Are you curious about what your credit report says about you? Do you want to make sure that everything is accurate and up-to-date? Checking your credit report is an important step in managing your finances and ensuring your financial health. Here’s how to do it.

First, you need to obtain a copy of your credit report from one or all of the three major credit reporting agencies: Equifax, Experian, and TransUnion. You are entitled to one free credit report from each agency every 12 months. By reviewing your credit report, you can identify any errors or fraudulent activity and take steps to correct them. So, let’s get started and learn how to check your credit report!

To check your credit report, you can request a free copy of your credit report from each of the three major credit bureaus – Equifax, Experian, and TransUnion – once every 12 months. To request your free credit report, visit AnnualCreditReport.com and follow the instructions. Review your credit report carefully for errors or fraudulent activity.

How Do I Check My Credit Report?

Checking your credit report is an important step in managing your financial well-being. Your credit report contains information about your credit history, payment behavior, and other financial activity that lenders use to determine your creditworthiness. It’s important to check your credit report regularly to ensure that the information is accurate and to identify any errors or potential fraud.

1. Order a Free Credit Report

You are entitled to one free credit report per year from each of the three major credit reporting agencies: Equifax, Experian, and TransUnion. You can order your free credit report online at annualcreditreport.com, by phone, or by mail. When ordering online, you will be asked to provide your personal information to verify your identity.

It’s important to note that your free credit report does not include your credit score. You will need to pay for that separately if you want to see your credit score.

2. Check for Errors

Once you receive your credit report, review it carefully to ensure that all of the information is accurate. Check for errors such as:

- Incorrect personal information

- Accounts that you did not open

- Accounts that show late payments when you paid on time

- Accounts that show a balance when it has been paid off

If you find errors, you can dispute them with the credit reporting agency. They are required to investigate and correct any errors within 30 days.

3. Look for Potential Fraud

Checking your credit report regularly can also help you identify potential fraud. Look for accounts that you did not open or inquiries from lenders that you did not authorize. This could be a sign that someone has stolen your identity and is using your information to open accounts or apply for credit.

If you suspect fraud, you should contact the credit reporting agency and the lender immediately to report the activity and take steps to protect your identity.

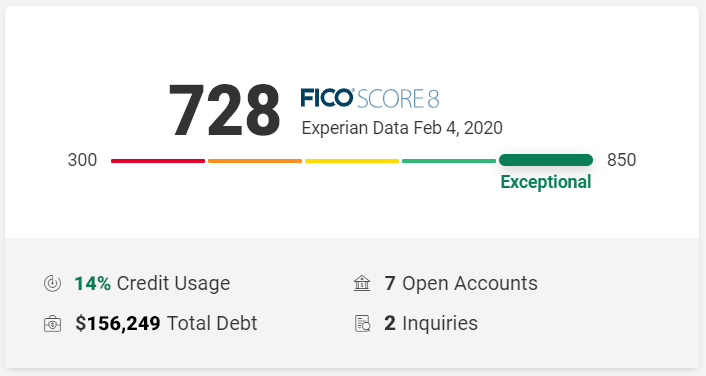

4. Understand Your Credit Score

Your credit score is a three-digit number that represents your creditworthiness. It’s based on your credit history, payment behavior, and other financial activity. Lenders use your credit score to determine whether to approve your credit application and what interest rate to offer you.

Understanding your credit score can help you identify areas where you need to improve your credit history. You can also use your credit score to negotiate better interest rates on loans and credit cards.

5. Monitor Your Credit Score

Monitoring your credit score regularly can help you stay on top of your credit history and identify any changes that could impact your creditworthiness. You can monitor your credit score through a credit monitoring service or by checking it regularly on your own.

Monitoring your credit score can also help you identify potential fraud. If you notice a sudden drop in your credit score, it could be a sign that someone has opened accounts or made charges in your name.

6. Understand the Factors that Affect Your Credit Score

Your credit score is based on several factors, including:

- Payment history

- Amounts owed

- Length of credit history

- New credit

- Credit mix

Understanding these factors can help you make better decisions about your credit behavior and improve your credit score over time.

