Personal loans can be a lifeline when you’re struggling with unexpected expenses or need a little extra cash to make a big purchase. With so many different types of personal loans available, it can be overwhelming to know where to start. But fear not, because we’re here to explore the different types of personal loans and their benefits to help you make an informed decision that’s right for you.

Whether you’re looking for a secured loan, an unsecured loan, a line of credit, or a payday loan, we’ll break down the pros and cons of each type so you can choose the best option for your financial needs. So let’s dive in and discover which personal loan is right for you!

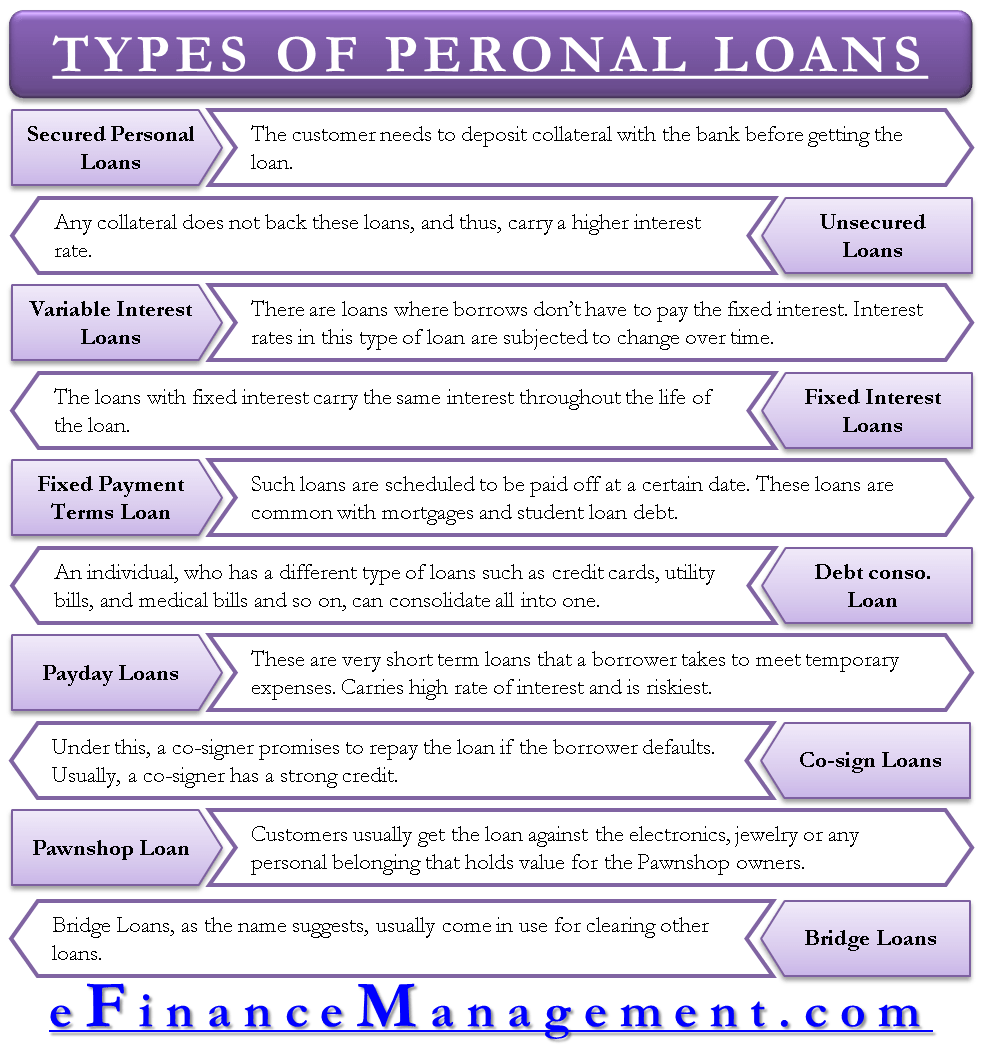

Personal loans come in different types, including secured and unsecured loans, debt consolidation loans, and home equity loans. Secured loans require collateral, while unsecured loans don’t. Debt consolidation loans can help you pay off high-interest debts, while home equity loans allow you to use your home’s equity as collateral. The benefits of personal loans include lower interest rates, fixed monthly payments, and flexible repayment terms.

