Creating a personal budget can be a daunting task for many individuals. However, it is an essential skill that can help you take control of your finances and achieve your financial goals. Whether you’re looking to save money for a down payment on a house, pay off debt, or simply manage your monthly expenses, creating a budget is the first step in the right direction.

In this article, we will guide you through the process of creating a personal budget. We will cover everything from tracking your expenses, determining your income, setting financial goals, and creating a budget that works for you. By the end of this article, you’ll have the tools and knowledge to take control of your finances and achieve your financial goals. So, let’s get started!

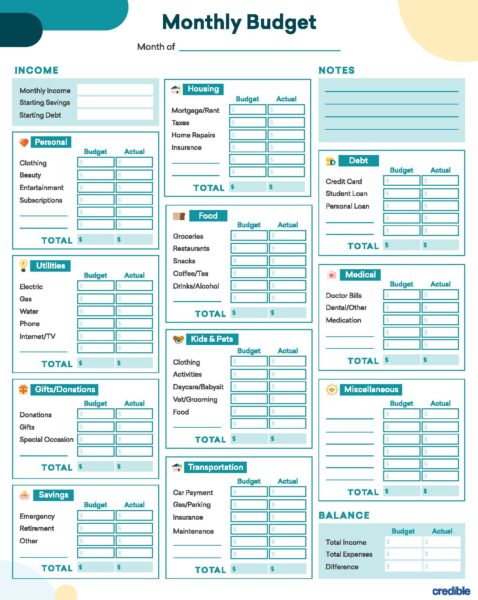

Creating a personal budget can be done in a few simple steps. First, determine your total monthly income. Next, make a list of all your monthly expenses, including bills, groceries, and entertainment. Subtract your expenses from your income to determine how much money you have left over. Allocate that money into categories, such as savings or debt repayment. Lastly, track your spending and adjust your budget as needed.

How Do I Create a Personal Budget?

Creating a personal budget is an essential step towards financial freedom. A budget helps you keep track of your income and expenses, and it allows you to plan for the future. If you are new to budgeting, it may seem daunting at first. However, with a little effort and dedication, you can create a budget that works best for you. Here are ten steps to help you create a personal budget.

Step 1: Determine Your Income

The first step to creating a personal budget is to determine your income. This includes all sources of income, such as your salary, bonuses, commissions, and any other income. Once you have determined your income, you can move on to the next step.

To determine your income accurately, you may need to review your pay stubs, bank statements, and tax returns. It’s important to know your net income, which is your income after taxes and other deductions.

Step 2: Track Your Expenses

The next step is to track your expenses. This includes all your regular bills, such as rent, utilities, and groceries, as well as any other expenses, such as entertainment, travel, and clothing. Tracking your expenses can be done manually using a notebook or spreadsheet, or you can use a budgeting app to help you keep track.

It’s important to be honest with yourself when tracking your expenses. Don’t forget to include any small purchases, such as coffee or snacks, as they can add up over time.

Step 3: Categorize Your Expenses

Once you have tracked your expenses, you need to categorize them. This helps you see where your money is going and identify areas where you can cut back. Common categories include housing, utilities, transportation, groceries, entertainment, and debt payments.

You can create your categories based on your spending habits. For example, if you eat out frequently, you may want to create a category for dining out.

Step 4: Create a Spending Plan

Using the information from steps one through three, you can now create a spending plan. This plan outlines how much you can spend in each category and helps you stay within your budget. Your spending plan should include your regular bills, such as rent and utilities, as well as discretionary spending, such as entertainment and dining out.

It’s important to be realistic when creating your spending plan. Don’t set unrealistic goals that you can’t achieve. Instead, focus on making small changes that add up over time.

Step 5: Set Savings Goals

Creating a personal budget isn’t just about paying bills and controlling spending. It’s also about setting savings goals. Whether you want to save for a down payment on a house, a new car, or a vacation, setting a savings goal helps you stay motivated and focused.

When setting your savings goals, be specific about what you want to achieve and how much you need to save. This helps you stay on track and avoid overspending.

Step 6: Automate Your Savings

One of the easiest ways to save money is to automate your savings. This means setting up automatic transfers from your checking account to your savings account. This way, you don’t have to think about saving money, and it happens automatically.

Automating your savings also helps you stay disciplined and avoid spending money that you should be saving.

Step 7: Pay Off Debt

If you have debt, such as credit card debt or student loans, it’s important to include debt payments in your budget. Paying off debt should be a priority, as it can help you save money in the long run.

