Investing in the stock market can be a great way to grow your wealth, but it’s important to do your due diligence before making any investment decisions. One key aspect of this process is analyzing the company you’re considering investing in, and there are a variety of factors to consider in order to make an informed decision.

From examining financial statements to evaluating industry trends, there are many different approaches you can take to analyzing a company before investing in its stock. By taking the time to thoroughly research and understand the company’s strengths, weaknesses, and potential for growth, you can make smarter investment decisions and increase your chances of success in the stock market.

Analyzing a company before investing in its stock requires thorough research and evaluation of various factors such as financial statements, management team, industry trends, and competition. Look into the company’s revenue, profit margins, debt-to-equity ratio, and cash flow. Check the management team’s track record and the company’s competitive advantage. Analyzing industry trends and the company’s position in the market can also help in making informed investment decisions.

Contents

- How Do I Analyze a Company Before Investing in Its Stock?

- Frequently Asked Questions

- What financial ratios should I look at when analyzing a company before investing in its stock?

- What are the key factors to look for when analyzing a company’s management team?

- What are the main sources of information for analyzing a company before investing in its stock?

- What are some red flags to look for when analyzing a company before investing in its stock?

- What are some common mistakes to avoid when analyzing a company before investing in its stock?

- 8 Steps to Research a Company to Invest in – Best Investment Series

How Do I Analyze a Company Before Investing in Its Stock?

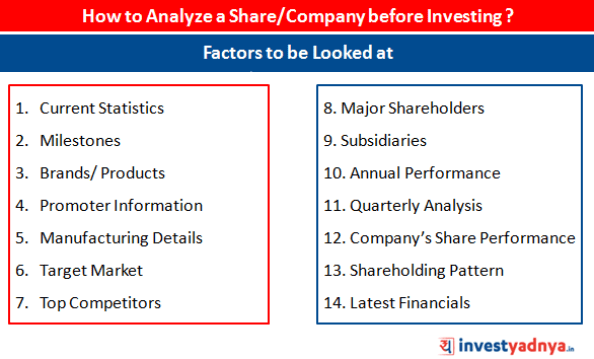

Investing in stocks can be a profitable way to grow your wealth, but it’s important to do your homework before jumping into the market. Analyzing a company before investing in its stock can help you make informed decisions, minimize risks, and maximize returns. Here are ten key factors to consider when analyzing a company before investing in its stock.

1. Financial Performance

The financial performance of a company is a critical factor to consider before investing in its stock. You need to look at the company’s income statement, balance sheet, and cash flow statement to assess its financial performance. The income statement will tell you how much revenue the company is generating, while the balance sheet will show you its assets, liabilities, and equity. The cash flow statement will tell you how much cash the company is generating from its operations.

It’s essential to look at the financial ratios, such as the earnings per share (EPS), price-to-earnings (P/E) ratio, and price-to-sales (P/S) ratio. These ratios can help you determine the company’s valuation and whether its stock is undervalued or overvalued.

2. Industry Analysis

The industry analysis is another critical factor to consider before investing in a company’s stock. You need to research the industry the company operates in and understand its competitive landscape. Look at the industry trends, growth prospects, and competition to assess the company’s position.

You can use tools like Porter’s Five Forces analysis to assess the industry’s competitiveness and the company’s position within it. This analysis considers factors like the bargaining power of suppliers and customers, the threat of new entrants, and the intensity of competitive rivalry.

3. Management Quality

The quality of the company’s management team is another factor to consider before investing in its stock. You need to research the management team’s track record, experience, and qualifications. Look at their decision-making processes, communication skills, and ability to execute the company’s strategy.

You can research the company’s management team through their biographies, earnings calls, and news articles. Look for signs of strong leadership, transparency, and a clear vision for the company’s future.

4. Company Strategy

The company’s strategy is another critical factor to consider before investing in its stock. You need to understand the company’s goals, plans, and initiatives to assess its potential for growth and profitability.

Look at the company’s annual reports, investor presentations, and news releases to understand its strategy. Look for a clear vision and a well-defined plan for executing that vision.

5. Competitive Advantage

The company’s competitive advantage is another critical factor to consider before investing in its stock. You need to understand what sets the company apart from its competitors and how it plans to maintain its competitive edge.

Look at the company’s products, services, and intellectual property to assess its competitive advantage. Look for innovative products, strong branding, and a loyal customer base.

6. Regulatory Environment

The regulatory environment is another important factor to consider before investing in a company’s stock. You need to understand the regulations that impact the company’s operations and how it complies with them.

Look at the company’s regulatory filings, news releases, and legal proceedings to assess its compliance with regulations. Look for any potential risks or liabilities related to non-compliance.

