S2•E579

In conclusion, getting a personal loan from Regions Bank is a straightforward process that can help you achieve your financial goals. With competitive rates, flexible terms, and a variety of loan options, Regions Bank has something to offer everyone. By following the steps outlined in this guide, you can apply for a personal loan with confidence and ease.

Remember to do your research, compare rates and terms, and consider your budget and financial goals before applying for a loan. Additionally, keep in mind that while a personal loan can be a useful tool, it should be used wisely and responsibly.

Overall, if you are in need of extra funds for a big purchase, debt consolidation, or other expenses, a personal loan from Regions Bank may be the solution you’ve been looking for. So, take the first step and explore your options today to see how Regions Bank can help you achieve your financial goals.