When paying off debt, focus on high-interest debt first, as this is the debt that costs you the most. Make extra payments whenever possible, and avoid taking on new debt.

Step 8: Review Your Budget Regularly

Once you have created a budget, it’s important to review it regularly. This helps you stay on track and make adjustments as needed. You may find that you need to cut back in certain areas or adjust your savings goals.

Reviewing your budget also helps you identify any changes in your income or expenses. For example, if you get a raise at work, you may be able to increase your savings goals.

Step 9: Stay Motivated

Creating a personal budget can be challenging, but it’s important to stay motivated. Remember why you are creating a budget and what your goals are. Celebrate your successes, no matter how small, and don’t get discouraged if you make mistakes.

Staying motivated also means being accountable. Tell a friend or family member about your budget and ask them to hold you accountable.

Step 10: Revisit Your Budget Regularly

Finally, it’s important to revisit your budget regularly. This means looking at your spending and savings goals and making adjustments as needed. Your budget should be flexible and adapt to changes in your life, such as a new job or a new expense.

Revisiting your budget regularly also helps you stay motivated and focused on your goals. Remember, creating a personal budget is a journey, and it takes time and effort to get it right. But with dedication and discipline, you can achieve financial freedom and live the life you want.

Contents

- Frequently Asked Questions

- What is the first step in creating a personal budget?

- How do I track my expenses for my personal budget?

- What should I do if my expenses exceed my income in my personal budget?

- How often should I review my personal budget?

- Why is it important to have a personal budget?

- HOW TO: THE EASIEST AND SIMPLEST WAY TO CREATE A MONTHLY BUDGET! 6-MINUTES PROCESS

Frequently Asked Questions

In this section, we will answer some common questions related to creating a personal budget.

What is the first step in creating a personal budget?

The first step in creating a personal budget is to determine your monthly income. This includes your salary, any freelance or side hustle income, and any other sources of money you receive each month. Once you know your total monthly income, you can start to build your budget around that number.

It’s important to be honest with yourself about your income and not overestimate it. This will help you create a more realistic budget that you can actually stick to.

How do I track my expenses for my personal budget?

Tracking your expenses is a crucial part of creating a personal budget. You can use a spreadsheet or budgeting app to track your expenses. Start by listing out all of your monthly expenses, including rent/mortgage, utilities, groceries, transportation, and any other bills you have. Then, track your spending in each of these categories throughout the month.

At the end of the month, review your expenses and see where you can cut back. This will help you stay within your budget and save more money each month.

What should I do if my expenses exceed my income in my personal budget?

If your expenses exceed your income in your personal budget, you may need to make some tough decisions. Look for areas where you can cut back on your expenses. This might mean eating out less, canceling subscription services, or finding ways to reduce your utility bills.

You may also need to find ways to increase your income. Consider taking on a side hustle or freelancing to bring in more money each month. Whatever you do, don’t ignore the problem and hope it will go away. Addressing it head-on will help you get back on track and reach your financial goals.

How often should I review my personal budget?

It’s important to review your personal budget regularly to make sure you’re staying on track. We recommend reviewing your budget every month. This will help you identify any areas where you’re overspending and make adjustments for the following month.

You should also review your budget any time your income or expenses change significantly. For example, if you get a raise at work or your rent goes up, you’ll need to adjust your budget accordingly.

Why is it important to have a personal budget?

A personal budget is important because it helps you take control of your finances. By creating a budget, you can see exactly where your money is going each month and identify areas where you can save. It also helps you plan for the future and reach your financial goals, whether that’s paying off debt, saving for a down payment on a house, or planning for retirement.

Without a budget, it’s easy to overspend and end up in debt. A personal budget helps you avoid this by giving you a clear picture of your finances and helping you make better financial decisions.

HOW TO: THE EASIEST AND SIMPLEST WAY TO CREATE A MONTHLY BUDGET! 6-MINUTES PROCESS

In conclusion, creating a personal budget can seem overwhelming at first, but it is an essential step towards achieving financial stability. By following the steps outlined above, you can create a budget that works for you and helps you achieve your financial goals.

Remember to be realistic when setting your budget and to track your expenses regularly. This will help you stay on track and make adjustments as needed.

Finally, don’t be afraid to seek help or advice if you need it. There are many resources available, from financial advisors to online budgeting tools, that can help you create and stick to a budget that works for you. With a little effort and discipline, you can take control of your finances and achieve your financial goals.