Updating your beneficiary information is essential to ensure that your loved ones receive your assets and benefits according to your wishes. Neglecting to update your beneficiaries can result in unintended consequences, such as disputes and delays in the distribution of your assets.

But how do you update your beneficiary information? Whether you need to change your beneficiaries due to a major life event or simply want to review and update your existing information, this guide will provide you with the necessary steps to ensure that your beneficiaries are up to date and accurately reflect your wishes.

To update your beneficiary information, you will need to contact your financial institution or insurance company and request the necessary forms to make changes. Once you have the forms, fill them out with the updated information and submit them according to the instructions provided. Be sure to keep a copy of the updated forms for your records.

Contents

- Updating Your Beneficiary Information: A Guide

- Frequently Asked Questions

- How often should I update my beneficiary information?

- What happens if I do not update my beneficiary information?

- Can I update my beneficiary information online?

- What information do I need to update my beneficiary information?

- Do I need to update my beneficiary information for all of my accounts?

- How To Update Your Beneficiaries.

Updating Your Beneficiary Information: A Guide

Updating beneficiary information is an essential task that can help ensure your assets go to the right people when you pass away. Whether you’ve recently gotten married, had a child, or just want to make changes to your existing beneficiaries, updating your information is a simple process that can give you peace of mind.

Why Update Your Beneficiary Information?

There are several reasons why you may need to update your beneficiary information. For example:

Changes in Your Family Situation: If you’ve recently gotten married, had a child, or gone through a divorce, you may need to update your beneficiary information.

Changes in Your Assets: If you’ve acquired new assets or sold existing assets, you may need to update your beneficiary information to ensure your assets go to the right people.

Changes in Your Beneficiaries: If one of your beneficiaries has passed away or you want to add or remove a beneficiary, you’ll need to update your beneficiary information.

How to Update Your Beneficiary Information

The process for updating your beneficiary information will depend on the type of asset you’re updating. Here are some common types of assets and how to update your beneficiary information for each:

Life Insurance: To update your beneficiary information for life insurance, you’ll need to contact your insurance company and request a change of beneficiary form. You’ll need to provide the new beneficiary’s name, address, and social security number.

Retirement Accounts: To update your beneficiary information for retirement accounts, such as a 401(k) or IRA, you’ll need to contact your account custodian and request a beneficiary designation form. You’ll need to provide the new beneficiary’s name, address, and social security number.

Bank Accounts: To update your beneficiary information for bank accounts, you’ll need to contact your bank and request a beneficiary designation form. You’ll need to provide the new beneficiary’s name, address, and social security number.

Benefits of Updating Your Beneficiary Information

Updating your beneficiary information can provide several benefits, including:

Peace of Mind: Knowing that your assets will go to the right people can give you peace of mind.

Preventing Disputes: Updating your beneficiary information can help prevent disputes among your family members.

Protecting Your Legacy: By updating your beneficiary information, you can ensure that your legacy is protected and passed down to the people you care about.

Updating Your Beneficiary Information: Common Mistakes to Avoid

When updating your beneficiary information, there are several common mistakes you should avoid, such as:

Forgetting to Update Your Beneficiary Information: If you forget to update your beneficiary information, your assets may go to the wrong people.

Not Naming Contingent Beneficiaries: If your primary beneficiary passes away before you, and you haven’t named any contingent beneficiaries, your assets may go to your estate instead of the people you intended.

Not Reviewing Your Beneficiary Information Regularly: It’s important to review your beneficiary information regularly to ensure it’s up-to-date and reflects your current wishes.

Conclusion

Updating your beneficiary information is an important task that can help protect your legacy and ensure your assets go to the right people. By following the steps outlined in this guide, you can update your beneficiary information with ease and give yourself peace of mind. Remember to review your beneficiary information regularly to ensure it’s always up-to-date.

Frequently Asked Questions

How often should I update my beneficiary information?

It is recommended to review and update your beneficiary information on a regular basis, preferably once a year. Major life events such as marriage, divorce, birth, and death should prompt an immediate update. It is important to ensure that your beneficiary information is up-to-date to avoid any complications or delays in distributing your assets.

Updating your beneficiary information is a simple process and can be done by contacting your plan administrator or insurance company. They will provide you with the necessary forms and instructions. Make sure to review your information carefully and double-check all details before submitting the form.

What happens if I do not update my beneficiary information?

If you do not update your beneficiary information, your assets may not be distributed according to your wishes. In the event of your death, your assets will be distributed based on the information on file, which may be outdated or incorrect. This can result in your assets going to the wrong person or not being distributed as you intended.

To avoid any confusion or complications, it is important to keep your beneficiary information up-to-date. By doing so, you can ensure that your assets are distributed according to your wishes and that your loved ones are taken care of.

Can I update my beneficiary information online?

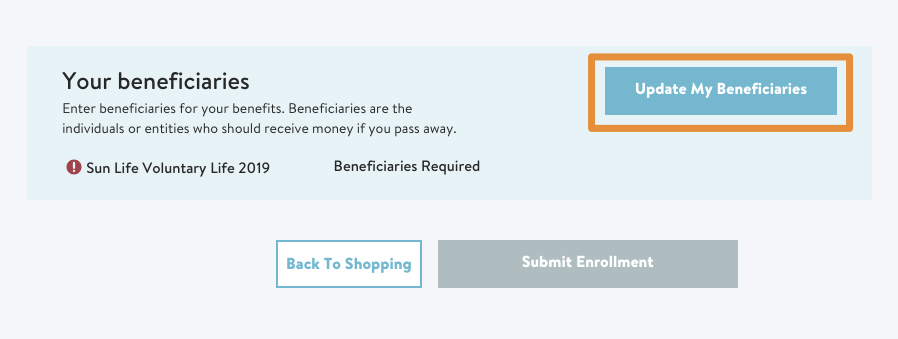

Yes, many plan administrators and insurance companies offer online platforms for updating your beneficiary information. This can be a convenient and efficient way to make updates and ensure that your information is current.

Before making any updates online, make sure to verify the security of the website and that you are on the correct page. It is also important to double-check all details before submitting the form.

What information do I need to update my beneficiary information?

To update your beneficiary information, you will need the full name, date of birth, and Social Security number or tax identification number of each beneficiary. You may also need to provide additional information such as relationship to the beneficiary and percentage of distribution.

Make sure to review the requirements of your plan administrator or insurance company before updating your information. Providing accurate and complete information will ensure that your assets are distributed according to your wishes.

Do I need to update my beneficiary information for all of my accounts?

Yes, it is important to review and update your beneficiary information for all of your accounts, including retirement plans, life insurance policies, and investment accounts.

Each account may have different requirements and procedures for updating your information, so make sure to review the details carefully. By keeping your beneficiary information up-to-date for all of your accounts, you can ensure that your assets are distributed according to your wishes and that your loved ones are taken care of.

How To Update Your Beneficiaries.

In conclusion, updating your beneficiary information is an important step in ensuring that your loved ones receive the benefits you intended for them. With the right information and resources, the process can be straightforward and stress-free.

First, check with your employer or financial institution to understand their specific requirements and procedures for updating beneficiary information. This may vary depending on the type of account or policy you have.

Next, take the time to review and update your beneficiaries regularly, especially after major life events such as a marriage, divorce, or the birth of a child. This can help avoid any confusion or disputes down the line.

Remember, updating your beneficiary information is a simple but crucial step in protecting your loved ones. By taking the time to understand the process and stay on top of any changes, you can have peace of mind knowing that your wishes will be carried out.