When it comes to securing a loan, it can be difficult to decide which loan type is right for you. Fixed interest rate loans and variable interest rate loans are two of the most common loan types, but both have their own advantages and disadvantages. In this article we will discuss the pros and cons of both fixed interest rate loans and variable interest rate loans, so you can make an informed decision about which type of loan is best for you.

| Fixed Interest Rate Loans | Variable Interest Rate Loans |

|---|---|

| Interest rate remains the same during the loan term | Interest rate can change during the loan term |

| Might require a higher deposit | Usually requires a lower deposit |

| Interest payments remain the same | Interest payments can change |

| Monthly payments remain the same | Monthly payments can change |

Fixed interest rate loans have an interest rate that remains the same throughout the loan term, while variable interest rate loans have an interest rate that can change during the loan term. Fixed interest rate loans may require a higher deposit than variable interest rate loans, and the interest payments and monthly payments on fixed rate loans will remain the same throughout the loan term, while the interest payments and monthly payments on variable interest rate loans can change.

Fixed Interest Rate Loans Vs Variable Interest Rate Loans: In-Depth Comparison Chart

| Fixed Interest Rate Loans | Variable Interest Rate Loans |

|---|---|

| A fixed interest rate loan allows you to borrow money at a set rate of interest for a certain period of time. This type of loan is great for those who like to have stability and predictability in their finances. | A variable interest rate loan is one that allows the borrower to take advantage of fluctuating market conditions. This type of loan offers the potential for lower interest rates and greater flexibility in repayment plans. |

| The main advantage of a fixed interest rate loan is that you know exactly how much you will be paying in interest each month. This makes budgeting and repayment easier to plan for. | The main advantage of a variable interest rate loan is that it allows you to take advantage of market conditions. If the interest rate drops, you can take advantage of lower payments and if the rate rises you can lock in a lower rate for a longer period of time. |

| The downside of a fixed interest rate loan is that if interest rates fall, you can’t take advantage of the lower rates. This means that you may be paying more than you need to in interest each month. | The downside of a variable interest rate loan is that the rate can fluctuate over time, making it difficult to plan for repayment. Also, if the interest rate rises, you may end up paying more than you anticipated. |

| Fixed interest rate loans are best for those who don’t want to worry about fluctuating interest rates and want the stability of a fixed payment each month. | Variable interest rate loans are best for those who want to take advantage of market conditions and are willing to take the risk of higher payments if interest rates rise. |

