Are you tired of traditional banks and their fees? Have you heard of credit unions but aren’t sure how they differ from banks? Well, you’re in luck! In this article, we’ll explore the key differences between credit unions and banks, and help you decide which option is best for you. So, let’s dive in and discover the unique benefits of credit unions!

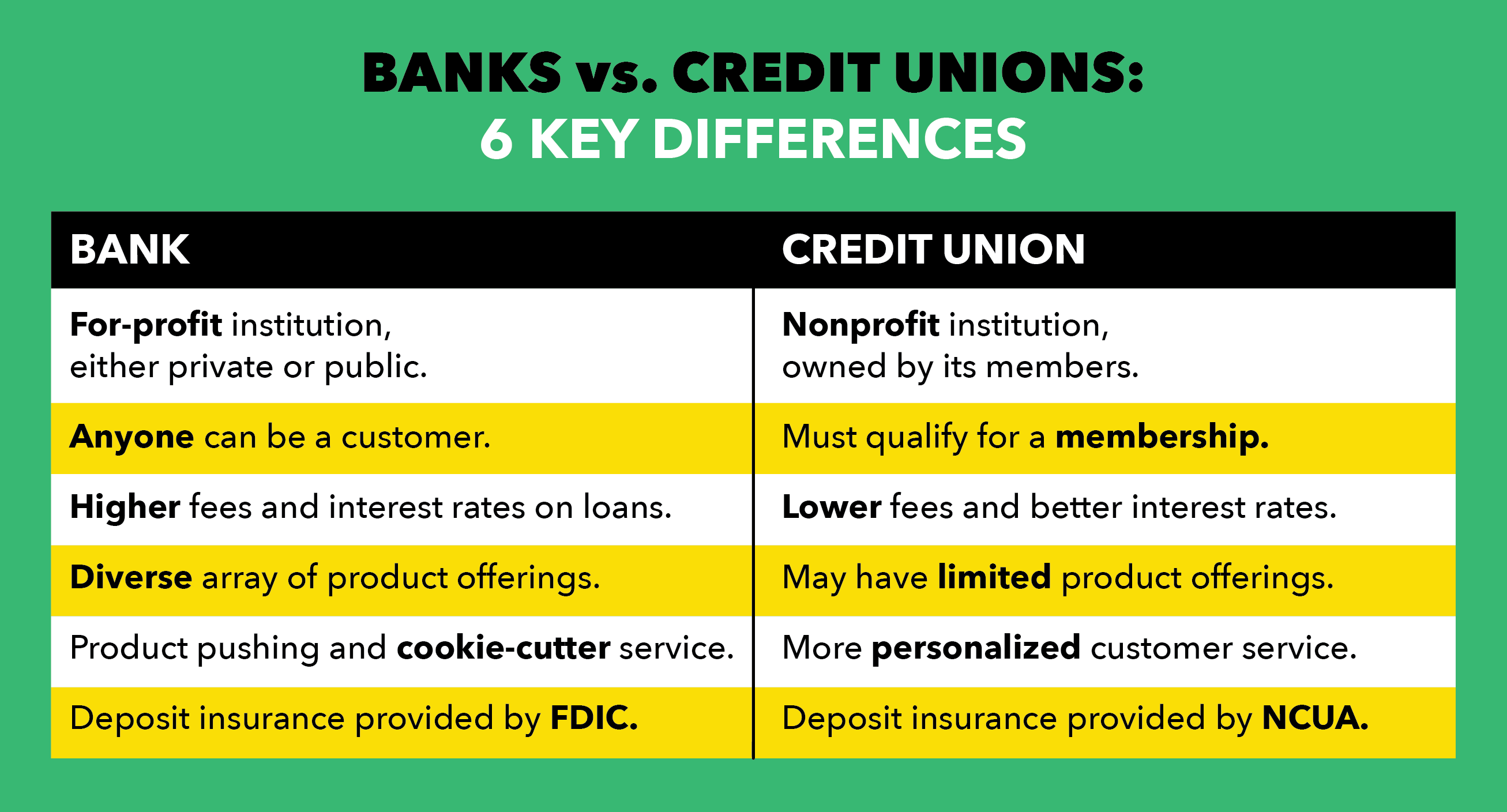

Credit unions and banks offer similar services, but there are key differences. Credit unions are not-for-profit organizations owned by their members, while banks are for-profit and owned by shareholders. This means that credit unions typically offer better interest rates, lower fees, and a more personalized approach to banking. Credit unions also often have more limited branch and ATM networks compared to banks.

