Direct deposit is a convenient and efficient way to receive your paycheck or other regular payments. Setting up direct deposit ensures that your funds are deposited directly into your bank account, eliminating the need to physically deposit a check. However, the process of setting up direct deposit can be daunting for those who have never done it before. In this article, we will guide you through the steps to set up direct deposit and answer any questions you may have. So, let’s get started!

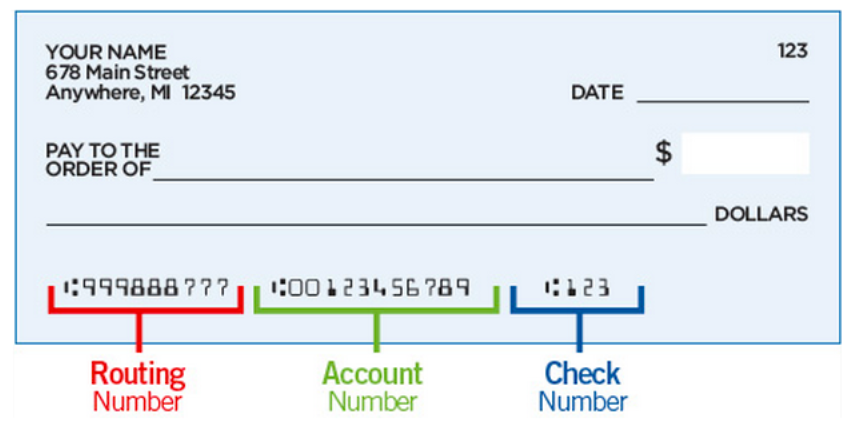

To set up direct deposit, you need to provide your employer with your bank account information. This includes your bank’s routing number and your account number, which you can find on the bottom of your checks or by contacting your bank directly. Once your employer has this information, they can set up direct deposit for you, allowing your paycheck to be automatically deposited into your account on payday.

Contents

- How Do I Set Up Direct Deposit?

- 1. Check with Your Employer

- 2. Gather Your Bank Account Information

- 3. Fill Out the Direct Deposit Form

- 4. Submit the Direct Deposit Form

- 5. Verify Your Direct Deposit

- 6. Benefits of Direct Deposit

- 7. Direct Deposit vs. Other Payment Methods

- 8. Common Direct Deposit Issues

- 9. Direct Deposit for Self-Employed Individuals

- 10. Conclusion

- Frequently Asked Questions

How Do I Set Up Direct Deposit?

Direct deposit is a convenient, secure way to receive your paycheck or other funds directly into your bank account. Setting up direct deposit can save you time and hassle, and it’s easy to do. Here’s what you need to know about setting up direct deposit.

1. Check with Your Employer

The first step in setting up direct deposit is to check with your employer to see if they offer the service. If they do, they will provide you with a direct deposit form to fill out. You will need to provide your employer with your bank account information, including your bank’s routing number and your account number.

It’s important to double-check this information before submitting it to your employer to ensure that your funds are deposited into the correct account. You should also verify that your bank accepts direct deposits and whether there are any fees associated with receiving them.

2. Gather Your Bank Account Information

Before you can set up direct deposit, you will need to gather your bank account information. This includes your bank’s routing number and your account number. You can find your bank’s routing number on your check or by contacting your bank directly.

You should also verify that your bank accepts direct deposits and whether there are any fees associated with receiving them. If you’re unsure about any of this information, contact your bank for assistance.

3. Fill Out the Direct Deposit Form

Once you have your bank account information, you can fill out the direct deposit form provided by your employer. Make sure to provide accurate and complete information to avoid any delays in receiving your funds.

You may also be required to provide additional information, such as your name, address, and Social Security number. This information is used to verify your identity and ensure that your funds are deposited into the correct account.

4. Submit the Direct Deposit Form

After you have completed the direct deposit form, submit it to your employer. They will process the form and begin depositing your funds directly into your bank account on the designated payday.

It’s important to keep in mind that it may take a few pay cycles before your direct deposit is fully set up and activated. During this time, you may need to continue receiving paper checks from your employer.

5. Verify Your Direct Deposit

Once your direct deposit is set up, it’s important to verify that your funds are being deposited into your bank account correctly. You can do this by checking your account balance and transaction history regularly.

If you notice any issues or discrepancies with your direct deposit, contact your employer or bank immediately to resolve the issue.

