Buying a home is one of the biggest investments you’ll make in your lifetime, and it all starts with getting a mortgage. But how do you qualify for one? With so many factors to consider, it can feel overwhelming. Don’t worry, we’ve got you covered. In this guide, we’ll break down the key requirements for getting a mortgage, so you can approach the process with confidence and clarity.

From credit scores to debt-to-income ratios, we’ll explore the factors that lenders look at when deciding whether to approve your mortgage application. We’ll also provide tips for improving your chances of getting approved, so you can move one step closer to achieving your dream of homeownership. So, whether you’re a first-time homebuyer or a seasoned pro, let’s dive in and learn how to qualify for a mortgage.

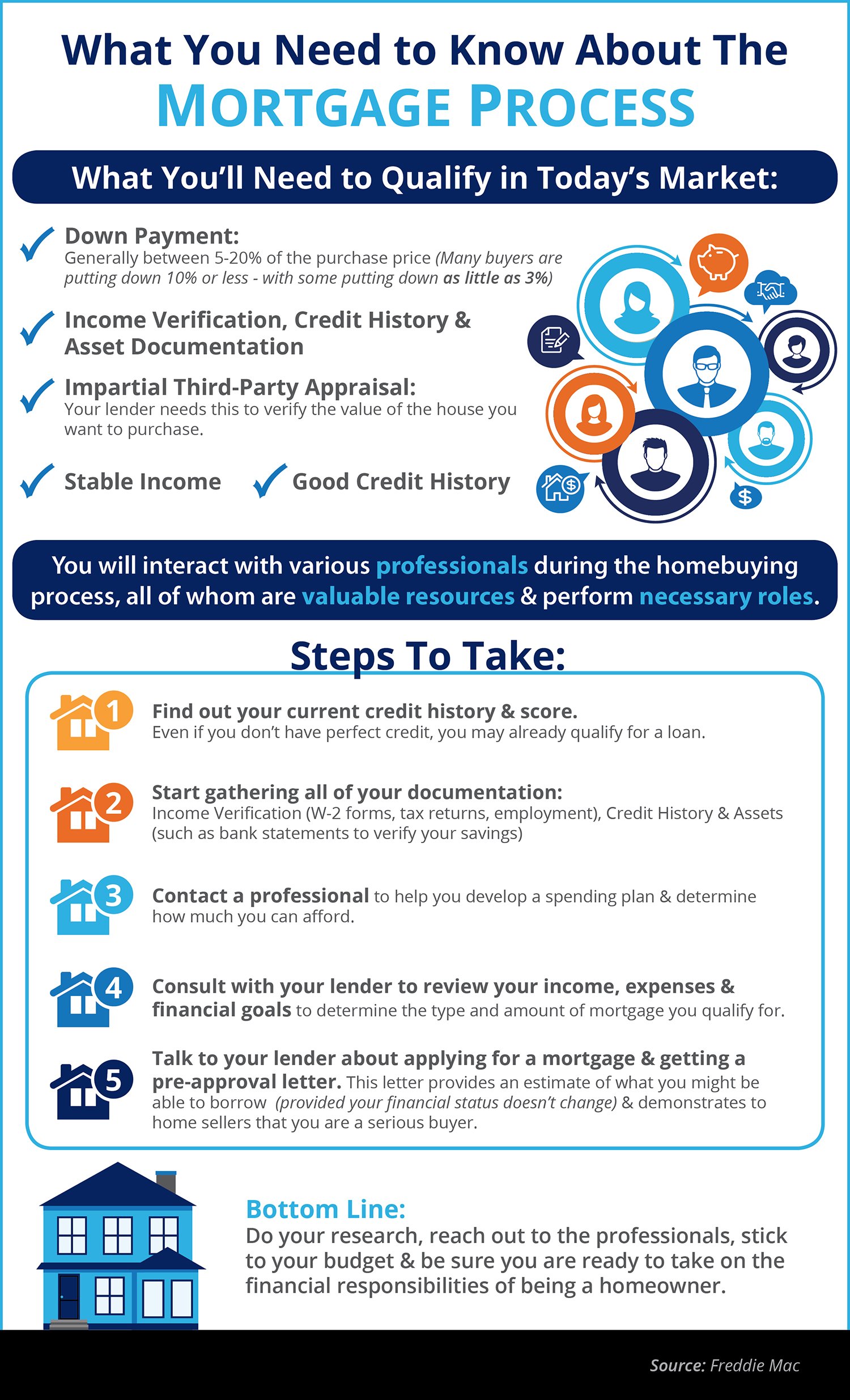

Qualifying for a mortgage depends on several factors, such as your credit score, income, and debt-to-income ratio. Generally, lenders want to see a credit score of at least 620 and a debt-to-income ratio of no more than 43%. You’ll also need to provide proof of income, employment history, and other financial documentation. Meeting these requirements can help you qualify for a mortgage.

Contents

- How Do I Qualify for a Mortgage?

- 1. Check Your Credit Score

- 2. Calculate Your Debt-to-Income Ratio

- 3. Save for a Down Payment

- 4. Gather Your Financial Documents

- 5. Shop Around for Lenders

- 6. Get Pre-Approved for a Mortgage

- 7. Choose the Right Mortgage

- 8. Understand the Closing Costs

- 9. Maintain Your Financial Stability

- 10. Enjoy Your New Home

- Frequently Asked Questions

- What is the minimum credit score needed to qualify for a mortgage?

- What is the maximum debt-to-income ratio allowed for a mortgage?

- What documents do I need to provide to qualify for a mortgage?

- Can I qualify for a mortgage if I am self-employed?

- What are some common reasons why mortgage applications are denied?

- SIMPLE way to calculate how much mortgage you qualify for (mortgage broker advice)

How Do I Qualify for a Mortgage?

Buying a home is a significant investment, and for most people, it is only possible with a mortgage. However, to secure a mortgage, you need to meet specific criteria set by lenders. Qualifying for a mortgage can be a daunting task, especially if you are a first-time homebuyer. But don’t worry, this guide will take you through the steps you need to take to qualify for a mortgage.

1. Check Your Credit Score

