Opening a checking account may seem like a daunting task, especially if you’re new to banking. However, it is an essential financial tool that can help you manage your money and build a strong financial foundation. In this guide, we’ll walk you through the process of opening a checking account and give you tips on how to choose the right one for your needs. So, let’s get started on your journey to financial freedom!

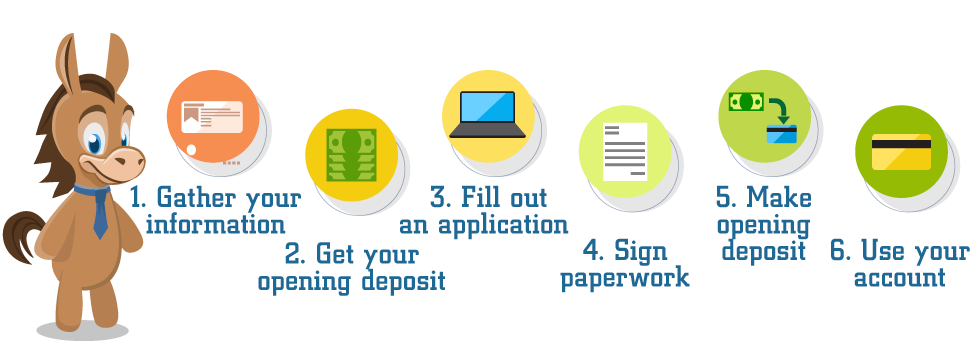

Opening a checking account is easy. To get started, choose a bank or credit union that suits your needs. Gather all the necessary documentation such as a government-issued identification, social security number, and proof of address. Fill out the application form accurately and truthfully. You may need to make an initial deposit to activate your account. Once your account is open, you can start using it to manage your finances.

How Do I Open a Checking Account?

Opening a checking account is an important step towards managing your finances. It provides a convenient way to deposit and withdraw money, pay bills, and track your spending. If you’re new to banking, you may be wondering how to open a checking account. Here’s what you need to know.

1. Choose a Bank or Credit Union

The first step in opening a checking account is to choose a financial institution that meets your needs. You can choose a traditional bank or a credit union. Both offer checking accounts, but credit unions are non-profit organizations that are owned by their members, while banks are for-profit corporations.

When choosing a bank or credit union, consider factors such as location, fees, interest rates, and services offered. Look for an institution that has convenient branches and ATMs, low fees, competitive interest rates, and features such as online banking and mobile banking.

2. Gather Your Information

Before you can open a checking account, you’ll need to provide some personal information to the financial institution. This may include your name, address, date of birth, Social Security number, and a valid form of identification such as a driver’s license or passport.

You may also need to provide information about your employment status, income, and any existing bank accounts or loans. Some financial institutions may require a minimum deposit to open a checking account, so be sure to have the necessary funds available.

3. Choose the Right Type of Checking Account

Financial institutions offer different types of checking accounts to meet the needs of their customers. Some accounts may have minimum balance requirements, monthly fees, or other restrictions. Others may offer rewards such as cash back or interest.

When choosing a checking account, consider your financial goals and habits. If you maintain a high balance, a high-yield checking account may be a good option. If you frequently use ATMs, look for an account that offers fee-free ATM access.

4. Complete the Application

Once you’ve chosen a financial institution and a checking account, you’ll need to complete an application. This may be done online or in person at a branch.

The application will ask for your personal information, as well as information about the type of account you want to open. You may also need to sign a signature card and make a deposit.

5. Set Up Online Banking

Most financial institutions offer online banking, which allows you to manage your checking account from anywhere with an internet connection. To set up online banking, you’ll need to create a username and password and provide some additional information.

Online banking allows you to check your account balance, view transactions, transfer money, pay bills, and more.

6. Order Checks and a Debit Card

Once your checking account is open, you’ll need to order checks and a debit card. These can usually be ordered online or in person at a branch.

Checks are used to make payments by mail or in person, while a debit card allows you to make purchases and withdraw cash from ATMs.

7. Understand Fees and Charges

Before opening a checking account, it’s important to understand the fees and charges associated with the account. This may include monthly maintenance fees, overdraft fees, ATM fees, and more.

Be sure to read the account disclosures carefully and ask questions if you’re unsure about any fees or charges.

8. Manage Your Account Carefully

Once your checking account is open, it’s important to manage it carefully. This means keeping track of your balance, avoiding overdrafts, and monitoring your transactions for errors or unauthorized charges.

You can use online banking or a mobile app to check your balance and transactions, set up alerts for low balances or unusual activity, and more.

9. Consider Direct Deposit and Automatic Payments

Direct deposit allows your employer to deposit your paycheck directly into your checking account, which can save you time and hassle. You can also set up automatic payments for bills such as rent, utilities, and credit card payments.

These options can help you avoid late fees and ensure that your bills are paid on time.

10. Reevaluate Your Account Regularly

Finally, it’s a good idea to reevaluate your checking account regularly to make sure it still meets your needs. You may find that you need a different type of account or that you’re paying too much in fees.

By staying aware of your options and keeping an eye on your account, you can ensure that your checking account is working for you.

Contents

- Frequently Asked Questions

- What do I need to open a checking account?

- Can I open a checking account online?

- What fees should I expect with a checking account?

- What is the difference between a checking account and a savings account?

- How do I choose the right checking account for me?

- Everything You Need to Know About Opening a Checking Account

Frequently Asked Questions

What do I need to open a checking account?

To open a checking account, you will typically need a valid government-issued ID, such as a driver’s license or passport. You will also need to provide your social security number and proof of address, such as a utility bill or lease agreement. Some banks may also require an initial deposit to open the account.

Can I open a checking account online?

Yes, many banks offer the option to open a checking account online. You will typically need to provide the same information as you would in person, such as your ID and social security number. Some banks may also require you to make an initial deposit online to open the account.

What fees should I expect with a checking account?

The fees associated with a checking account can vary depending on the bank and type of account you choose. Common fees include monthly maintenance fees, overdraft fees, and ATM fees. Some banks may waive certain fees if you meet certain requirements, such as maintaining a minimum balance or setting up direct deposit.

What is the difference between a checking account and a savings account?

A checking account is typically used for everyday expenses and transactions, such as paying bills and making purchases. A savings account, on the other hand, is designed for long-term savings goals and typically offers a higher interest rate than a checking account. Savings accounts may also have limitations on the number of withdrawals you can make per month.

How do I choose the right checking account for me?

To choose the right checking account for your needs, consider factors such as fees, interest rates, and account features. Look for an account with low fees and a high interest rate, if possible. You may also want to consider the bank’s online and mobile banking options, as well as any rewards programs or account perks they offer.

Everything You Need to Know About Opening a Checking Account

In conclusion, opening a checking account is an essential step towards managing your finances. With the right approach, opening a checking account can be a straightforward and hassle-free process. Ensure that you have all the necessary documents, such as a valid ID and proof of address, before heading to the bank. Remember to compare different banks’ offerings to find the best fit for your needs.

Furthermore, many banks offer online account opening options, which can save you time and energy. Be sure to read the terms and conditions carefully to understand any fees or limitations associated with the account. Once you have opened your checking account, it’s essential to stay on top of your transactions and balance to avoid any overdraft fees or other penalties.

Overall, opening a checking account is a crucial step towards financial stability and independence. With a little research and preparation, you can find the best account for your needs and start managing your finances with ease. So, why not take the first step today and open a checking account?