Are you tired of manually paying your bills every month? Do you want to simplify your life and automate your payments? Pre-authorized payment may be the solution for you. In this article, we’ll dive into what pre-authorized payment is, how it works, and the benefits of using it.

Pre-authorized payment allows an organization to withdraw funds automatically from your bank account on a regular basis to pay for a service or product. It is a convenient and hassle-free way to pay bills as it eliminates the need for you to remember to make payments each month. Let’s explore this payment option in more detail and see if it’s the right fit for you.

A pre-authorized payment (PAP) is an agreement between a customer and a merchant that allows the merchant to withdraw funds from the customer’s account on a regular basis without the need for the customer to initiate the transaction each time. PAPs are commonly used for recurring payments such as utility bills, subscriptions, and memberships.

What is a Pre-Authorized Payment?

A pre-authorized payment, also known as a pre-authorized debit or PAD, is an agreement that allows a company or service provider to withdraw funds from a customer’s bank account on a regular basis. The customer provides permission for the company to withdraw a predetermined amount of money on a set schedule, such as weekly, bi-weekly, or monthly. Pre-authorized payments are commonly used for recurring bills, such as mortgage payments, utility bills, and insurance premiums.

How Do Pre-Authorized Payments Work?

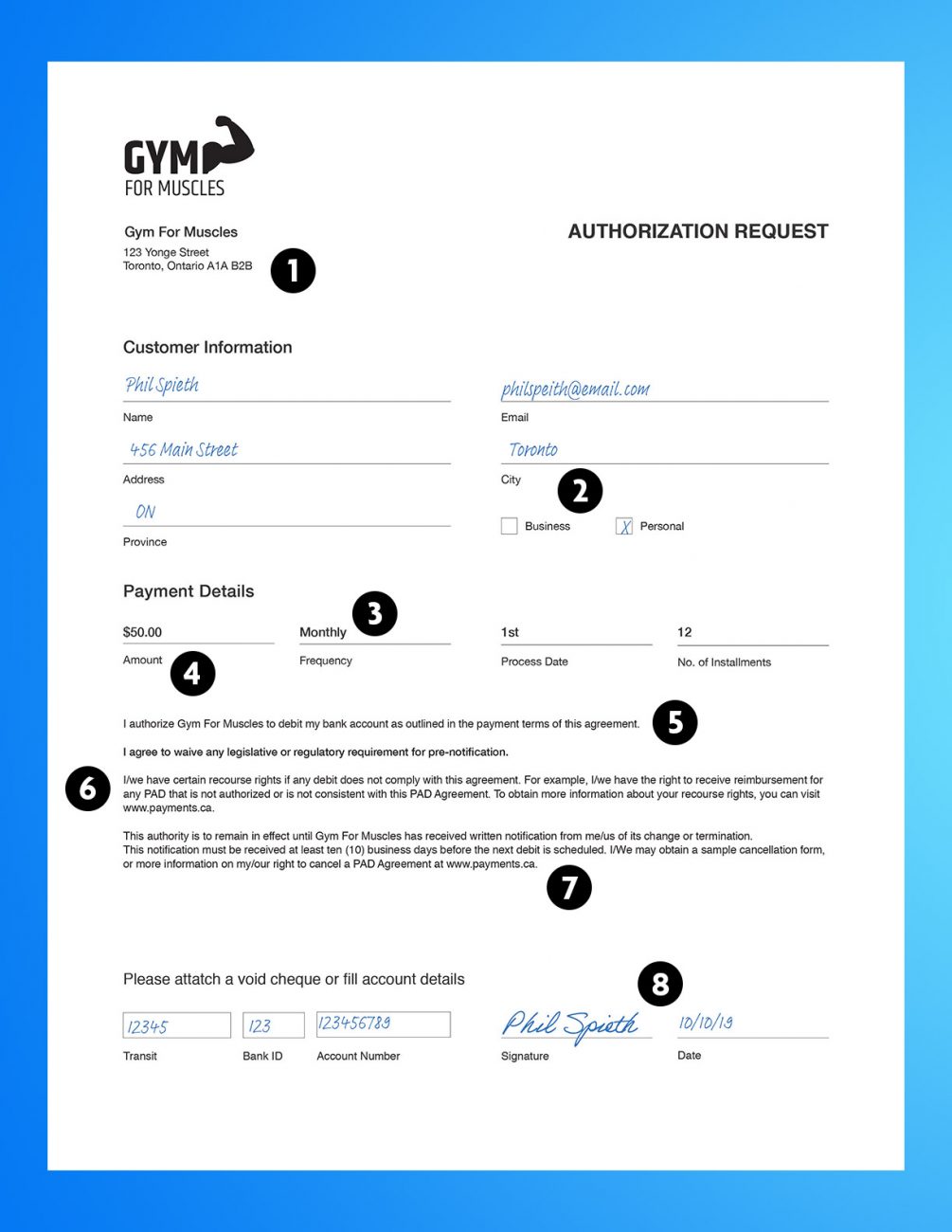

To set up a pre-authorized payment, the customer typically provides their bank account information to the company or service provider. This information includes the account number and transit number, which allows the company to access the customer’s bank account. The customer also provides authorization for the company to withdraw funds from their account on a regular schedule.