Your credit score is one of the most critical factors that lenders consider when deciding whether to approve your mortgage application. Your credit score is a reflection of your creditworthiness, and it gives lenders an idea of how likely you are to repay your debts. A credit score of 680 or higher is considered good and will increase your chances of getting approved for a mortgage.

To improve your credit score, check your credit report for errors and dispute any inaccuracies. Pay off any outstanding debts, and avoid applying for new credit cards or loans before applying for a mortgage.

2. Calculate Your Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is the percentage of your monthly income that goes towards paying your debts. Lenders use your DTI ratio to determine whether you can afford to take on a mortgage. Ideally, your DTI ratio should be below 36%.

To calculate your DTI ratio, add up all your monthly debt payments, including credit cards, car loans, and student loans, and divide them by your gross monthly income. If your DTI ratio is above 36%, consider paying off some of your debts before applying for a mortgage.

3. Save for a Down Payment

Most lenders require a down payment of at least 3% of the purchase price of the home. However, if you can afford to put down a larger down payment, it will lower your monthly mortgage payments and increase your chances of getting approved for a mortgage.

Saving for a down payment can be challenging, but there are several ways to do it. You can set up a separate savings account and automate your savings contributions. You can also reduce your expenses and increase your income by taking on a side job.

4. Gather Your Financial Documents

To apply for a mortgage, you will need to provide several financial documents, including your W-2s, tax returns, bank statements, and pay stubs. Make sure to gather all these documents before applying for a mortgage to speed up the process.

5. Shop Around for Lenders

Different lenders offer different mortgage rates and terms, so it’s essential to shop around and compare offers from multiple lenders. Get quotes from at least three lenders and compare the interest rates, fees, and terms before choosing a lender.

6. Get Pre-Approved for a Mortgage

Getting pre-approved for a mortgage is an essential step in the homebuying process. It will give you an idea of how much you can afford to borrow and help you narrow down your home search. To get pre-approved, you will need to provide your financial documents and undergo a credit check.

7. Choose the Right Mortgage

There are several types of mortgages to choose from, including fixed-rate mortgages, adjustable-rate mortgages, and government-backed mortgages. Each type of mortgage has its pros and cons, so it’s essential to choose the right mortgage for your financial situation.

