Thinking about your pension can be daunting, especially when it comes to transferring it to your bank account. Luckily, with the right information and resources, the process can be straightforward and stress-free.

If you’re wondering whether you can transfer your pension to your bank account, the answer is yes! In fact, it’s one of the most common ways to access your pension funds. But before you make any decisions, it’s important to understand the rules and regulations surrounding pension transfers. Keep reading to learn more.

Yes, you can transfer your pension to your bank account. However, the process may vary depending on your pension provider and bank. Typically, you will need to fill out a form or make a request online to initiate the transfer. Some providers may charge a fee for this service. It’s important to review the terms and conditions of your pension plan to ensure that you are not penalized for transferring funds.

Can I Transfer My Pension to My Bank Account?

When you retire, one of the most important questions you may have is whether you can transfer your pension to your bank account. The good news is that in most cases, you can transfer your pension to your bank account. However, there are some important things you need to know before you do.

Understanding Pension Transfers

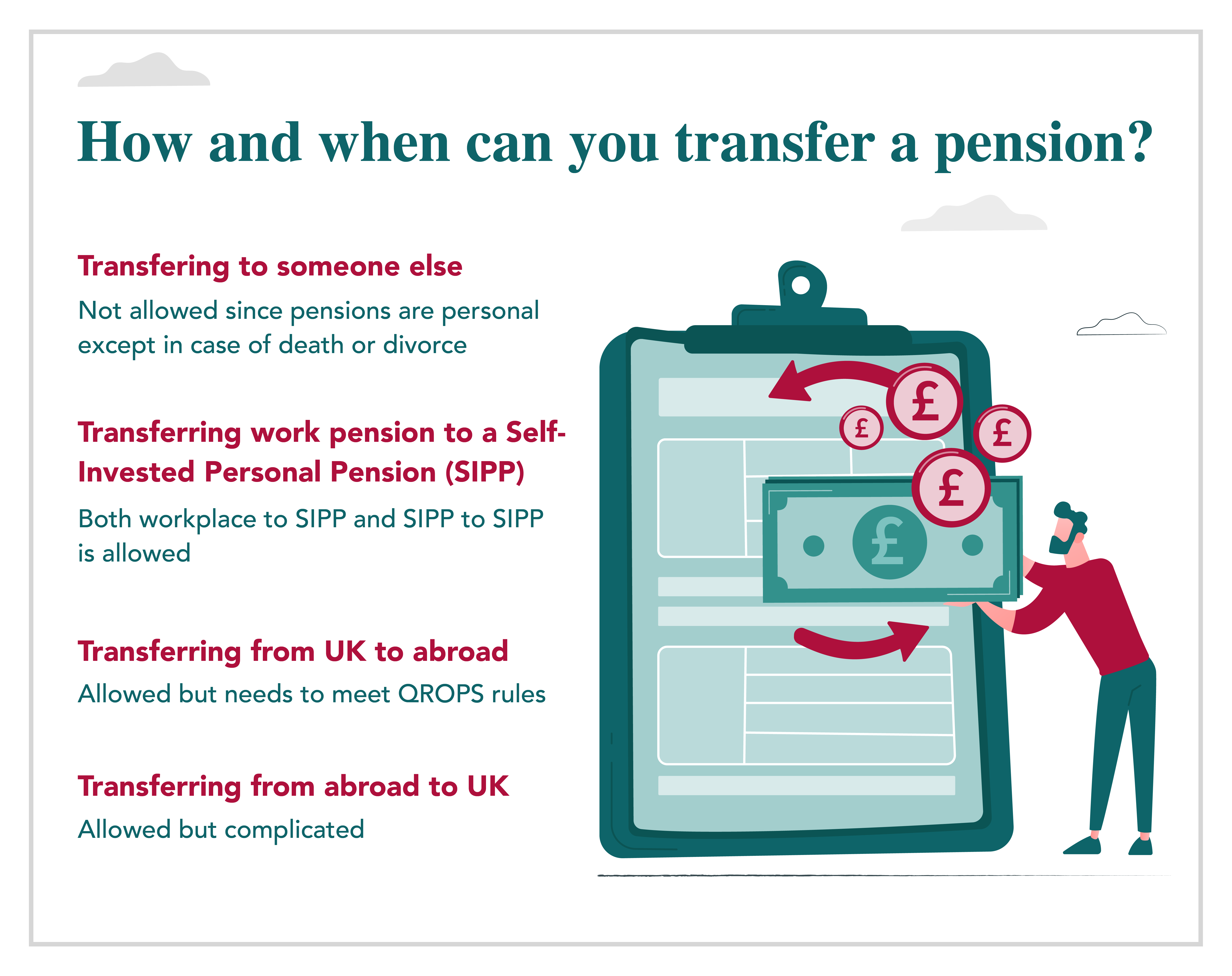

Pension transfers can be a complex process, so it’s important to understand what’s involved before you make any decisions. A pension transfer is essentially the process of moving your pension from one provider to another. This can be useful if you want to consolidate your pensions or if you’re not happy with your current provider.

