Personal loans can be a great solution for financial needs such as debt consolidation, home renovations, or unexpected medical bills. However, it’s important to understand how taking out a personal loan can affect your credit score.

Your credit score is a crucial factor that lenders use to determine your creditworthiness. Therefore, before applying for a personal loan, it’s important to understand the potential impact it could have on your credit score. In this article, we will explore how personal loans affect your credit score and what you can do to ensure you maintain a good credit rating.

Taking out a personal loan can affect your credit score in both positive and negative ways. On one hand, making timely payments can boost your credit score. On the other hand, taking out too many loans or missing payments can have a negative impact. Additionally, applying for multiple loans can result in multiple hard inquiries on your credit report, which can lower your score temporarily. It’s important to weigh the pros and cons before taking out a personal loan.

How Does a Personal Loan Affect My Credit Score?

Personal loans are a type of unsecured loan that can be used for various purposes such as debt consolidation, home renovation, or purchasing a vehicle. However, before applying for a personal loan, it’s important to understand how it can impact your credit score. In this article, we’ll explore the different ways a personal loan can affect your credit score.

1. Payment History

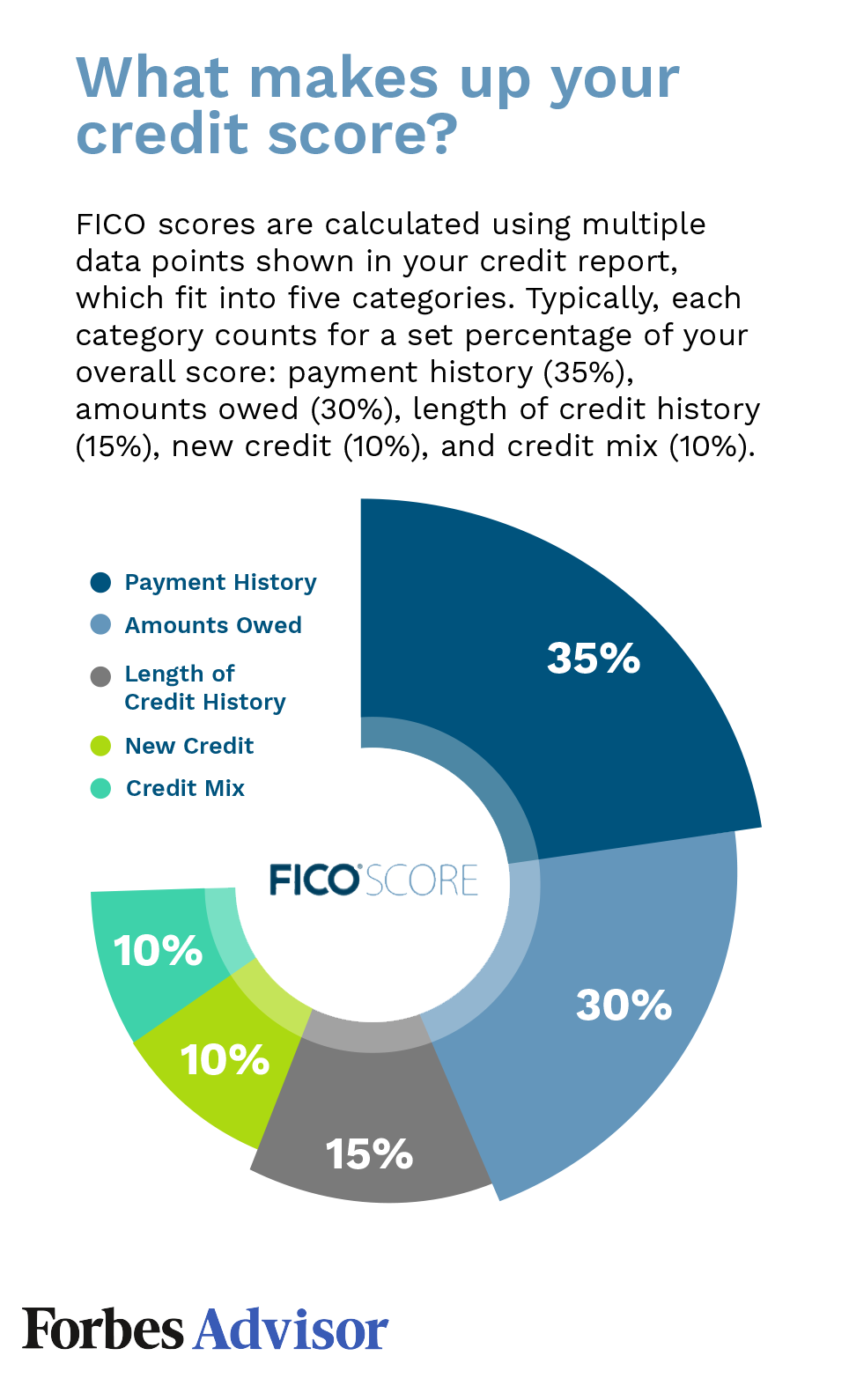

One of the most critical factors that can affect your credit score is your payment history. Your payment history shows how responsible you are in making your payments on time. If you miss a payment or make a late payment, it can negatively impact your credit score.

When you take out a personal loan, you’ll have to make monthly payments to repay the loan amount. If you make your payments on time, it can have a positive impact on your credit score. On the other hand, if you miss a payment, it can hurt your credit score. Therefore, it’s important to make your loan payments on time to maintain a good credit score.

2. Credit Utilization

Credit utilization is the percentage of your available credit that you’re currently using. For example, if you have a credit card with a $10,000 limit and you’ve used $5,000, your credit utilization is 50%. A high credit utilization can negatively impact your credit score.

