Opening a trust account can be a daunting task, especially if you’re not familiar with the process. But don’t worry! With the right guidance, it can be a straightforward and stress-free experience.

A trust account is an excellent option for those looking to protect their assets and ensure their loved ones are taken care of after they’re gone. In this article, we’ll guide you through the steps of opening a trust account and give you all the information you need to make informed decisions about your financial future. So, let’s get started!

Opening a trust account involves a few simple steps. First, determine the type of trust account you need. Next, choose a financial institution and gather the required documents, including the trust agreement and identification for all trustees. Finally, complete the account application and fund the account. Consider seeking the advice of a financial advisor or attorney to ensure the trust account is set up correctly.

How Do I Open a Trust Account?

Trust accounts serve as a way to manage assets and property for the benefit of another person or entity. Trust accounts can be opened for a variety of reasons, such as estate planning, charitable giving, or protecting assets from creditors. If you’re interested in opening a trust account, here are the steps you need to take.

1. Determine the Type of Trust Account You Need

Before opening a trust account, you need to determine the type of trust you need. There are many different types of trusts, including revocable living trusts, irrevocable trusts, charitable trusts, and special needs trusts. Each type of trust has different requirements and benefits, so it’s important to do your research and consult with an attorney or financial advisor to determine the best type of trust for your needs.

Once you’ve determined the type of trust you need, you’ll need to gather the necessary documents and information to open the account. This may include your personal information, the names and addresses of beneficiaries, and any legal documents related to the trust.

2. Choose a Trustee

The trustee is the person or entity responsible for managing the trust assets and distributing them according to the terms of the trust. Choosing a trustee is an important decision, as they will have significant control over the assets in the trust.

You can choose to be the trustee of your own trust, or you can appoint someone else to act as trustee. If you choose to appoint someone else, make sure to choose someone who is trustworthy, responsible, and has experience managing financial accounts.

3. Find a Trustee Service or Financial Institution

Once you’ve determined the type of trust you need and chosen a trustee, you’ll need to find a trustee service or financial institution to open the trust account. Many banks and financial institutions offer trust services, so it’s important to shop around and compare fees, services, and reputation before choosing a provider.

Some factors to consider when choosing a trustee service or financial institution include their experience and expertise in managing trusts, their fees and charges, and their level of customer service and support.