6. Benefits of Direct Deposit

Direct deposit offers several benefits over traditional paper checks. For one, it’s more secure, as there is no risk of your check being lost or stolen. Additionally, direct deposit is faster and more convenient, as your funds are deposited directly into your bank account.

Direct deposit also eliminates the need to physically deposit your check at a bank or ATM, saving you time and hassle. Finally, direct deposit is more environmentally friendly, as it eliminates the need for paper checks and envelopes.

7. Direct Deposit vs. Other Payment Methods

Direct deposit is just one of several payment methods that employers may offer. Other options include paper checks, paycards, and electronic payment services like PayPal.

Direct deposit is often the preferred payment method for both employers and employees, as it’s faster, more secure, and more convenient than other options. However, it’s important to choose the payment method that works best for you and your needs.

8. Common Direct Deposit Issues

While direct deposit is generally a reliable and hassle-free payment method, there are a few common issues that can arise. These include incorrect bank account information, delays in processing, and issues with the payroll system.

If you experience any of these issues, contact your employer or bank immediately to resolve the issue. It’s also important to keep your bank account information up-to-date to avoid any issues with direct deposit.

9. Direct Deposit for Self-Employed Individuals

Self-employed individuals can also take advantage of direct deposit by setting up a separate business bank account. This account can be used to receive payments from clients or customers directly into your bank account.

To set up direct deposit as a self-employed individual, you will need to provide your clients or customers with your bank account information, including your routing number and account number. You may also need to provide additional information, such as your business name and tax identification number.

10. Conclusion

Direct deposit is a convenient, secure way to receive your paycheck or other funds directly into your bank account. Setting up direct deposit is easy, and it offers several benefits over traditional paper checks.

To set up direct deposit, check with your employer to see if they offer the service, gather your bank account information, fill out the direct deposit form, and submit it to your employer. Once your direct deposit is set up, verify that your funds are being deposited correctly and enjoy the convenience and security of direct deposit.

Frequently Asked Questions

What is Direct Deposit?

Direct Deposit is a convenient and secure way to receive your payments electronically. Instead of receiving a paper check, your payment is deposited directly into your bank account. This method saves you time and effort as you don’t have to physically deposit the check yourself.

Direct Deposit also eliminates the risk of lost or stolen checks as the funds are directly deposited into your account. It is a safe and reliable way to receive your payments.

How do I sign up for Direct Deposit?

To sign up for Direct Deposit, you will need to contact your employer or the organization that is issuing your payments. They will provide you with a form to fill out which will require your bank account information, such as your account number and routing number.

Once you have completed the form and submitted it, your payments will be directly deposited into your account. It may take a few pay cycles for the Direct Deposit to take effect, so be sure to plan accordingly.

Is it possible to split my Direct Deposit between multiple accounts?

Yes, it is possible to split your Direct Deposit between multiple accounts. This is a great way to allocate your funds to different accounts, such as savings and checking accounts.

To set up multiple accounts for Direct Deposit, you will need to provide your employer or the organization issuing your payments with the account information for each account. They will then be able to allocate your payment between the different accounts as per your instructions.

Can I change my Direct Deposit information?

Yes, you can change your Direct Deposit information at any time. If you have changed your bank account or routing number, or if you want to change the allocation of your Direct Deposit between multiple accounts, you will need to contact your employer or the organization issuing your payments.

They will provide you with a form to fill out with the updated information. Once you have submitted the form, your Direct Deposit information will be updated and your payments will be deposited into the new account.

What happens if my Direct Deposit is delayed or doesn’t go through?

If your Direct Deposit is delayed or doesn’t go through, you should contact your employer or the organization issuing your payments. They will be able to investigate the issue and provide you with information on when you can expect to receive your payment.

In some cases, there may be an issue with your bank account information or the organization’s payment processing system. It is important to address any issues with Direct Deposit as soon as possible to avoid any delays in receiving your payments.

In conclusion, setting up direct deposit is a simple and convenient way to receive your paychecks. By following the steps provided by your employer or financial institution, you can ensure that your funds are deposited directly into your account, saving you time and effort.

One of the main benefits of direct deposit is its reliability. You no longer have to worry about lost or stolen checks, and your funds are available immediately upon deposit. Additionally, many employers offer incentives such as early access to funds or reduced fees for using direct deposit.

Finally, setting up direct deposit is a great way to take control of your finances. With automatic deposits, you can easily budget and manage your money without the hassle of cashing checks or making frequent trips to the bank. So why wait? Contact your employer or financial institution today to set up direct deposit and start enjoying its benefits!