Budgeting is a crucial element to achieving financial success, but the way you choose to budget is up to you. When it comes to budgeting, there are two main options: budgeting apps and spreadsheet budgeting. Both can be effective tools for managing your finances, but there are important differences between the two. In this article, we’ll explore the pros and cons of budgeting apps versus spreadsheet budgeting, so you can make an informed decision on the best budgeting method for you.

| Budgeting Apps | Spreadsheet Budgeting |

|---|---|

| Provides an easy to use interface with step-by-step instructions | Requires more technical knowledge to set up and use |

| Offers automated tracking of expenses and income | Manual tracking of expenses and income required |

| Can sync to bank and credit card accounts | No automatic syncing with bank and credit card accounts |

| Often offers budgeting and goal-setting tools | No built-in budgeting and goal-setting tools |

In comparison, budgeting apps provide an easy to use interface with step-by-step instructions, automated tracking of expenses and income, and the ability to sync to bank and credit card accounts. Spreadsheet budgeting requires more technical knowledge to set up and use, manual tracking of expenses and income, and has no automatic syncing with bank and credit card accounts. Additionally, budgeting apps often offer budgeting and goal-setting tools, while spreadsheet budgeting does not have any built-in budgeting and goal-setting tools.

Budgeting Apps Vs Spreadsheet Budgeting: Comparison Chart

| Budgeting Apps | Spreadsheet Budgeting |

|---|---|

| Budgeting apps are computer programs that allow users to easily track and manage their finances. They can be accessed from any device with an internet connection and allow users to view their finances in real-time. Budgeting apps are typically very intuitive and user friendly, making them ideal for those who are new to budgeting. | Spreadsheet budgeting is the process of using a spreadsheet program such as Microsoft Excel to create and track a budget. Spreadsheet budgeting allows users to customize the budget to their individual needs, as well as allowing them to track their spending in greater detail. Spreadsheet budgeting is often more complicated than budgeting apps and may require more time to master. |

| Ease of Use | Cost |

| Budgeting apps are designed to be user friendly, making them easy to use for even the most novice of users. They are typically straightforward and don’t require a lot of technical knowledge to use. | Spreadsheet budgeting is generally free, as most computers come with a spreadsheet program installed. Budgeting apps typically require a subscription fee, although there are a few free options available. |

| Customization | Data Security |

| Budgeting apps offer limited customization options, as they are designed to be user-friendly and straightforward. They typically don’t offer the same level of customization as a spreadsheet budget. | Spreadsheet budgeting does not offer the same level of data security as budgeting apps, as the data is stored locally on the user’s computer. Budgeting apps typically use encryption and other security measures to protect user data. |

| Real-Time Data | Learning Curve |

| Budgeting apps offer real-time data, allowing users to view their finances in real time. This can be helpful for keeping track of spending and making sure that budget goals are met. | Spreadsheet budgeting can be more complicated than budgeting apps and may require more time to master. The user must have a basic understanding of spreadsheet programs and be able to customize the budget to their individual needs. |

Contents

- Budgeting Apps Vs Spreadsheet Budgeting

- Budgeting Apps Vs Spreadsheet Budgeting Pros & Cons

- Budgeting Apps Vs Spreadsheet Budgeting: Which is Better?

- Frequently Asked Questions About Budgeting Apps Vs Spreadsheet Budgeting

- What Are the Benefits of Using a Budgeting App?

- What Are the Benefits of Using Spreadsheet Budgeting?

- What Are the Drawbacks of Budgeting Apps?

- What Are the Drawbacks of Spreadsheet Budgeting?

- Which One Is Better: Budgeting Apps or Spreadsheet Budgeting?

- App vs. Spreadsheet – Which Should You Use for Budgeting?

Budgeting Apps Vs Spreadsheet Budgeting

Budgeting apps and spreadsheet budgeting are two of the most popular methods of tracking your finances. Each has its own set of benefits and drawbacks, so it’s important to understand the differences between them and determine which one is best for you.

Ease of Use

Budgeting apps are typically easier to use than spreadsheet budgeting. Most budgeting apps will have an intuitive user interface, so you can quickly set up and begin tracking your finances. Spreadsheet budgeting, on the other hand, is a bit more complicated since you are responsible for creating the budgeting template, entering the data and formatting the sheet.

Budgeting apps also make it easier to access your information from any device. Most budgeting apps are available on both desktop and mobile devices, which makes it convenient to access your data from anywhere. Spreadsheet budgeting is typically limited to desktop usage.