8. Understand the Closing Costs

Closing costs can add up to thousands of dollars, and they are typically paid at the closing of the home purchase. Closing costs include fees for the appraisal, loan origination, title search, and title insurance. Make sure to factor in the closing costs when budgeting for your mortgage.

9. Maintain Your Financial Stability

Once you have qualified for a mortgage, it’s essential to maintain your financial stability. Avoid taking on new debt or missing any payments, as it can negatively impact your credit score and your ability to repay your mortgage.

10. Enjoy Your New Home

Congratulations! You have qualified for a mortgage and purchased your new home. Now it’s time to enjoy your new home and make it your own. Remember to keep up with your mortgage payments and maintain your financial stability to ensure a bright future in your new home.

In conclusion, qualifying for a mortgage can be a challenging process, but it’s worth it in the end. By following these steps, you can increase your chances of getting approved for a mortgage and achieve your dream of homeownership.

Frequently Asked Questions

What is the minimum credit score needed to qualify for a mortgage?

The minimum credit score needed to qualify for a mortgage varies depending on the type of loan you are applying for. Generally, a score of 620 or higher is required for conventional loans, but some lenders may require higher scores. FHA loans may be available to borrowers with scores as low as 500, but a higher score will typically result in a lower interest rate and better loan terms.

In addition to your credit score, lenders will consider other factors such as your income, debt-to-income ratio, and employment history when determining whether you qualify for a mortgage.

What is the maximum debt-to-income ratio allowed for a mortgage?

The maximum debt-to-income (DTI) ratio allowed for a mortgage depends on the type of loan and the lender’s requirements. Generally, the maximum DTI ratio for conventional loans is 43%, but some lenders may allow higher ratios for borrowers with strong credit and income. FHA loans may allow ratios up to 50%, but a higher ratio may result in higher interest rates or other fees.

Your debt-to-income ratio is calculated by dividing your monthly debt payments by your gross monthly income. Lenders use this ratio to determine whether you can afford to make your mortgage payments in addition to your other debts and expenses.

What documents do I need to provide to qualify for a mortgage?

To qualify for a mortgage, you will need to provide various documents to the lender. These may include your W-2 forms, tax returns, pay stubs, bank statements, and proof of any other sources of income or assets. You will also need to provide information about your employment history, debts, and other financial obligations.

It is important to be prepared to provide these documents and to be honest and accurate in your disclosures. Failing to provide accurate information could result in your loan application being denied or your loan being rescinded later on.

Can I qualify for a mortgage if I am self-employed?

Yes, it is possible to qualify for a mortgage if you are self-employed, but it may be more challenging than it is for those who are employed by someone else. Lenders will typically require more documentation from self-employed borrowers to verify their income and financial stability.

You may be required to provide several years’ worth of tax returns, as well as profit and loss statements or other documents that demonstrate your income and business expenses. It is important to work with a lender who has experience working with self-employed borrowers and who can guide you through the process.

What are some common reasons why mortgage applications are denied?

There are several reasons why a mortgage application may be denied. These may include a low credit score, a high debt-to-income ratio, insufficient income, or a history of late payments or other financial problems. Some lenders may also have strict requirements for the type of property or the location of the property being purchased.

If your mortgage application is denied, it is important to understand the reason why and to take steps to address any issues that may be preventing you from qualifying. This may involve working to improve your credit score, paying down debt, or finding a co-signer or other way to increase your income or assets.

SIMPLE way to calculate how much mortgage you qualify for (mortgage broker advice)

In conclusion, qualifying for a mortgage can seem like a daunting task, but with the right preparation and understanding of the requirements, it can be a smooth process.

Firstly, make sure you have a good credit score and a steady income to show lenders that you are a reliable borrower. Secondly, save up for a down payment and consider getting pre-approved for a loan to give you a better idea of what you can afford.

Lastly, don’t be afraid to seek guidance from a mortgage professional who can provide you with invaluable advice and support throughout the process. With these steps, you’ll be well on your way to owning your dream home and enjoying the benefits of homeownership.