Contents

Fixed Interest Rate Loans Vs Variable Interest Rate Loans

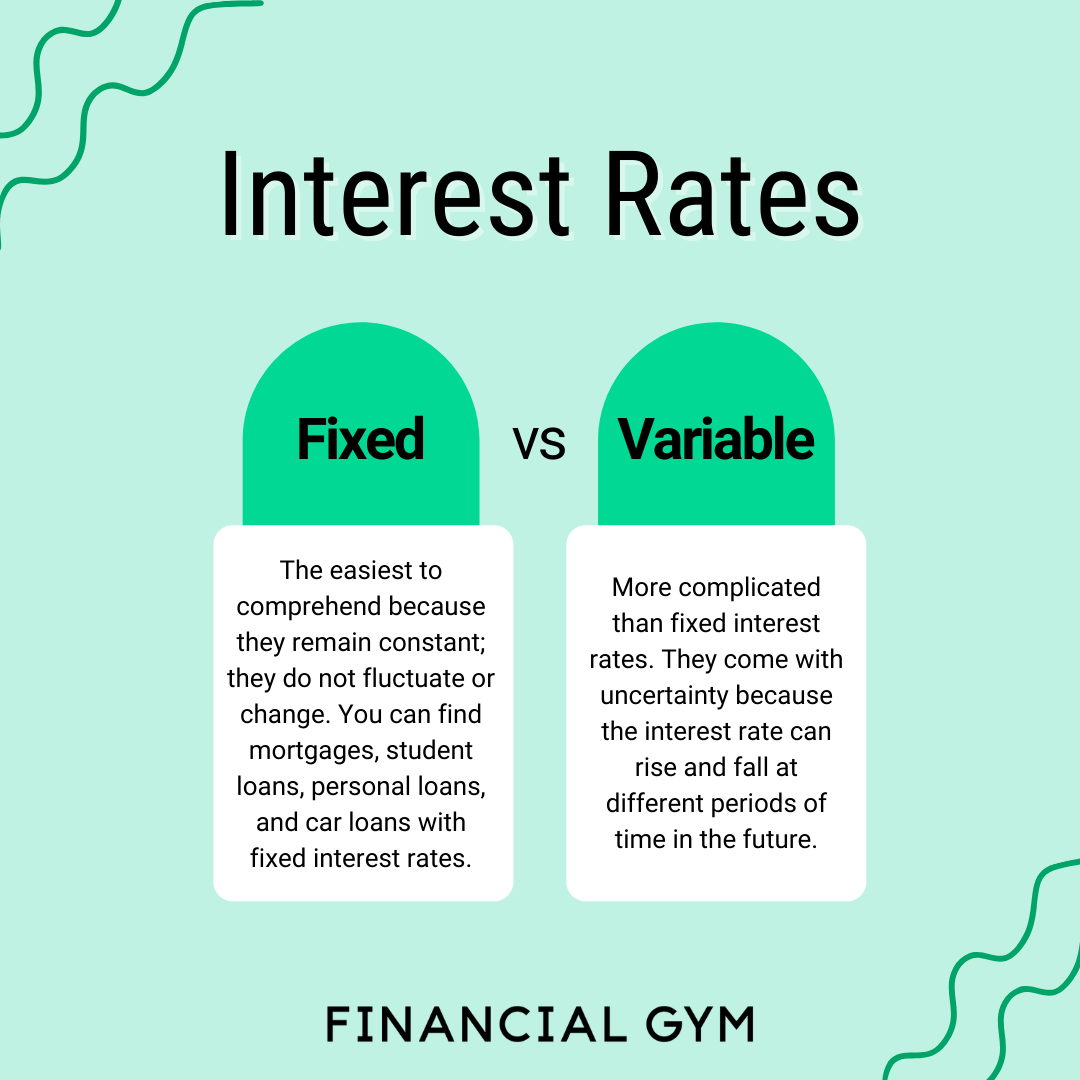

A fixed interest rate loan is a loan where the rate of interest remains the same for the entire life of the loan. A variable interest rate loan is a loan where the rate of interest can fluctuate over the life of the loan. Knowing the differences between the two types of loans can help you decide which one is best for you.

Advantages of Fixed Interest Rate Loans

One of the main advantages of a fixed interest rate loan is that it provides you with a stable payment amount. Since the interest rate does not change, you will know exactly how much you need to pay each month. This can be beneficial for budgeting purposes, as you will be able to plan your finances accordingly.

In addition, fixed rate loans are often easier to qualify for than variable rate loans. This is because lenders are more likely to offer a lower interest rate on a fixed rate loan since they know the amount they will be paid back each month. For this reason, it can be easier to secure a fixed rate loan as opposed to a variable rate loan.

Lastly, fixed rate loans are often preferred by investors and those looking to purchase a home. This is because the interest rate will remain the same even if market conditions change. This means that your monthly payments will remain stable, even if the market fluctuates.

Advantages of Variable Interest Rate Loans

One of the main advantages of a variable interest rate loan is that it can offer you lower rates in the short-term. Since the interest rate can fluctuate over time, you may be able to secure a lower rate in the beginning of the loan. This can be beneficial if you are looking to save money in the short-term.

In addition, variable rate loans can offer you more flexibility in terms of repayment. Since the interest rate can change, you may be able to adjust your payments depending on your financial situation. This can be beneficial if your income fluctuates over time.

Lastly, variable rate loans are often preferred by those who are comfortable taking risks. Since the interest rate can change, you may be able to benefit from lower rates if market conditions improve. However, you may also be subject to higher rates if market conditions worsen.

Considerations for Fixed Interest Rate Loans Vs Variable Rate Loans

When considering a fixed rate loan vs a variable rate loan, it is important to consider your own financial situation. If you are looking for stability and are comfortable with a fixed payment amount, then a fixed rate loan may be the best option for you. However, if you are looking for more flexibility and are comfortable with taking risks, then a variable rate loan may be the best option.

In addition, it is important to consider the length of the loan. If you are looking for a short-term loan, then a variable rate loan may be the better option. However, if you are looking for a longer-term loan, then a fixed rate loan may be the better option. This is because the rate of interest will remain the same, even if market conditions change.

Lastly, it is important to consider the terms of the loan. Make sure you understand all the terms of the loan before signing any documents. This will ensure that you are aware of all the fees and conditions associated with the loan.

Risks of Fixed Interest Rate Loans Vs Variable Rate Loans

One of the main risks associated with a fixed rate loan is that you may end up paying more in the long-term. This is because the interest rate will remain the same, even if market conditions change. As a result, you may end up paying more in the long-term if market conditions worsen.

In addition, fixed rate loans are often more difficult to qualify for than variable rate loans. This is because lenders are more likely to offer a lower interest rate on a variable rate loan since they know the amount they will be paid back each month. For this reason, it can be more difficult to secure a fixed rate loan as opposed to a variable rate loan.

Lastly, it is important to consider the terms of the loan. Make sure you understand all the terms of the loan before signing any documents. This will ensure that you are aware of all the fees and conditions associated with the loan.

Comparing Fixed Interest Rate Loans Vs Variable Rate Loans

When comparing fixed rate loans vs variable rate loans, it is important to consider your own financial situation and goals. A fixed rate loan can provide you with a stable payment amount and is often easier to qualify for than a variable rate loan. However, a variable rate loan can offer you lower rates in the short-term and more flexibility in terms of repayment. Ultimately, the choice between the two types of loans will depend on your individual needs and goals.

It is also important to consider the risks associated with each type of loan. Fixed rate loans may end up costing more in the long-term if market conditions worsen, and they are often more difficult to qualify for than variable rate loans. On the other hand, variable rate loans may be subject to higher rates if market conditions worsen.

Overall, it is important to do your research and compare the different types of loans before making a decision. Knowing the differences between the two types of loans can help you decide which one is best for you.