When you take out a personal loan, it can increase your available credit, which can lower your credit utilization. However, it’s important to note that taking out too many loans can also hurt your credit score. Therefore, it’s essential to manage your credit utilization and only take out loans that you can afford to repay.

3. Credit Mix

Credit mix refers to the different types of credit that you have, such as credit cards, mortgages, and loans. Having a diverse credit mix can positively impact your credit score. When you take out a personal loan, it can add to your credit mix, which can improve your credit score.

4. Length of Credit History

The length of your credit history is another factor that can impact your credit score. The longer your credit history, the better it is for your credit score. When you take out a personal loan, it can add to your credit history, which can improve your credit score.

5. Credit Inquiries

When you apply for a loan or credit card, the lender will perform a credit inquiry to check your credit score and credit history. Too many credit inquiries can negatively impact your credit score.

When you apply for a personal loan, the lender will perform a hard credit inquiry, which can temporarily lower your credit score. However, if you’re approved for the loan and make your payments on time, it can have a positive impact on your credit score.

6. Benefits of a Personal Loan

Taking out a personal loan can have many benefits, such as consolidating high-interest debt, making home improvements, or funding a large purchase. Personal loans often have lower interest rates than credit cards, which can save you money in interest charges.

7. Personal Loan vs. Credit Card

When deciding between a personal loan and a credit card, it’s important to consider your financial situation and needs. Personal loans have a fixed interest rate and a fixed repayment term, which can make it easier to budget for your monthly payments. Credit cards have variable interest rates and no fixed repayment term, which can make it harder to manage your debt.

8. Personal Loan vs. Payday Loan

Payday loans are short-term loans that are designed to be repaid on your next payday. Payday loans often have high-interest rates and fees, which can trap you in a cycle of debt. Personal loans, on the other hand, have lower interest rates and longer repayment terms, which can make it easier to pay off your debt.

9. Applying for a Personal Loan

When applying for a personal loan, it’s essential to shop around and compare different lenders’ rates and terms. You should also check your credit score and credit report to ensure that there are no errors or inaccuracies that could negatively impact your loan application.

10. Conclusion

In conclusion, taking out a personal loan can impact your credit score in various ways. Making your loan payments on time can have a positive impact on your credit score, while missing payments can hurt your credit score. It’s essential to manage your credit utilization, credit mix, and credit inquiries to maintain a good credit score. Before applying for a personal loan, it’s important to consider your financial situation and needs and compare different lenders’ rates and terms.

Frequently Asked Questions

What is a personal loan?

A personal loan is a type of loan that can be used for a variety of purposes, such as consolidating debt, paying for a wedding or vacation, or making home improvements. Personal loans are typically unsecured, which means they are not backed by collateral, such as a home or car.

When you apply for a personal loan, the lender will review your credit history and other factors to determine whether you qualify for the loan and at what interest rate. If you are approved, you will receive the loan amount in a lump sum, and you will be required to make regular payments to repay the loan over a fixed period of time.

How does a personal loan affect my credit score?

Taking out a personal loan can have both positive and negative effects on your credit score. When you apply for a personal loan, the lender will review your credit history, which will result in a hard inquiry on your credit report. This can temporarily lower your credit score by a few points.

However, if you are approved for the loan and make all of your payments on time, your credit score will likely improve over time. This is because making timely payments will demonstrate to lenders that you are responsible with credit and can be trusted to make payments on time.

What happens if I miss a payment on my personal loan?

If you miss a payment on your personal loan, it can have a negative impact on your credit score. The lender may report the missed payment to the credit bureaus, which can lower your credit score. In addition, the lender may charge you a late fee, and the missed payment may accrue interest, which can make it harder to pay off the loan over time.

If you know you are going to miss a payment, it’s important to contact your lender as soon as possible to discuss your options. Some lenders may be willing to work out a payment plan or offer forbearance if you are experiencing financial hardship.

Can I pay off my personal loan early?

Yes, you can usually pay off your personal loan early without penalty. In fact, paying off your loan early can have a positive impact on your credit score, as it shows that you are responsible with credit and can manage your debt. However, before you pay off your loan early, it’s important to check with your lender to make sure there are no prepayment penalties or fees.

If you do decide to pay off your loan early, make sure you understand the process and any fees or penalties that may be involved. You may need to contact your lender to get a payoff quote and instructions on how to make the final payment.

What should I consider before taking out a personal loan?

Before you take out a personal loan, it’s important to consider several factors, such as your credit score, your income, and your debt-to-income ratio. You should also shop around for the best interest rate and loan terms, and make sure you understand all of the fees and costs associated with the loan.

In addition, you should consider whether you really need the loan and whether you can afford the monthly payments. Taking out a personal loan can be a good way to consolidate debt or pay for a major expense, but it’s important to make sure you can repay the loan on time and in full to avoid damaging your credit score and incurring additional fees and interest.

Dos and Don’ts of Taking Out a Personal Loan to Build Credit

In conclusion, a personal loan can have both positive and negative effects on your credit score. If you make timely payments and pay off the loan in full, it can actually improve your credit score and demonstrate to lenders that you are a responsible borrower. However, if you miss payments or default on the loan, it can have a negative impact on your credit score and make it more difficult to obtain credit in the future.

It’s important to carefully consider whether a personal loan is the right choice for your financial situation. Make sure you have a plan in place for repaying the loan and consider seeking advice from a financial professional if you are unsure about the best course of action. By taking a thoughtful and responsible approach to personal loans, you can make sure that they have a positive impact on your credit score and help you achieve your financial goals.