Once the pre-authorized payment is set up, the company will withdraw the agreed-upon amount of money from the customer’s account on the set schedule. The customer does not need to take any action to make the payment, as it is automatically deducted from their account.

Benefits of Pre-Authorized Payments

There are several benefits to using pre-authorized payments. First, they are convenient for customers who have recurring bills, as they do not need to remember to make the payment each month. This can help customers avoid late fees and potential service interruptions.

Second, pre-authorized payments can help customers manage their cash flow. By knowing exactly when payments will be deducted from their account, customers can plan their finances accordingly.

Finally, pre-authorized payments can help companies reduce their administrative costs. By automating the payment process, companies can save time and money on billing and collections.

Pre-Authorized Payments vs. Other Payment Methods

Pre-authorized payments are just one of several payment methods available to customers. Here are some of the key differences between pre-authorized payments and other payment methods:

Credit Card Payments: Credit card payments require the customer to manually make the payment each month. While some credit card companies offer automatic payments, they are typically only for the minimum payment and may not be available for all accounts.

Online Bill Payments: Online bill payments allow customers to make payments electronically through their bank’s website. While this method is convenient, it may still require the customer to remember to make the payment each month.

Traditional Check Payments: Traditional check payments require the customer to write a check and mail it to the company. This method can be time-consuming and may result in late payments if the check is not received on time.

Overall, pre-authorized payments offer a convenient and reliable way for customers to pay their bills. By automating the payment process, customers can save time and avoid potential service interruptions. Companies can also benefit from the reduced administrative costs associated with pre-authorized payments.

Frequently Asked Questions

Below are some common questions and answers related to pre-authorized payments.

Pre-authorized payment is an agreement between a customer and a merchant that allows the merchant to automatically withdraw funds from the customer’s bank account or credit card on a regular basis. The customer provides their payment information and authorizes the merchant to make withdrawals on specific dates or intervals, such as monthly or quarterly. The merchant then processes the payment without requiring the customer to initiate the transaction each time.

This type of payment arrangement is commonly used for recurring bills, such as mortgage payments, utilities, and subscription services. It can help customers avoid late fees and missed payments, while also reducing the administrative burden for merchants.

Pre-authorized payment offers several benefits for both customers and merchants. For customers, it provides a convenient and hassle-free way to pay bills and manage their finances. They don’t need to remember payment due dates or worry about missing a payment, which can help them avoid late fees and negative credit marks. For merchants, pre-authorized payment can help improve cash flow, reduce payment processing costs, and streamline billing and collection processes.

Overall, pre-authorized payment is a win-win solution that can benefit both parties involved in the transaction.

Pre-authorized payment can be used for a wide range of payment types, including recurring bills, subscription services, loan payments, and donations. It is commonly used for payments that are made on a regular basis and have a fixed amount, such as monthly rent, car payments, and insurance premiums. However, it can also be used for variable payments, such as utility bills or credit card payments, as long as the amount is within the agreed-upon range.

Before setting up pre-authorized payment, customers should check with their bank or credit card provider to ensure that the payment type is supported and to understand any potential fees or restrictions.

Pre-authorized payment is a secure payment method when used with reputable merchants and financial institutions. Customers should only provide their payment information to trusted sources and ensure that the merchant is authorized to make withdrawals from their account. They should also review their account statements regularly to ensure that all transactions are legitimate and authorized.

Merchants, on the other hand, should implement secure payment processing systems and comply with industry standards and regulations, such as PCI-DSS, to protect their customers’ payment information.

Customers can usually cancel or modify pre-authorized payment agreements by contacting the merchant or their financial institution. They may need to provide written notice or fill out a form to make changes to the agreement. It’s important to cancel or modify the agreement before the next payment is due to avoid any unwanted withdrawals.

Merchants should also provide clear instructions on how to cancel or modify pre-authorized payment agreements and ensure that customer requests are processed in a timely and accurate manner.

In conclusion, a pre-authorized payment is a convenient and secure way to pay recurring bills. By authorizing a company to withdraw funds from your account on a specific date each month, you can avoid late fees and ease the burden of remembering to make payments manually.

It’s important to note that pre-authorized payments can only be set up with companies that offer this service, and you should always review and understand the terms and conditions before authorizing any payments. Additionally, it’s essential to regularly monitor your account statements to ensure that you are only being charged for authorized payments.

Overall, pre-authorized payments offer a hassle-free way to manage your recurring bills and can provide peace of mind knowing that your payments are being made on time. With proper research and attention to detail, you can take advantage of this convenient payment method and streamline your finances.