Contents

- How is a Credit Union Different From a Bank?

- Frequently Asked Questions

- What is a credit union and how does it differ from a bank?

- How do credit union fees compare to bank fees?

- What types of financial services do credit unions offer?

- Who is eligible to become a member of a credit union?

- Are deposits at credit unions insured?

- Banks vs. Credit Unions: What’s the Difference? | NerdWallet

How is a Credit Union Different From a Bank?

Credit unions and banks are financial institutions that offer similar products and services, but they operate in different ways. While banks are for-profit entities, credit unions are not-for-profit cooperatives. This fundamental difference affects the way these institutions function and the benefits they offer to their members. In this article, we will explore the key differences between credit unions and banks.

Ownership and Governance

One of the primary differences between credit unions and banks is their ownership and governance structures. Banks are owned by shareholders who invest in the institution and expect a return on their investment. Shareholders elect a board of directors to oversee the bank’s operations and make decisions on behalf of the shareholders.

In contrast, credit unions are owned by their members. Members elect a board of directors from among their peers to oversee the credit union’s operations. The board of directors is responsible for making decisions that benefit the members, rather than shareholders. This structure allows credit unions to focus on providing high-quality services and products to their members, rather than maximizing profits for shareholders.

Membership Requirements

Another key difference between credit unions and banks is their membership requirements. Banks are open to anyone who meets their account opening requirements, such as having a certain amount of money to deposit. Credit unions, on the other hand, have membership requirements that must be met before someone can become a member.

Typically, credit unions have specific eligibility criteria, such as living in a certain geographic area, working for a particular employer, or belonging to a certain organization. Once someone becomes a member of a credit union, they have access to all of the institution’s products and services.

Products and Services

Credit unions and banks offer similar products and services, such as checking and savings accounts, loans, and credit cards. However, credit unions often offer these products and services at lower costs and with more favorable terms than banks.

For example, credit unions may offer lower interest rates on loans and credit cards, higher interest rates on savings accounts, and fewer fees than banks. Credit unions also often have more flexible lending criteria, making it easier for members to qualify for loans.

Technology and Convenience

Banks have traditionally been at the forefront of technological innovation, offering online banking, mobile apps, and other digital services. However, credit unions are quickly catching up in this area, offering many of the same technological conveniences as banks.

Credit unions may also offer additional conveniences, such as shared branching and ATM networks, that allow members to access their accounts at other credit unions and ATMs across the country. This can be particularly helpful for members who travel frequently or live in areas where their credit union doesn’t have a physical branch.

Customer Service

Because credit unions are not-for-profit institutions that focus on serving their members, they often provide better customer service than banks. Credit unions typically have shorter wait times, more personalized service, and more knowledgeable staff than banks.

Credit union staff members are often more involved in the community and have a better understanding of their members’ needs than bank employees. This allows them to provide more tailored advice and recommendations to help members achieve their financial goals.

Regulation

Both credit unions and banks are regulated by federal and state agencies to ensure that they operate safely and soundly. However, credit unions are subject to different regulations than banks because of their not-for-profit status.

Credit unions are regulated by the National Credit Union Administration (NCUA), while banks are regulated by the Federal Deposit Insurance Corporation (FDIC). The NCUA focuses on ensuring the safety and soundness of credit unions, as well as protecting the interests of their members. This regulatory approach allows credit unions to focus on serving their members, rather than maximizing profits for shareholders.