7. Know Your Rights

As a consumer, you have rights when it comes to your credit report. The Fair Credit Reporting Act (FCRA) gives you the right to:

- Know what is in your credit report

- Dispute inaccurate information

- Have errors corrected by the credit reporting agency

- Get a free credit report annually

- Place a fraud alert or credit freeze on your credit report

Knowing your rights can help you protect your credit history and ensure that your credit report is accurate.

8. Consider Credit Monitoring Services

Credit monitoring services can help you stay on top of your credit history and identify potential fraud. These services monitor your credit report and alert you to any changes or suspicious activity.

While credit monitoring services can be helpful, they are not foolproof. They may not catch all instances of fraud or errors on your credit report.

9. Use Credit Wisely

Using credit wisely is key to maintaining a good credit score and financial health. Pay your bills on time, keep your credit card balances low, and only apply for credit when you need it.

Using credit wisely can also help you avoid high interest rates and fees. It’s important to read and understand the terms and conditions of any credit agreement before signing up.

10. Get Help if You Need It

If you are struggling with debt or credit issues, there are resources available to help you. Nonprofit credit counseling agencies can provide free or low-cost counseling and debt management services.

You can also contact your creditors directly to discuss payment options or negotiate a payment plan. Ignoring your debts can lead to financial problems and damage your credit history.

In conclusion, checking your credit report regularly is an important step in managing your financial well-being. Understanding your credit report and credit score can help you make better decisions about your credit behavior and improve your creditworthiness over time. By following these tips and using credit wisely, you can protect your credit history and achieve your financial goals.

Contents

Frequently Asked Questions

1. What is a credit report?

A credit report is a detailed report of your credit history. It includes information about your credit accounts, such as credit cards, loans, and mortgages, as well as your payment history and any outstanding balances. Your credit report also includes information about any bankruptcies, foreclosures, or other negative credit events.

Lenders, landlords, and other creditors use your credit report to determine your creditworthiness and decide whether to approve your application for credit or services.

2. Why should I check my credit report?

Checking your credit report regularly is important for several reasons. First, it allows you to ensure that the information on your report is accurate and up-to-date. Errors on your credit report can negatively impact your credit score and may lead to credit denials or higher interest rates.

Second, monitoring your credit report can help you detect and prevent identity theft. If you see unfamiliar accounts or transactions on your report, you can take steps to address them before they cause serious damage to your credit and finances.

3. How often should I check my credit report?

It’s a good idea to check your credit report at least once a year, but you may want to check it more frequently if you’re actively working to improve your credit or if you suspect identity theft. You can request one free credit report per year from each of the three major credit bureaus: Equifax, Experian, and TransUnion.

You can also sign up for credit monitoring services that will notify you of any changes to your credit report, such as new accounts or inquiries.

4. How do I dispute errors on my credit report?

If you notice errors on your credit report, you can dispute them with the credit bureau that provided the report. You’ll need to provide documentation to support your dispute, such as receipts or bank statements.

The credit bureau will investigate your dispute and notify you of the results. If the bureau determines that the information is incorrect, they’ll remove it from your report. You can also contact the creditor directly to dispute the information.

5. Does checking my credit report hurt my credit score?

No, checking your own credit report does not hurt your credit score. This is considered a “soft inquiry” and does not impact your credit in any way.

However, if you apply for credit and a lender checks your credit report, this is considered a “hard inquiry” and may temporarily lower your credit score. It’s important to only apply for credit when you need it and to limit the number of hard inquiries on your report.

How To Check Your Annual Credit Report for Free

In conclusion, checking your credit report is an essential aspect of maintaining your financial health. By regularly reviewing your credit report, you can ensure that your credit score is accurate and that there are no errors that could negatively impact your creditworthiness.

To check your credit report, you have several options available, including requesting a free credit report from each of the three major credit bureaus or using a credit monitoring service. Whichever option you choose, be sure to review your credit report thoroughly and report any errors or discrepancies immediately.

Remember, your credit report is a snapshot of your financial history and can play a significant role in your ability to obtain credit, secure a loan, or even land a job. By staying on top of your credit report, you can take control of your financial future and make informed decisions that will help you achieve your goals.