Exploring Different Types of Personal Loans and Their Benefits

1. Secured Personal Loans

Secured personal loans require collateral, such as a car or house, to secure the loan. Because the lender has a guarantee that they will be repaid, secured loans typically offer lower interest rates than unsecured loans. Additionally, secured loans can be easier to obtain for individuals with less-than-perfect credit.

However, there are risks associated with secured loans. If the borrower defaults on the loan, they risk losing their collateral. Additionally, the loan amount is often limited by the value of the collateral.

Benefits:

- Lower interest rates

- Easier to obtain for individuals with poor credit

2. Unsecured Personal Loans

Unsecured personal loans do not require collateral, but they typically come with higher interest rates than secured loans. These loans are based solely on the borrower’s creditworthiness, and the lender has no guarantee of repayment.

However, unsecured loans can be a good option for individuals who do not have collateral to offer. Additionally, these loans can be a good way to consolidate high-interest debt or make a large purchase.

Benefits:

- No collateral required

- Can be used for debt consolidation or large purchases

3. Payday Loans

Payday loans are short-term loans that are typically due on the borrower’s next payday. These loans are designed to provide quick cash to individuals who are facing an unexpected expense or emergency.

However, payday loans come with high interest rates and fees. Additionally, if the borrower is unable to repay the loan on time, they may be subject to additional fees and penalties.

Benefits:

- Quick access to cash

- Can be a good option for emergencies

4. Debt Consolidation Loans

Debt consolidation loans are designed to help individuals consolidate multiple debts into one monthly payment. These loans can be secured or unsecured, and they typically offer lower interest rates than credit cards or other forms of unsecured debt.

However, debt consolidation loans can be risky if the borrower is not committed to changing their spending habits. If the borrower continues to accumulate debt, they may find themselves in a worse financial situation than before.

Benefits:

- Lower interest rates than credit cards and other unsecured debt

- Consolidates multiple debts into one monthly payment

5. Personal Lines of Credit

Personal lines of credit are similar to credit cards, but they typically have lower interest rates. These loans allow borrowers to borrow up to a certain amount, and they only pay interest on the amount they borrow.

However, personal lines of credit can be risky if the borrower is not disciplined with their spending. Additionally, the interest rates on these loans can be variable, meaning they can fluctuate over time.

Benefits:

- Lower interest rates than credit cards

- Flexible borrowing options

6. Co-Signed Loans

Co-signed loans are loans that are co-signed by another individual, typically a family member or friend. These loans can be secured or unsecured, and they typically offer lower interest rates than loans that are not co-signed.

However, co-signed loans can be risky for both the borrower and the co-signer. If the borrower defaults on the loan, the co-signer is responsible for repaying the loan. Additionally, if the co-signer has poor credit, they may not be able to secure a loan with a lower interest rate.

Benefits:

- Lower interest rates than loans that are not co-signed

- Can be easier to obtain for individuals with poor credit

7. Peer-to-Peer Loans

Peer-to-peer loans are loans that are funded by individual investors rather than traditional banks or credit unions. These loans can be secured or unsecured, and they typically offer lower interest rates than traditional loans.

However, peer-to-peer loans can be risky if the borrower is not aware of the terms and conditions of the loan. Additionally, these loans can be difficult to obtain for individuals with poor credit.

Benefits:

- Lower interest rates than traditional loans

- Funded by individual investors rather than traditional banks or credit unions

8. Small Business Loans

Small business loans are designed to help individuals start or grow a small business. These loans can be secured or unsecured, and they typically offer lower interest rates than personal loans.

However, small business loans can be difficult to obtain and may require extensive documentation and proof of income. Additionally, if the borrower is unable to repay the loan, they risk losing their business.

Benefits:

- Lower interest rates than personal loans

- Designed to help individuals start or grow a small business

9. Car Title Loans

Car title loans are secured loans that require the borrower to use their car as collateral. These loans can be a good option for individuals who need quick cash, but they come with high interest rates and fees.

Additionally, if the borrower is unable to repay the loan, they risk losing their car. Car title loans should only be used as a last resort.

Benefits:

- Quick access to cash

- Can be a good option for individuals with poor credit

10. Home Equity Loans

Home equity loans allow individuals to borrow against the equity in their home. These loans typically offer lower interest rates than personal loans, and the interest may be tax-deductible.

