Applying for a personal loan can seem like a daunting task, but with the right knowledge and preparation, it can be a straightforward process. Whether you’re looking to consolidate debt, finance a large purchase, or cover unexpected expenses, a personal loan can provide the funds you need. In this guide, we’ll explore the steps you need to take to apply for a personal loan and provide tips to help you secure the best possible terms and rates. So, let’s get started on your journey to financial freedom!

First, we’ll discuss the factors that lenders consider when evaluating your loan application, such as your credit score, income, and debt-to-income ratio. Then, we’ll walk you through the steps involved in the application process, including gathering the necessary documentation, submitting your application, and waiting for a decision. Finally, we’ll provide some tips on how to compare loan offers and negotiate with lenders to ensure that you get the best deal possible. By the end of this guide, you’ll be well-equipped to apply for a personal loan and take control of your financial future.

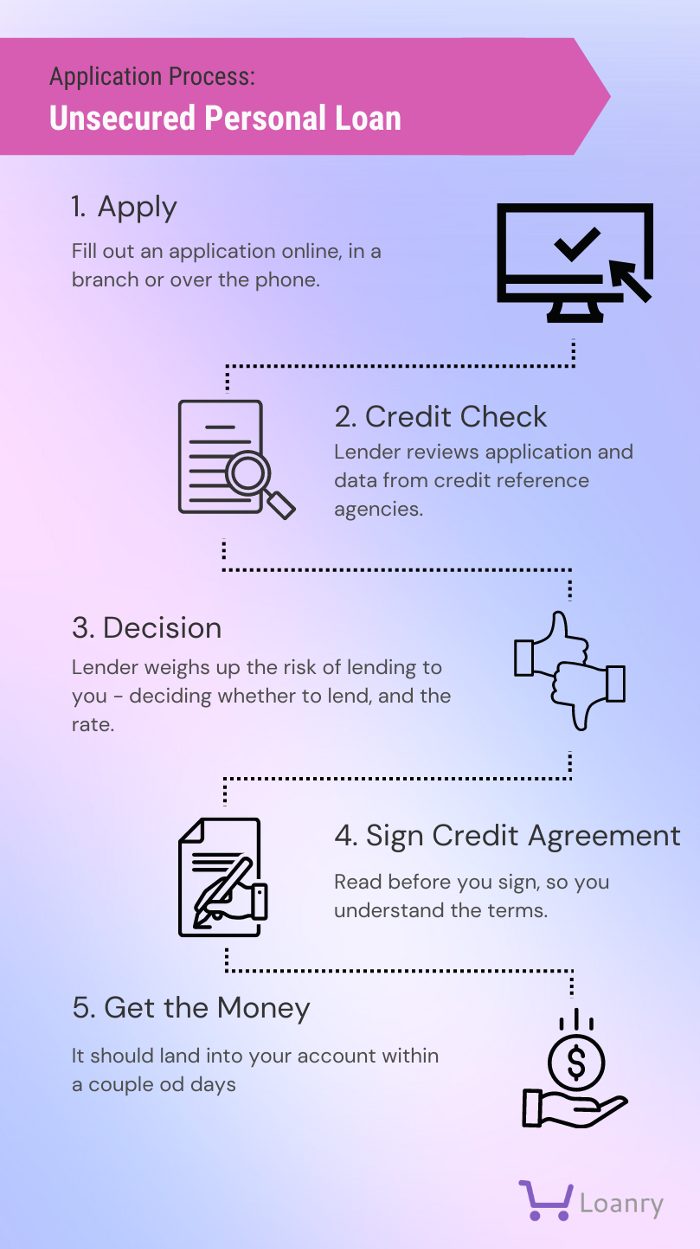

To apply for a personal loan, you’ll need to gather personal and financial information, such as your income, employment history, and credit score. Then, research and compare lenders to find the best fit for your needs. Fill out the application, provide any necessary documentation, and await approval. Once approved, review the terms and conditions carefully before accepting the loan.

How Do I Apply for a Personal Loan?

Applying for a personal loan can be a daunting task, especially if you are unsure about where to start. Personal loans are a great way to obtain the extra funds you need to finance a major purchase or consolidate debt. In this article, we will guide you through the process of applying for a personal loan, so you can make an informed decision and get the best possible loan terms.

Step 1: Determine Your Needs and Budget

Before applying for a personal loan, it’s important to determine your needs and budget. Consider how much money you need, what you will use the funds for, and how much you can afford to repay each month. This will help you choose the right loan amount and term that suits your needs.

Once you have a clear understanding of your needs and budget, you can start shopping around for personal loans. You can compare interest rates, fees, and terms of different lenders to find the best loan for you.

Step 2: Check Your Credit Score

Your credit score plays a big role in getting approved for a personal loan and getting favorable loan terms. Before applying for a personal loan, check your credit score and make sure it’s accurate. You can get a free copy of your credit report from one of the three major credit bureaus: Equifax, Experian, and TransUnion.

If you have a low credit score, consider improving it before applying for a personal loan. This can be done by paying bills on time, paying off debt, and disputing any errors on your credit report.

Step 3: Gather Required Documents

To apply for a personal loan, you will need to provide certain documents, such as proof of income, employment history, and identification. Make sure you have all the necessary documents before you start the application process.