To transfer your pension to your bank account, you’ll first need to check whether your pension provider allows this. Not all providers offer this option, so it’s important to check before you make any plans. If your provider does allow pension transfers to bank accounts, you’ll need to follow their specific process for doing so.

The Benefits of Transferring Your Pension to Your Bank Account

There are several benefits to transferring your pension to your bank account. One of the main benefits is that it can give you more control over your pension. By transferring your pension to your bank account, you’ll be able to manage your pension funds more easily and access them whenever you need to.

Another benefit of transferring your pension to your bank account is that it can simplify your finances. If you have multiple pensions with different providers, transferring them to your bank account can make it easier to keep track of your retirement savings.

The Drawbacks of Transferring Your Pension to Your Bank Account

While there are benefits to transferring your pension to your bank account, there are also some drawbacks to consider. One of the main drawbacks is that you may be charged fees for transferring your pension. These fees can be significant, so it’s important to factor them into your decision.

Another drawback of transferring your pension to your bank account is that it may affect your entitlement to certain benefits. If you’re currently receiving means-tested benefits, transferring your pension to your bank account could affect your eligibility for these benefits.

Transferring Your Pension to Your Bank Account vs. Annuities

When it comes to retirement planning, there are several options available to you. One alternative to transferring your pension to your bank account is to purchase an annuity. An annuity is essentially an insurance policy that provides you with a guaranteed income for life.

The main advantage of an annuity is that it provides you with a guaranteed income for life, regardless of how long you live. This can provide you with peace of mind and financial security in retirement. However, annuities can also be expensive and inflexible, so it’s important to shop around and consider all of your options before making a decision.

How to Transfer Your Pension to Your Bank Account

If you’ve decided to transfer your pension to your bank account, the process will depend on your specific provider. However, there are some general steps you can expect to follow:

- Contact your pension provider and let them know you want to transfer your pension to your bank account

- Provide your bank account details to your pension provider

- Complete any necessary paperwork or forms

- Wait for your pension provider to transfer the funds to your bank account

It’s important to note that the time it takes to transfer your pension to your bank account can vary depending on your provider. Some providers may take just a few days, while others may take several weeks.

Conclusion

Transferring your pension to your bank account can be a useful way to manage your retirement savings and simplify your finances. However, it’s important to consider the potential drawbacks, such as fees and impact on benefits, before making a decision. Ultimately, the best approach will depend on your individual circumstances and retirement goals.

Frequently Asked Questions

Here are some common questions related to pension transfers to bank accounts:

What is a pension transfer?

A pension transfer is when you move your retirement savings from one pension plan to another. This can be done for various reasons such as seeking better investment options, lower fees, or more flexibility in accessing your funds.

However, not all pension plans allow transfers, so you should check with your provider to see if this option is available to you.

Can I transfer my pension to my bank account?

No, you cannot transfer your pension directly to your bank account. When you transfer your pension, it must go into another registered pension plan or a qualifying recognized overseas pension scheme (QROPS).

However, once the funds are transferred to the new plan, you may be able to access them through a bank account linked to that plan.

How long does a pension transfer take?

The length of time it takes to transfer a pension can vary depending on the providers involved and the complexity of the transfer. In general, it can take several weeks to several months to complete a transfer.

It’s important to plan ahead and give yourself plenty of time if you need to transfer your pension by a specific deadline, such as when you’re moving abroad.

What are the tax implications of a pension transfer?

The tax implications of a pension transfer depend on various factors such as your country of residence, the type of pension plan you’re transferring from and to, and any tax treaties that may be in place.

You should consult with a tax professional or financial advisor to understand the tax implications of your specific situation before making a pension transfer.

What should I consider before transferring my pension?

Before transferring your pension, you should consider factors such as the fees and charges associated with the new plan, the investment options available, and any restrictions on accessing your funds.

You should also carefully review the terms and conditions of the new plan and seek advice from a financial advisor or pension specialist if you have any questions or concerns.

Can I transfer my pension myself

In conclusion, transferring your pension to your bank account is possible, but it is important to understand the rules and regulations that come with it. It is always a good idea to seek advice from a financial advisor before making any big decisions.

Remember that transferring your pension to your bank account may have tax implications, so it’s important to consider all the options available to you. You may also want to consider the impact on your pension income and retirement plans before making a transfer.

Overall, transferring your pension to your bank account can be a great option for those who need access to their funds. Just make sure you understand the process and any potential consequences before making a decision.