Fixed Interest Rate Loans Vs Variable Interest Rate Loans Pros & Cons

Pros of Fixed Interest Rate Loans

- Provides consistent monthly payments

- The borrower can budget for the future

- The borrower is protected from market fluctuations

Cons of Fixed Interest Rate Loans

- The borrower can miss out on potential lower interest rates

- The borrower is unable to benefit if the market rate decreases

- The borrower will not qualify for certain lower rate options

Pros of Variable Interest Rate Loans

- The borrower could benefit from a decrease in rates

- The borrower could qualify for certain lower rate options

- The borrower can benefit from potential savings

Cons of Variable Interest Rate Loans

- The borrower will have to deal with fluctuating monthly payments

- The borrower is exposed to the risks of market fluctuations

- The borrower might have to pay higher interest rates

Which is Better – Fixed Interest Rate Loans Vs Variable Interest Rate Loans?

When it comes to choosing between fixed interest rate loans and variable interest rate loans, it can be a difficult decision to make. Both loan types offer different advantages and disadvantages, and the right choice ultimately depends on an individual’s specific financial situation and goals.

Fixed interest rate loans provide borrowers with a steady interest rate over the life of the loan, which can be beneficial for individuals who are looking for a steady and reliable rate. On the other hand, variable interest rate loans allow borrowers to benefit from potential decreases in interest rates over time, which can help them save money in the long run.

Ultimately, the best choice depends on the individual’s needs and financial goals. For individuals who are looking for a steady and reliable loan rate, a fixed interest rate loan is likely the best option. For individuals who are looking for potentially lower interest rates over time, a variable interest rate loan may be the better option.

Overall, the following are three reasons why a fixed interest rate loan may be the better choice:

- The interest rate is steady and reliable throughout the life of the loan.

- The loan payments will remain the same each month.

- It is easier to budget and plan for the future with a fixed interest rate loan.

Frequently Asked Questions

Fixed interest rate loans and variable interest rate loans are two common types of loans. Both have their own advantages and disadvantages and understanding the differences between them is important before deciding which one is right for you.

What is a Fixed Interest Rate Loan?

A fixed interest rate loan is a loan with an interest rate that remains fixed throughout the life of the loan. This means that the borrower’s monthly payments will remain the same over the entire term of the loan. This type of loan provides the borrower with the security of knowing exactly what their payments will be. It also makes budgeting easier since the payments will remain the same over the life of the loan.

On the other hand, the interest rate for a fixed loan is usually higher than for a variable rate loan. This means that the borrower will have to pay more in interest over the life of the loan. Additionally, if interest rates decrease over the life of the loan, the borrower will not benefit from the lower rate.

What is a Variable Interest Rate Loan?

A variable interest rate loan is a loan with an interest rate that can change over time. The interest rate on this type of loan is usually tied to an index, such as the Prime Rate, and will change as the index changes. This means that the borrower’s monthly payments can go up or down depending on the changes in the index.

The advantage of a variable rate loan is that the interest rate can be much lower than a fixed rate loan. This can result in lower monthly payments, allowing the borrower to save money over the life of the loan. However, the downside is that the borrower has no control over when the interest rate will change and the payment could increase significantly if the index increases.

What are the Pros and Cons of Fixed Interest Rate Loans?

The main advantage of a fixed interest rate loan is the security and predictability of the payments. The borrower knows exactly what their payments will be over the life of the loan, which makes budgeting and planning easier. Additionally, the interest rate is usually higher than a variable rate loan, meaning that the borrower will pay more in interest over the life of the loan.

The main disadvantage of a fixed interest rate loan is that the borrower does not benefit from any decreases in the overall market interest rate. If interest rates go down over the life of the loan, the borrower will still be paying the same amount each month and will not benefit from the lower rate.

What are the Pros and Cons of Variable Interest Rate Loans?

The main advantage of a variable interest rate loan is the potential for lower monthly payments. Since the interest rate is tied to an index, it can be much lower than a fixed rate loan. This means that the borrower could save money over the life of the loan if the index remains low.

The main disadvantage of a variable rate loan is the uncertainty of the payments. Since the interest rate can change at any time, the borrower is not sure what their payment will be in the future. Additionally, if the index increases, the payments could become unaffordable for the borrower.

Which Type of Loan is Right for Me?

The type of loan that is right for you depends on your individual situation and goals. If you are looking for security and predictability, then a fixed rate loan may be the best option. However, if you are looking to save money over the life of the loan, then a variable rate loan may be a better choice.

It is important to compare the different types of loans and understand the pros and cons of each before making a decision. It is also important to speak with a knowledgeable loan officer who can help you find the best loan for your particular situation.

Variable vs Fixed Interest Rate

When it comes to choosing a loan, there are many factors to consider and it is important to understand the difference between fixed interest rate loans and variable interest rate loans. A fixed interest rate loan offers stability and protection from future interest rate increases, while a variable interest rate loan can provide more flexibility and potentially lower interest rates. Ultimately, the best loan for you depends on your individual financial situation and goals. It is important to compare the terms of each loan carefully to ensure you make the best decision for your needs.