You may also be required to provide collateral, such as a car or house, to secure the loan. Make sure you have a clear understanding of the collateral requirements before applying for a loan.

Step 4: Apply for the Loan

Once you have determined your needs, checked your credit score, and gathered all the necessary documents, you can start the application process. You can apply for a personal loan online, over the phone, or in person.

During the application process, you will be asked to provide personal and financial information. This information will be used to determine if you qualify for a loan and what the loan terms will be.

Step 5: Review and Accept Loan Terms

After you have submitted your application, the lender will review your information and determine if you qualify for a loan. If you are approved, you will be presented with the loan terms, including the interest rate, fees, and repayment schedule.

Review the loan terms carefully and make sure you understand all the terms and conditions before accepting the loan. If you have any questions or concerns, don’t hesitate to ask the lender for clarification.

Step 6: Receive Your Funds

Once you have accepted the loan terms, the lender will disburse the funds to your bank account. The time it takes to receive the funds may vary depending on the lender and the loan type.

Make sure you have a clear understanding of the repayment schedule and make timely payments to avoid late fees and penalties.

Benefits of Personal Loans

Personal loans can provide several benefits, such as:

– Flexibility: Personal loans can be used for a variety of purposes, such as home renovations, debt consolidation, or unexpected expenses.

– Lower interest rates: Personal loans usually have lower interest rates compared to credit cards, making them a more affordable option for borrowing.

– Fixed payments: Personal loans have fixed payments, which means you know exactly how much you need to pay each month and can budget accordingly.

Personal Loans vs. Credit Cards

Personal loans and credit cards are both options for borrowing money, but they have different features and benefits.

– Interest rates: Personal loans usually have lower interest rates compared to credit cards, making them a more affordable option for borrowing.

– Repayment terms: Personal loans have fixed repayment terms, while credit card payments can vary each month.

– Credit impact: Personal loans can have a positive impact on your credit score if you make timely payments, while credit card debt can negatively impact your credit score.

Conclusion

Applying for a personal loan can be a great way to obtain the extra funds you need to finance a major purchase or consolidate debt. By following these steps and considering the benefits of personal loans, you can make an informed decision and get the best possible loan terms. Remember to shop around and compare different lenders to find the best loan for your needs and budget.

Contents

- Frequently Asked Questions

- What are the requirements for applying for a personal loan?

- Where can I apply for a personal loan?

- How long does it take to get approved for a personal loan?

- What factors affect my personal loan application?

- What should I consider before applying for a personal loan?

- How To Get Approved For A Personal Loan

Frequently Asked Questions

Here are some common questions about applying for a personal loan:

What are the requirements for applying for a personal loan?

Before applying for a personal loan, you should make sure you meet the lender’s requirements. Typically, you will need to provide proof of income, such as pay stubs or tax returns, as well as proof of identity and residency. You may also need to have a certain credit score and debt-to-income ratio. Make sure to check the lender’s specific requirements before applying.

Additionally, you may need to provide collateral or find a co-signer if you have a low credit score or unstable income. It’s important to review all the requirements and understand the terms of the loan before applying.

Where can I apply for a personal loan?

You can apply for a personal loan from various lenders, including banks, credit unions, and online lenders. It’s important to research different lenders and compare their rates and terms to find the best option for you. Some lenders may offer pre-qualification, which can give you an idea of your eligibility and interest rates without affecting your credit score.

When you apply, be prepared to provide the necessary documentation and information, such as your income and expenses, employment history, and credit score. It’s important to be honest and accurate in your application to avoid any issues or delays in the approval process.

How long does it take to get approved for a personal loan?

The time it takes to get approved for a personal loan can vary depending on the lender and your application. Some lenders may offer instant approval or pre-qualification, while others may take several days or weeks to review your application and make a decision.

To speed up the process, make sure to provide all the necessary information and documentation accurately and promptly. You can also follow up with the lender to check on the status of your application and ask if there is anything else you can provide to expedite the process.

What factors affect my personal loan application?

Several factors can affect your personal loan application, including your credit score, income, debt-to-income ratio, and employment history. Lenders use these factors to assess your ability to repay the loan and determine your interest rate and loan amount.

Other factors, such as the loan purpose, collateral, and co-signer, can also impact your application. It’s important to review all the factors and requirements before applying and to improve your credit score and financial stability if necessary.

What should I consider before applying for a personal loan?

Before applying for a personal loan, you should consider several factors, such as your financial goals, budget, and credit score. You should also compare different lenders and their rates, fees, and terms to find the best option for you.

Additionally, you should review the loan agreement carefully and understand the repayment terms, including the interest rate, payment frequency, and any penalties for late or missed payments. It’s important to only borrow what you can afford to repay and to have a plan in place to manage your debt and improve your credit score.

How To Get Approved For A Personal Loan

In conclusion, applying for a personal loan may seem daunting at first, but it is a straightforward process. By checking your credit score and researching lenders, you can find the best loan option for your needs. It’s important to have all the necessary documents ready before applying and to make sure you understand the terms and conditions of the loan.

Remember to only borrow what you can afford to pay back and to make your payments on time. By responsibly managing your personal loan, you can improve your credit score and achieve your financial goals. So, take the first step and start your personal loan application today!