Flexibility

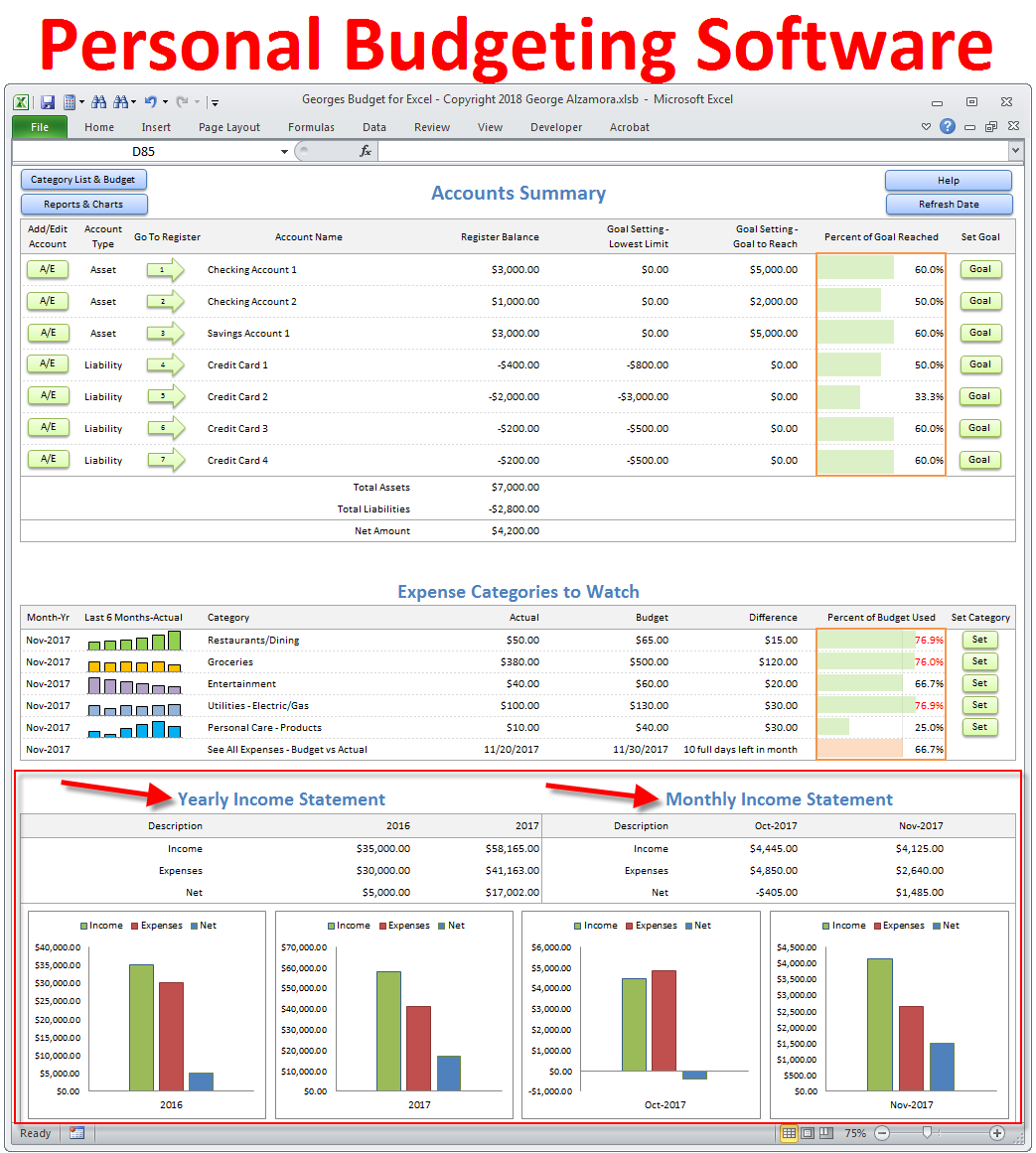

Spreadsheet budgeting is more flexible than budgeting apps. With spreadsheet budgeting, you can customize the template to meet your exact needs. This makes it easier to track special items like investments, savings goals, and other financial information. Budgeting apps usually have limited customization options and are more geared towards basic budgeting needs.

For those who are comfortable with spreadsheets, spreadsheet budgeting can offer an advantage since it allows you to use formulas and other advanced features to get more out of the data. Budgeting apps are typically limited in this regard.

Cost

Budgeting apps are generally more expensive than spreadsheet budgeting. Most budgeting apps require a subscription fee, and some may even have additional fees for extra features. Spreadsheet budgeting is usually free, since you only need to create the spreadsheet once and can reuse it from month to month.

The cost of spreadsheet budgeting is also dependent on the type of software you use to create the spreadsheet. Some programs, like Microsoft Excel, have a one-time cost, while others, like Google Sheets, are completely free.

Features

Budgeting apps typically come with a wide range of features, such as automated budget tracking, goal setting, and financial notifications. These features make it easy to stay on top of your finances and track your progress over time. Spreadsheet budgeting is more limited in this regard since you can only track the information that you manually enter into the spreadsheet.

However, some budgeting apps may be missing features that are important to you. This is where spreadsheet budgeting can be beneficial, since you can customize the sheet to include any additional information that you need.

Security

Budgeting apps generally offer more security than spreadsheet budgeting. Budgeting apps usually use encryption to protect your data and most offer two-factor authentication to further protect your account. Spreadsheet budgeting does not offer the same level of security, as you are responsible for protecting the data.

It is also important to note that budgeting apps generally have more reliable backups than spreadsheets. If something happens to your spreadsheet, it may be difficult to recover the information. Budgeting apps, on the other hand, usually have backups of your data, so you can easily restore your information if needed.

Which is Best?

