Choosing the right savings account can be a daunting task with so many options available. It’s essential to find an account that fits your needs and goals, whether you’re saving for a short-term goal or a long-term investment. In this article, we will explore the factors to consider when selecting a savings account and help you make an informed decision.

With interest rates, fees, and access to funds varying from one account to another, it’s crucial to assess your financial situation and determine what you need from a savings account. From traditional savings accounts to high-yield savings accounts, we will provide you with the information you need to choose the right savings account that is tailored to your individual needs.

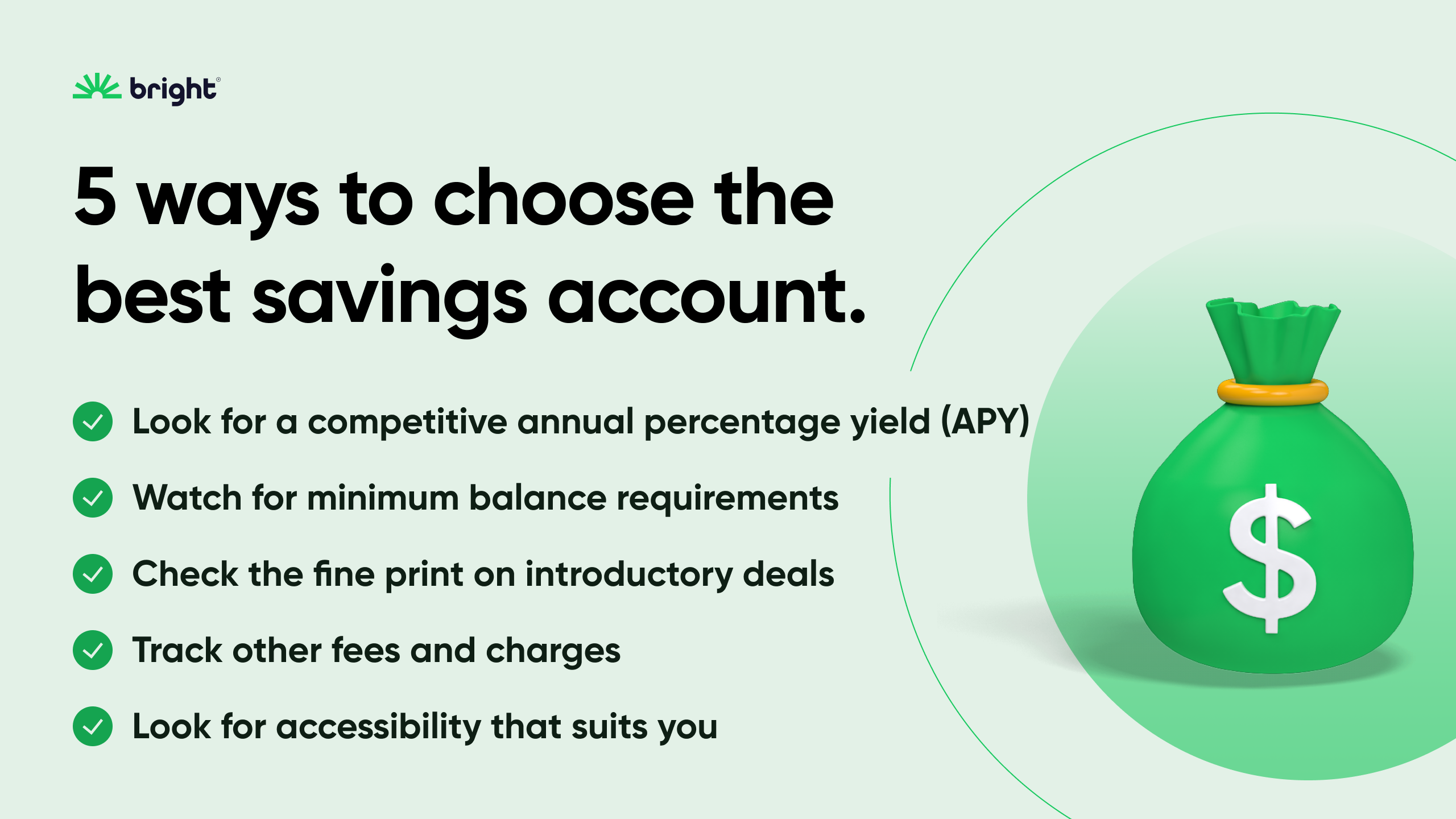

Choosing the right savings account depends on your financial goals and needs. Consider factors such as interest rates, fees, minimum balance requirements, and accessibility. Research different options and compare their features before making a decision. Some common types of savings accounts include traditional savings accounts, high-yield savings accounts, and money market accounts.

Choosing the Right Savings Account: A Guide to Help You Save

1. Determine Your Savings Goals

When choosing a savings account, it’s important to first determine your savings goals. Are you saving for a short-term goal like a vacation or a long-term goal like retirement? Knowing your goals will help you choose the right type of account and the appropriate interest rate.

Once you’ve determined your savings goals, you should also consider your risk tolerance. If you’re comfortable taking on a bit of risk, you may want to consider a high-yield savings account or a money market account. These accounts typically offer higher interest rates, but they may also come with higher fees or minimum balance requirements.

On the other hand, if you’re more risk-averse, a traditional savings account may be a better option. These accounts typically have lower interest rates, but they also come with lower fees and fewer restrictions.

2. Compare Interest Rates

When choosing a savings account, one of the most important factors to consider is the interest rate. The higher the interest rate, the more money you’ll earn on your savings over time.

Be sure to compare interest rates from several different banks and credit unions before making a decision. Keep in mind that interest rates can change frequently, so it’s important to check rates regularly to ensure you’re still getting the best deal.