7. Risk Management

The company’s risk management is another critical factor to consider before investing in its stock. You need to assess the company’s ability to identify, assess, and manage risks.

Look at the company’s risk management policies, procedures, and practices to assess its risk management framework. Look for signs of a proactive approach to risk management and effective risk mitigation strategies.

8. Corporate Governance

The company’s corporate governance is another critical factor to consider before investing in its stock. You need to assess how the company is managed, how decisions are made, and how it ensures accountability and transparency.

Look at the company’s board of directors, executive compensation, and shareholder rights to assess its corporate governance practices. Look for signs of transparency, accountability, and alignment with shareholder interests.

9. Valuation

The company’s valuation is another critical factor to consider before investing in its stock. You need to assess whether the stock is undervalued or overvalued based on its financial performance, industry trends, and future growth prospects.

Look at the company’s price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, and other valuation metrics to assess its valuation. Look for a reasonable valuation that reflects the company’s potential for growth and profitability.

10. Investor Sentiment

Investor sentiment is the final factor to consider before investing in a company’s stock. You need to assess how other investors feel about the company and its stock.

Look at the company’s stock price, trading volume, and analyst ratings to assess investor sentiment. Look for signs of optimism or pessimism and assess whether it aligns with your own investment thesis.

In conclusion, analyzing a company before investing in its stock requires a thorough assessment of various factors, such as financial performance, industry analysis, management quality, company strategy, competitive advantage, regulatory environment, risk management, corporate governance, valuation, and investor sentiment. By considering these factors, you can make informed investment decisions and maximize your returns while minimizing risks.

Frequently Asked Questions

What financial ratios should I look at when analyzing a company before investing in its stock?

When analyzing a company before investing in its stock, there are several financial ratios that you should consider. These include the price-to-earnings ratio (P/E ratio), price-to-book ratio (P/B ratio), return on equity (ROE), and debt-to-equity ratio (D/E ratio). The P/E ratio is calculated by dividing the current market price per share by the earnings per share. The P/B ratio is calculated by dividing the current market price per share by the book value per share. The ROE is calculated by dividing the net income by the shareholder equity. The D/E ratio is calculated by dividing the total debt by the total equity.

What are the key factors to look for when analyzing a company’s management team?

When analyzing a company’s management team, there are several key factors to consider. These include the experience and track record of the CEO and other top executives, the company’s corporate governance practices, the alignment of the management team’s interests with those of shareholders, and the company’s approach to risk management. You should also evaluate the company’s overall strategy and whether the management team has a clear vision for the future.

What are the main sources of information for analyzing a company before investing in its stock?

There are several sources of information that you can use to analyze a company before investing in its stock. These include the company’s annual report, financial statements, SEC filings, analyst reports, and news articles. You can also use online tools and databases to access financial data and other key metrics. It’s important to gather information from a variety of sources and to evaluate the credibility and reliability of each source.

What are some red flags to look for when analyzing a company before investing in its stock?

When analyzing a company before investing in its stock, there are several red flags to look out for. These include declining revenue or earnings, high levels of debt, poor corporate governance practices, insider trading or other unethical behavior, and a lack of transparency or disclosure. You should also be wary of companies that are heavily reliant on one product or customer, as this can increase the risk of volatility and instability.

What are some common mistakes to avoid when analyzing a company before investing in its stock?

When analyzing a company before investing in its stock, there are several common mistakes that you should avoid. These include relying too heavily on a single metric or ratio, failing to consider the company’s industry or competitive landscape, neglecting to evaluate the management team’s track record and experience, and not conducting thorough due diligence. You should also be careful not to let emotions or biases cloud your judgment, and to maintain a long-term perspective when making investment decisions.

8 Steps to Research a Company to Invest in – Best Investment Series

In conclusion, analyzing a company before investing in its stock is crucial to make informed investment decisions. Firstly, it is essential to understand the company’s financial statements, such as the income statement, balance sheet, and cash flow statement. Secondly, researching the company’s industry and competitors can provide valuable insights into its performance. Finally, examining the management team’s experience and track record can give a glimpse of the company’s future prospects.

Moreover, it is important to keep in mind that investing in the stock market involves risks, and thorough analysis can only minimize the risk. Therefore, it is recommended to seek guidance from a financial advisor before making any investment decisions.

In conclusion, analyzing a company before investing in its stock requires careful consideration of various factors. By understanding the company’s financials, researching the industry and competitors, and examining the management team’s experience, investors can make informed decisions. However, it is essential to remember that investing involves risks, and seeking professional advice is always advisable.