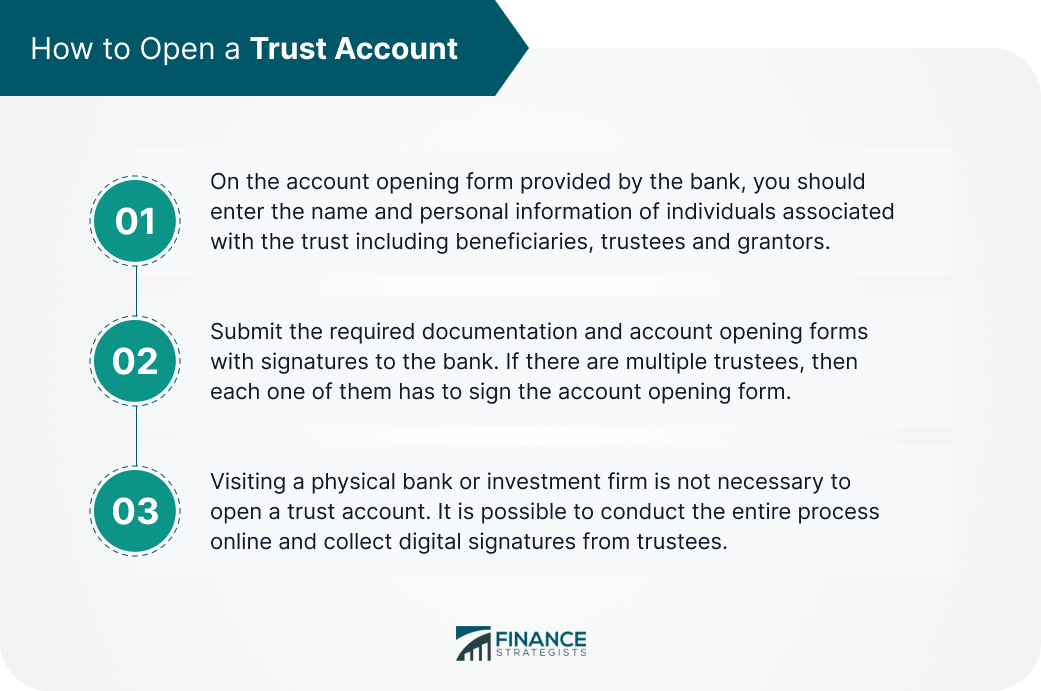

4. Open the Trust Account

Once you’ve chosen a trustee service or financial institution, you can begin the process of opening the trust account. This typically involves completing an application and providing the necessary documents and information, such as your personal information, the names and addresses of beneficiaries, and any legal documents related to the trust.

Once the account is open, you can begin transferring assets into the trust and managing them according to the terms of the trust.

5. Manage the Trust Account

Managing a trust account involves monitoring the assets in the account, making investment decisions, and distributing assets to beneficiaries according to the terms of the trust. This can be a complex and time-consuming process, so it’s important to work closely with your trustee and financial advisor to ensure that the trust is managed properly.

Some benefits of opening a trust account include tax benefits, asset protection, and the ability to control how your assets are distributed after your death. However, there are also some downsides to consider, such as the fees and charges associated with managing a trust account and the potential loss of control over your assets.

Overall, opening a trust account can be a great way to manage your assets and protect your legacy for future generations. By following these steps and working with trusted professionals, you can ensure that your trust is set up properly and managed effectively.

Contents

Frequently Asked Questions

Trust accounts are a popular way to protect your assets and ensure they are distributed according to your wishes. Here are some common questions about how to open a trust account:

What is a trust account?

A trust account is a type of financial account that holds assets for the benefit of another person or entity. The person who creates the trust, known as the grantor, transfers assets into the account, which is managed by a trustee. The trustee is responsible for administering the trust according to the grantor’s instructions and distributing the assets to the beneficiaries.

Trust accounts are often used to protect assets from creditors, minimize taxes, and ensure that assets are distributed according to the grantor’s wishes after their death.

Who can open a trust account?

Anyone can open a trust account, as long as they have assets to transfer into the account. Common types of trust accounts include living trusts, which are set up during the grantor’s lifetime and can be changed or revoked at any time, and testamentary trusts, which are created through a will and become active after the grantor’s death.

Before opening a trust account, it’s important to consult with an attorney or financial advisor to determine the best type of trust for your needs and ensure that your assets are protected.

What documents are needed to open a trust account?

The documents needed to open a trust account can vary depending on the financial institution and the type of trust being created. Generally, you will need to provide identification documents, such as a driver’s license or passport, as well as proof of address and social security number.

If you are setting up a living trust, you will also need to provide a copy of the trust agreement, which outlines the terms of the trust and identifies the trustee and beneficiaries. If you are creating a testamentary trust, the trust agreement will be included in your will.

What fees are associated with trust accounts?

The fees associated with trust accounts can vary depending on the financial institution and the type of trust being created. Some common fees include account setup fees, annual maintenance fees, and trustee fees.

It’s important to review the fee schedule carefully before opening a trust account to ensure that you understand the costs involved and can budget accordingly. Be sure to ask about any additional fees that may be charged for services such as asset management or legal advice.

How do I choose a trustee for my trust account?

Choosing a trustee for your trust account is an important decision, as they will be responsible for managing your assets and distributing them to your beneficiaries. Ideally, your trustee should be someone you trust and who has experience managing financial accounts.

You may choose to appoint a family member or friend as your trustee, or you may opt to hire a professional trustee, such as a trust company or financial advisor. When selecting a trustee, be sure to consider their financial expertise, availability, and willingness to serve in the role.

How to Set Up a Trust Fund in 2023 [Step-by-Step]

Remember that trust accounts can be complex, so seeking guidance from a qualified financial advisor or attorney can be helpful. Additionally, regularly reviewing and updating your trust can ensure that it continues to meet your evolving needs and goals.

Overall, opening a trust account is an important decision that requires careful consideration, but can ultimately provide peace of mind knowing that your financial legacy is in good hands.