3. Consider Fees

In addition to interest rates, it’s also important to consider any fees associated with the savings account. Some common fees include monthly maintenance fees, ATM fees, and overdraft fees.

Be sure to read the fine print and understand all the fees associated with a particular savings account before opening it. Look for accounts that offer fee waivers or low minimum balance requirements to help you save money.

4. Evaluate Accessibility

Another factor to consider when choosing a savings account is accessibility. How easy is it to access your money when you need it?

Some savings accounts may limit the number of withdrawals or transfers you can make each month, while others may offer unlimited access. Consider your needs and lifestyle when evaluating accessibility.

5. Look for FDIC Insurance

When choosing a savings account, it’s important to ensure that your money is protected. Look for accounts that are FDIC-insured, which means that your deposits are insured up to $250,000 per depositor, per account type.

FDIC insurance provides peace of mind and ensures that your money is safe, even in the event of a bank failure.

6. Consider Additional Benefits

Some savings accounts may offer additional benefits, such as rewards programs or ATM fee reimbursements. These benefits can help you save even more money and make it easier to access your funds.

Be sure to compare the additional benefits of different savings accounts when making your decision.

7. Traditional Savings Accounts vs. High-Yield Savings Accounts

When choosing a savings account, you’ll likely come across both traditional savings accounts and high-yield savings accounts. What’s the difference?

Traditional savings accounts typically offer lower interest rates but come with fewer restrictions and fees. High-yield savings accounts, on the other hand, offer higher interest rates but may come with higher fees or minimum balance requirements.

Consider your savings goals and risk tolerance when deciding between a traditional savings account and a high-yield savings account.

8. Money Market Accounts

A money market account is another type of savings account to consider. These accounts typically offer higher interest rates than traditional savings accounts but may come with higher fees or minimum balance requirements.

Money market accounts may also offer limited check-writing privileges, making it easier to access your funds when you need them.

9. Certificates of Deposit (CDs)

Certificates of deposit, or CDs, are another savings option to consider. CDs typically offer higher interest rates than traditional savings accounts but require you to lock up your money for a set period of time.

If you’re comfortable with a longer-term savings strategy and don’t need immediate access to your funds, a CD may be a good option.

10. Bottom Line

Choosing the right savings account requires careful consideration and research. Determine your savings goals, compare interest rates and fees, evaluate accessibility, and consider additional benefits before making your decision.

Remember to regularly review your savings account to ensure you’re still getting the best deal and to adjust your strategy as your savings goals change over time.

Contents

- Frequently Asked Questions

- What factors should I consider when choosing a savings account?

- What types of savings accounts are available?

- What should I look for in a bank or financial institution offering savings accounts?

- Should I consider opening multiple savings accounts?

- What should I do if I am unhappy with my current savings account?

- Best Savings Accounts of 2023 – [United States Banks]

Frequently Asked Questions

What factors should I consider when choosing a savings account?

When choosing a savings account, there are several factors to consider. First, consider the interest rate offered by the account. A higher interest rate means more money earned on your savings. Additionally, consider any fees associated with the account, such as monthly maintenance fees or transaction fees. Look for accounts with low or no fees. Finally, consider the accessibility of the account. Will you be able to easily access your money when you need it?

It’s important to weigh all of these factors when choosing a savings account to ensure that you find the best account for your needs.

What types of savings accounts are available?

There are several types of savings accounts available. The most common types include traditional savings accounts, high-yield savings accounts, and money market accounts. Traditional savings accounts typically offer lower interest rates, but may have fewer fees. High-yield savings accounts offer higher interest rates, but may have more fees or require higher balances to earn those rates. Money market accounts are similar to high-yield savings accounts, but typically require higher balances to earn the best interest rates.

Consider your needs and financial goals when choosing the type of savings account that is right for you.

What should I look for in a bank or financial institution offering savings accounts?

When choosing a bank or financial institution offering savings accounts, consider their reputation and stability. Look for a bank that is FDIC-insured to ensure your deposits are protected. Additionally, research the bank’s customer service and online banking options. You may also want to consider the bank’s physical locations and ATM network if you prefer in-person banking.

Overall, choose a bank or financial institution that is trustworthy and meets your individual needs.

Should I consider opening multiple savings accounts?

Opening multiple savings accounts can be a good strategy for some people. For example, you may want to open one account for short-term savings goals and another account for long-term savings goals. Alternatively, you may want to open multiple accounts with different banks or financial institutions to take advantage of the best interest rates and promotions.

However, having multiple accounts can also make it more difficult to keep track of your savings and may result in more fees. Consider your personal preferences and financial goals when deciding whether to open multiple savings accounts.

What should I do if I am unhappy with my current savings account?

If you are unhappy with your current savings account, consider switching to a different account or bank. Research other options and compare interest rates, fees, and other features. Before closing your current account, make sure you understand any penalties or fees associated with closing the account.

Remember that it’s important to regularly review and evaluate your savings account to ensure that it is meeting your needs and helping you achieve your financial goals.

Best Savings Accounts of 2023 – [United States Banks]

In conclusion, choosing the right savings account is a crucial decision that can impact your financial stability in the long run. To make the right choice, start by identifying your savings goals and determining the features that matter most to you. Consider factors such as interest rates, fees, and accessibility before making a final decision.

Remember that there is no one-size-fits-all savings account, so take your time to research and explore different options. Don’t be afraid to ask questions and seek advice from financial experts or trusted friends and family members. By making an informed decision, you can set yourself up for financial success and achieve your savings goals with confidence. So start today and choose the savings account that’s right for you!