Benefits of Choosing a Credit Union

Choosing a credit union over a bank can offer many benefits. Credit unions often offer lower fees, lower interest rates, and more personalized service than banks. Credit unions also typically have a strong focus on community involvement and may offer additional benefits, such as financial education resources and special member events.

Members of credit unions also have a voice in the governance of the institution, as they elect the board of directors and have a say in the credit union’s policies and operations. This can give members a greater sense of ownership and control over their financial institution.

Credit Union vs Bank: Which is Right for You?

Deciding whether to choose a credit union or a bank ultimately depends on your individual needs and preferences. If you value personalized service, community involvement, and competitive rates and fees, a credit union may be the right choice for you.

If you prioritize technological innovations, convenience, and accessibility, a bank may be a better fit. It’s important to research both options and compare their products, services, and fees before making a decision.

Final Thoughts

Credit unions and banks both offer valuable financial products and services, but they operate in different ways. Credit unions are not-for-profit cooperatives that prioritize serving their members, while banks are for-profit entities that prioritize maximizing profits for shareholders.

Choosing between a credit union and a bank depends on your individual needs and preferences. By understanding the key differences between these institutions, you can make an informed decision that best serves your financial goals and interests.

Frequently Asked Questions

What is a credit union and how does it differ from a bank?

A credit union is a non-profit financial institution owned by its members. Members pool their money together to provide loans and other financial services to each other at competitive rates. Unlike banks, credit unions are not-for-profit organizations, which means that they exist solely to serve their members and not to generate profits for shareholders.

Credit unions are also typically smaller than banks, which allows them to provide more personalized service to their members. In addition, credit unions may offer lower fees and better interest rates on loans and savings accounts than traditional banks.

How do credit union fees compare to bank fees?

Credit unions generally have lower fees than banks, which means that members can save money on things like ATM fees, overdraft fees, and account maintenance fees. In addition, credit unions often offer free checking accounts and other financial services that banks may charge for.

One reason why credit unions are able to offer lower fees is because they are not-for-profit organizations. Instead of generating profits for shareholders, credit unions use their earnings to provide better rates and services to their members.

What types of financial services do credit unions offer?

Credit unions offer a wide range of financial services, including savings accounts, checking accounts, loans, credit cards, and investment services. Members can also access online banking services, mobile banking, and other convenient features to manage their accounts.

Credit unions are often able to offer more competitive rates on loans and other financial products than traditional banks. This is because credit unions are able to use the money they earn to provide better rates and services to their members, rather than generating profits for shareholders.

Who is eligible to become a member of a credit union?

Membership requirements for credit unions vary, but in general, credit unions are open to anyone who meets certain criteria. Some credit unions are restricted to employees of a particular company or members of a certain organization, while others are open to residents of a particular area.

To become a member of a credit union, you will typically need to open a savings account and maintain a minimum balance. Some credit unions may also require you to pay a one-time membership fee.

Are deposits at credit unions insured?

Yes, deposits at credit unions are insured by the National Credit Union Administration (NCUA), which is a federal agency that provides insurance coverage similar to the Federal Deposit Insurance Corporation (FDIC) for banks. The NCUA insures deposits up to $250,000 per individual account, which means that your money is safe and secure at a credit union.

Banks vs. Credit Unions: What’s the Difference? | NerdWallet

In conclusion, credit unions and banks may seem similar at first glance, but there are key differences that set them apart. Credit unions are member-owned, meaning that account holders have a say in how the institution is run and may receive better rates and fees as a result. On the other hand, banks are often publicly traded and prioritize profits over customer satisfaction.

Additionally, credit unions typically have a more personal touch when it comes to customer service, as they are often community-based and focus on building relationships with their members. Banks, on the other hand, may have a larger customer base and may not prioritize individual attention.

Overall, whether you choose a credit union or a bank may depend on your personal preferences and financial needs. It’s important to do your research and compare rates, fees, and services before making a decision.