However, home equity loans can be risky if the borrower is unable to repay the loan. If the borrower defaults on the loan, they risk losing their home.

Benefits:

- Lower interest rates than personal loans

- Interest may be tax-deductible

In conclusion, there are many different types of personal loans available to individuals with varying needs and creditworthiness. It’s important to carefully consider the benefits and risks of each type of loan before making a decision. Additionally, it’s important to work with a reputable lender and to carefully read and understand the terms and conditions of the loan.

Frequently Asked Questions

What are the different types of personal loans available?

Personal loans come in various forms such as secured, unsecured, fixed-rate, and variable-rate loans. Secured personal loans require collateral, while unsecured loans don’t. Fixed-rate loans have a fixed interest rate throughout the loan term, while variable-rate loans have interest rates that fluctuate. Each type of loan has its own benefits and drawbacks, so it’s important to carefully consider your options before choosing one.

When it comes to personal loans, it’s important to choose the one that best suits your needs. Secured loans are a good option if you have a valuable asset to use as collateral, such as a car or home. Unsecured loans are a better choice if you don’t have any collateral. Fixed-rate loans provide stability and predictability, while variable-rate loans offer flexibility and potential savings if interest rates drop.

What are the benefits of taking out a personal loan?

Personal loans offer several benefits, including flexibility, convenience, and quick access to funds. Unlike other types of loans, personal loans can be used for a variety of purposes, such as home repairs, medical bills, and debt consolidation. They also offer a fixed repayment schedule, which can help you budget and plan your finances more effectively.

Personal loans can be a great option if you need money quickly. They typically have a shorter application process than other types of loans, and you can often receive your funds within a few days. Additionally, personal loans can help you improve your credit score if you make your payments on time and in full.

How do I choose the right personal loan?

When choosing a personal loan, there are several factors to consider, such as the interest rate, repayment terms, and fees. It’s important to shop around and compare different lenders to find the best deal. You should also consider your own financial situation and needs, and make sure that the loan you choose fits within your budget.

To choose the right personal loan, start by checking your credit score and researching different lenders. Look for lenders that offer competitive interest rates and favorable repayment terms. You should also read the fine print and understand any fees associated with the loan, such as origination fees or prepayment penalties.

How much can I borrow with a personal loan?

The amount you can borrow with a personal loan depends on several factors, such as your credit score, income, and debt-to-income ratio. Generally, lenders will offer personal loans ranging from a few thousand dollars up to $100,000 or more. However, the amount you can borrow will vary depending on the lender and your individual circumstances.

To find out how much you can borrow with a personal loan, start by researching different lenders and checking their eligibility requirements. You can also use online calculators to estimate how much you can afford to borrow based on your income and expenses.

What are the eligibility requirements for a personal loan?

The eligibility requirements for a personal loan vary depending on the lender and the type of loan. Generally, lenders will consider factors such as your credit score, income, and debt-to-income ratio when deciding whether to approve your loan application. Some lenders may also require collateral or a co-signer if you have a low credit score or high debt-to-income ratio.

To qualify for a personal loan, you typically need a good credit score, stable income, and a reasonable amount of debt. You may also need to provide proof of income and identification, such as a driver’s license or passport. It’s important to check the eligibility requirements for different lenders before applying, as they may vary significantly.

Understanding different types of personal loan

In conclusion, exploring different types of personal loans can be a smart financial move for those in need of extra funds. Whether you opt for a secured or unsecured loan, fixed or variable interest rates, or a line of credit, there are a range of options to choose from that can match your specific needs. By doing your research and comparing rates and terms from various lenders, you can find the right personal loan that meets your financial goals.

One of the main benefits of personal loans is their flexibility. Unlike other types of loans that require collateral or have specific purposes, personal loans can be used for a variety of expenses, from home renovations to unexpected medical bills. Additionally, many personal loans have shorter repayment periods, meaning you can pay off your debt faster and potentially save on interest costs.

Another advantage of personal loans is the opportunity to improve your credit score. By making on-time payments, you can build a positive credit history and increase your credit score over time. This can lead to better interest rates and loan terms in the future, as well as greater financial stability overall. So if you’re considering a personal loan, take the time to explore your options and find the right fit for your needs and goals.