Have you ever felt like you’re just another bank loan pick up line? You know the feeling – you walk into a bank, hoping to secure a loan to finance your dreams, only to be met with a barrage of questions and paperwork. It can be overwhelming, frustrating, and downright discouraging. But what if there was a better way?

Fortunately, there are alternative lending options available that prioritize your needs as a borrower. From online lenders to community-based credit unions, there are options out there that can help you secure the financing you need without feeling like just another number. So, are you ready to break free from the traditional bank loan pick up lines and find a lending partner that truly has your best interests at heart? Let’s explore the possibilities together.

As a professional writer, I can confidently say that using a bank loan as a pick-up line is not a wise choice. Not only is it inappropriate and unprofessional, but it also shows a lack of respect for the other person and their financial situation. Instead, try using genuine and respectful conversation to get to know them better.

Contents

- Are You a Bank Loan Pick Up Line?

- Frequently Asked Questions

- What is a bank loan pick up line?

- Why are bank loan pick up lines not a good idea?

- What are some examples of bank loan pick up lines?

- What are some better alternatives to bank loan pick up lines?

- What is the best way to approach someone you’re interested in?

- Are you an bank loan? – Best Pickup Lines! #shorts

Are You a Bank Loan Pick Up Line?

Are you in need of some cash to help get your business off the ground or to fund a big purchase? If so, you may be considering taking out a bank loan. While there are many benefits to getting a loan from a bank, there are also some important things to consider before you apply. In this article, we’ll explore whether you’re a good candidate for a bank loan and what you need to know before you apply.

What is a Bank Loan?

A bank loan is a type of financing that you can get from a bank or other financial institution. The bank will lend you a certain amount of money, and you’ll agree to pay it back over a set period of time with interest. Bank loans can be used for a variety of purposes, including starting a business, buying a house, or funding a big purchase like a car or boat.

If you’re considering taking out a bank loan, there are a few things you’ll need to consider. First, you’ll need to decide how much money you need and how long you’ll need it for. You’ll also need to think about how much interest you’re willing to pay and whether you have the credit score and income to qualify for a loan.

Benefits of Bank Loans

There are many benefits to getting a bank loan. First, bank loans tend to have lower interest rates than other types of financing, like credit cards or payday loans. This means you’ll pay less in interest over the life of the loan, which can save you a lot of money.

Another benefit of bank loans is that they can help you build your credit score. If you make all your payments on time and in full, your credit score will improve over time. This can help you qualify for other types of financing in the future, like a mortgage or a car loan.

Types of Bank Loans

There are many different types of bank loans, each with its own requirements and benefits. Here are a few of the most common types of bank loans:

- Personal loans: These are loans that you can use for any purpose, like paying for a wedding or consolidating debt.

- Business loans: These are loans that are specifically designed for entrepreneurs and small business owners who need financing to start or grow their businesses.

- Mortgages: These are loans that you can use to buy a house or other real estate.

- Auto loans: These are loans that you can use to buy a car or other vehicle.

How to Qualify for a Bank Loan

In order to qualify for a bank loan, you’ll need to meet certain requirements. First, you’ll need to have a good credit score. This shows the bank that you’re responsible with your money and are likely to pay back the loan on time.

You’ll also need to have a steady income and a low debt-to-income ratio. This shows the bank that you have the financial means to pay back the loan. Finally, you’ll need to provide the bank with documentation like tax returns, bank statements, and pay stubs to prove your income and financial stability.

Pros and Cons of Bank Loans

Like any type of financing, bank loans have their pros and cons. Here are a few of the advantages and disadvantages of getting a bank loan:

| Pros | Cons |

|---|---|

| Lower interest rates | Strict requirements to qualify |

| Longer repayment terms | May require collateral |

| Can help build credit | May take longer to get approved |

Alternatives to Bank Loans

If you don’t qualify for a bank loan or you’re not comfortable with the interest rates or repayment terms, there are other financing options available. Here are a few alternatives to bank loans:

- Credit cards

- Payday loans

- Peer-to-peer lending

- Crowdfunding

While these options may be easier to qualify for, they often come with higher interest rates and fees. Make sure you understand the terms and conditions of any financing option before you sign on the dotted line.

Conclusion

Getting a bank loan can be a great way to finance your dreams and build your credit, but it’s important to understand the requirements and risks involved. Make sure you have a solid understanding of your financial situation and the terms and conditions of the loan before you apply. With the right preparation and research, you can find the financing option that’s right for you.

Frequently Asked Questions

Find below some frequently asked questions about bank loan pick up lines:

What is a bank loan pick up line?

A bank loan pick up line is a phrase or sentence used by someone to initiate a conversation with a potential romantic partner that revolves around the idea of borrowing money.

The pick up line may include references to interest rates, loan terms, or other financial jargon that is typically used in the context of banking or lending.

Why are bank loan pick up lines not a good idea?

Bank loan pick up lines are not a good idea because they can come across as insincere, offensive, or even predatory.

Using a bank loan pick up line can also create an awkward or uncomfortable situation for the person being approached, especially if they have no interest in discussing financial matters with a stranger.

What are some examples of bank loan pick up lines?