Both budgeting apps and spreadsheet budgeting have their own unique advantages and disadvantages. It is important to consider your own needs when deciding which one is best for you. If you are looking for an easy-to-use tool with automated features, then budgeting apps may be the best option. If you are comfortable with spreadsheets and want more customization options, then spreadsheet budgeting may be a better choice.

Budgeting Apps Vs Spreadsheet Budgeting Pros & Cons

Pros of Budgeting Apps

- Provide automated tracking of expenses

- Help to create a better budgeting system

- Allow users to easily access their budgets

- Set up reminders to pay bills

Cons of Budgeting Apps

- May cost more than spreadsheet budgeting

- Potential for hackers to access information

- May require users to learn how to use the app

- May not be compatible with all devices

Pros of Spreadsheet Budgeting

- Inexpensive way to track finances

- Flexibility to customize budget

- No need to learn new software

- Simple to track income and expenses

Cons of Spreadsheet Budgeting

- No automated reminders

- More time consuming to use

- Potential for errors

- Difficult to share with others

Budgeting Apps Vs Spreadsheet Budgeting: Which is Better?

When it comes to budgeting, it can be difficult to decide which approach to take. Budgeting apps and spreadsheet budgeting are both popular options, each with their own benefits and drawbacks. To help you make a decision, here are the pros and cons of budgeting apps and spreadsheet budgeting.

One of the major benefits of budgeting apps is that they provide a user-friendly way to track your budget. They typically include features like spending reminders and automated alerts when you are about to exceed your budget. Most budgeting apps also provide detailed reports about your spending, allowing you to easily identify areas where you can cut back or save more money.

Spreadsheet budgeting has its own advantages. You can customize spreadsheets however you like, and they also provide more detailed tracking of your spending. You can also customize the reports to your own needs, so you can easily identify your spending patterns. Spreadsheet budgeting also allows you to set up automated reminders so you don’t forget to pay your bills on time.

Ultimately, it comes down to personal preference. Both budgeting apps and spreadsheet budgeting can be effective tools when it comes to managing your budget. To help you decide which one is the right option for you, here are three factors to consider when making your decision.

- Customization: If you value the ability to customize your budget, spreadsheet budgeting may be the better option.

- User-Friendliness: If you prefer a more user-friendly experience, budgeting apps are the way to go.

- Tracking: If you need detailed tracking of your spending, spreadsheet budgeting is the better choice.

In conclusion, both budgeting apps and spreadsheet budgeting can be effective tools for managing your budget. When deciding which one to use, consider the customization, user-friendliness, and tracking capabilities of each option to determine which one is right for you.

Frequently Asked Questions About Budgeting Apps Vs Spreadsheet Budgeting

Budgeting apps and spreadsheet budgeting are both useful tools for managing money. They both have advantages and disadvantages, depending on your needs and preferences. This FAQ will help you determine which one is best for you.

What Are the Benefits of Using a Budgeting App?

Budgeting apps are designed to make budgeting easier and more efficient. They provide users with the ability to track their spending, set goals, and create budgets. They also make it easier to manage your finances, as they allow you to categorize your spending and set up reminders for upcoming expenses. Additionally, many budgeting apps provide helpful educational resources to help you understand how to manage your money better.

What Are the Benefits of Using Spreadsheet Budgeting?

Spreadsheet budgeting offers a more hands-on approach to budgeting. You’re able to customize your budget to suit your own needs, and can track your spending in more detail. It also allows you to see your progress towards your financial goals, and provides you with a bigger picture view of your finances. Additionally, you’re able to customize your spreadsheet to include additional information, such as debt management or investment tracking.

What Are the Drawbacks of Budgeting Apps?

One of the main drawbacks to using a budgeting app is the cost. Many of them require a subscription fee, while others require an in-app purchase. Additionally, budgeting apps may not be as customizable as spreadsheet budgeting, which can be a disadvantage if you have specific needs.

What Are the Drawbacks of Spreadsheet Budgeting?

Spreadsheet budgeting requires more manual effort, which can be a disadvantage to those who don’t have the time or technical know-how. Additionally, it may be difficult to track your spending in detail, as it requires you to manually enter each transaction. Finally, spreadsheet budgeting isn’t as user-friendly as some of the more established budgeting apps, so it may take some time to learn how to use it.

Which One Is Better: Budgeting Apps or Spreadsheet Budgeting?

The answer to this question really depends on your needs and preferences. If you’re looking for an easier and more efficient way to manage your finances, a budgeting app may be the best option. However, if you’re looking for more customization and detail, spreadsheet budgeting may be the better choice. Ultimately, it’s up to you to decide which one is right for you.

App vs. Spreadsheet – Which Should You Use for Budgeting?

In conclusion, budgeting apps and spreadsheet budgeting are both great ways to keep track of your funds. Ultimately, the choice between the two boils down to what works best for you and your needs. Budgeting apps are great for those who want their budgeting to be done automatically and for those who don’t want to worry about manually entering data. Spreadsheets are great for those who want to customize their budgeting and who want more control over their finances. No matter which one you choose, having an organized budget is key to achieving your financial goals.