Examples of bank loan pick up lines include:

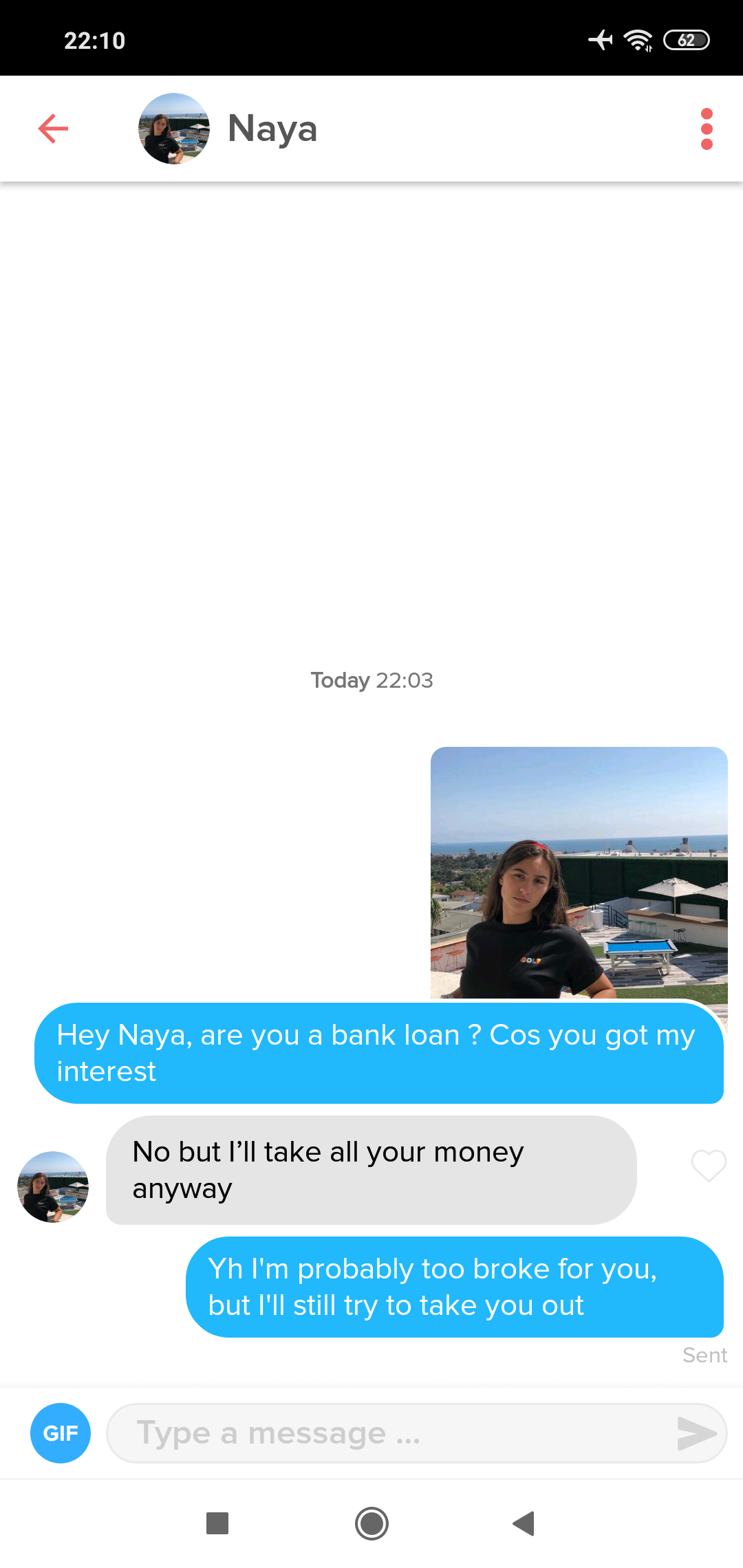

“Are you a bank loan? Because you’ve got my interest.”

“Can I borrow a kiss? I promise I’ll pay it back with interest.”

“Are you a bank loan officer? Because I’d love to take out a loan with you.”

What are some better alternatives to bank loan pick up lines?

Better alternatives to bank loan pick up lines include initiating a conversation based on common interests, asking for a person’s name and introducing yourself, or simply offering a friendly compliment.

It is important to approach someone in a respectful and genuine manner, rather than relying on gimmicks or preconceived notions about how to start a conversation.

What is the best way to approach someone you’re interested in?

The best way to approach someone you’re interested in is to be yourself, be respectful, and be confident.

Start by introducing yourself and asking for the person’s name. Show a genuine interest in getting to know them and finding common ground. Avoid using pick up lines or making assumptions about the person based on their appearance or other superficial factors.

Are you an bank loan? – Best Pickup Lines! #shorts

In conclusion, using pick-up lines to secure a bank loan is not only unprofessional but also highly inappropriate. Banks are institutions that require serious and sincere approaches when seeking financial assistance. Using cheesy or inappropriate pick-up lines may not only damage your chances of getting a loan but also tarnish your reputation as a business person.

Instead of relying on pick-up lines, it’s important to prepare yourself adequately before seeking a bank loan. This includes having a solid business plan, understanding the terms and conditions of the loan, and being able to communicate effectively with the loan officer.

In the end, it’s important to remember that securing a bank loan is a serious matter that requires a professional and respectful approach. So, leave the pick-up lines for the dating scene and focus on presenting yourself as a competent and responsible business person when seeking financial assistance from a bank.