Have you ever written a check and then realized that you need to stop payment on it? Maybe you lost the check, or the transaction fell through. Whatever the reason may be, placing a stop payment on a check can be a crucial step to protect your finances.

In this article, we will guide you through the process of placing a stop payment on a check. We will cover everything from the reasons to place a stop payment, to the steps you need to take to ensure that your request is processed correctly. So, let’s dive in and learn how to protect your financial assets!

To place a stop payment on a check, you’ll need to contact your bank and provide them with the check number, amount, and date. You may also need to fill out a stop payment request form and pay a fee. Keep in mind that stop payments are not guaranteed and may only be effective for a limited time, usually six months. It’s important to act quickly if you need to stop a payment.

Stop Payment on a Check: Everything You Need to Know

If you’ve issued a check to someone, but for some reason, you don’t want them to deposit or cash it, you can stop payment on the check. A stop payment order is a request made by the account holder to the bank to halt a payment on a check that hasn’t been cashed yet. In this article, we will discuss how to place a stop payment on a check and some important things you need to know.

What is a Stop Payment Order?

A stop payment order is an instruction given by an account holder to their bank to stop the payment on a check that they have issued. This order is usually given when the account holder has lost the check, or they suspect that the check has been stolen or misplaced. In such cases, the account holder can request the bank to stop payment on the check to prevent any unauthorized person from cashing or depositing it.

To place a stop payment order, you need to provide your bank with some information about the check. This includes the check number, the date it was issued, the amount, and the name of the payee. You may also have to pay a fee to the bank for this service.

The Benefits of Placing a Stop Payment Order

Placing a stop payment order gives you control over your finances and helps prevent any unauthorized payments from being made. It also helps protect you from fraud and identity theft, as it stops any unauthorized person from cashing or depositing your check.

The Drawbacks of Placing a Stop Payment Order

Placing a stop payment order can be expensive, and it may not always be effective. If the check has already been cashed or deposited, the stop payment order will not work, and you may lose the money. Moreover, some banks may charge a fee for placing a stop payment order, and this fee can vary depending on the bank.

How to Place a Stop Payment Order

To place a stop payment order, you need to follow these steps:

1. Call your bank: Call your bank and inform them that you want to place a stop payment order on a check.

2. Provide the details: Provide the bank with the details of the check, such as the check number, the date it was issued, the amount, and the name of the payee.

3. Pay the fee: You may have to pay a fee to the bank for this service. The fee varies depending on the bank.

4. Confirm the order: Make sure to confirm the stop payment order with the bank. Ask for a reference number or confirmation number for your records.

Using Online Banking to Place a Stop Payment Order

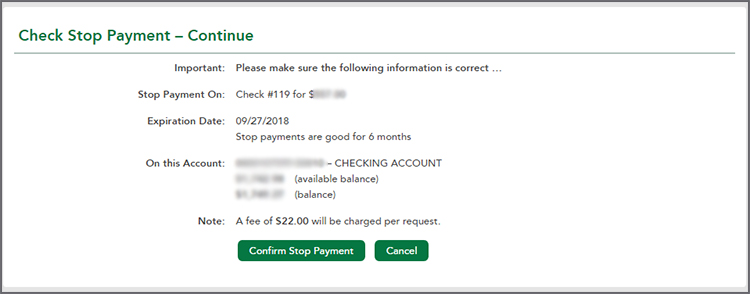

Most banks also offer the option to place a stop payment order online. If you have online banking, you can follow these steps:

1. Log in: Log in to your online banking account.

2. Select the check: Select the check you want to stop payment on.

3. Provide the details: Provide the bank with the details of the check, such as the check number, the date it was issued, the amount, and the name of the payee.

4. Pay the fee: You may have to pay a fee to the bank for this service. The fee varies depending on the bank.

5. Confirm the order: Make sure to confirm the stop payment order with the bank. Ask for a reference number or confirmation number for your records.

What to Do if the Check Has Already Been Cashed or Deposited?

If the check has already been cashed or deposited, the stop payment order will not work, and you may lose the money. In such cases, you need to contact your bank immediately and report the incident. The bank will investigate the matter and try to recover the funds.

Stopping a Recurring Payment

If you want to stop a recurring payment, such as a subscription or membership fee, you need to contact the merchant or service provider directly. The bank may not be able to stop the payment unless you cancel the subscription or membership.

Conclusion

In conclusion, placing a stop payment order is a useful tool to have in your financial arsenal. It gives you control over your finances and helps prevent any unauthorized payments from being made. However, it can be expensive, and it may not always be effective. If you need to place a stop payment order, make sure to provide your bank with all the necessary details and confirm the order to ensure that it is processed correctly.

Contents

Frequently Asked Questions

Stop payments are used to prevent a check from being cashed or deposited. If you need to stop a payment on a check, it’s important to act quickly. Here are some common questions and answers about how to place a stop payment on a check.

What is a stop payment?

A stop payment is a request to your bank or credit union to prevent a check from being cashed or deposited. You might need to place a stop payment if you’ve lost a check, had a check stolen, or if you’ve written a check to someone and changed your mind about the payment. It’s important to note that stop payments are not always guaranteed, and there may be fees associated with the request.

To place a stop payment, you’ll typically need to provide specific information about the check, including the check number, the name of the payee, and the date of the check. Your bank or credit union may also ask for additional information to verify your identity and prevent fraud.

How do I place a stop payment on a check?

To place a stop payment on a check, you’ll need to contact your bank or credit union as soon as possible. Many institutions allow you to request a stop payment online, over the phone, or in person at a branch location. You’ll typically need to provide specific information about the check, including the check number, the name of the payee, and the date of the check.

It’s important to note that stop payments are not always guaranteed, and there may be fees associated with the request. Your bank or credit union may also require you to follow up in writing to confirm the stop payment request.

What are the fees for placing a stop payment?

The fees for placing a stop payment can vary depending on the bank or credit union. Some institutions may charge a flat fee, while others may charge a fee based on the amount of the check. In some cases, the fee may be waived if you have a certain type of account or if you’ve experienced fraud. It’s important to check with your bank or credit union to understand their specific policies and fees.

Keep in mind that even if a fee is charged, it may be worth it to prevent a larger loss if the check is cashed or deposited. It’s also important to act quickly, as fees may increase the longer you wait to place the stop payment.

How long does a stop payment last?

A stop payment typically lasts for six months. After that time, the check may be able to be cashed or deposited again. If you need to extend the stop payment, you’ll need to contact your bank or credit union to request an extension. It’s important to keep track of the expiration date of the stop payment and follow up as necessary.

If the check has already been cashed or deposited before the stop payment was placed, you may need to work with your bank or credit union to resolve the issue and recover any funds that were lost.

What should I do if the check has already been cashed or deposited?

If the check has already been cashed or deposited before the stop payment was placed, you may need to work with your bank or credit union to resolve the issue and recover any funds that were lost. Depending on the circumstances, you may need to file a police report or take legal action to recover the funds.

If you suspect that the check was stolen or fraudulently cashed, it’s important to report the issue to your bank or credit union as soon as possible to prevent further losses.

In conclusion, placing a stop payment on a check can be a simple process if you follow the necessary steps. Remember to act quickly and provide all the required information to your bank. Be prepared to pay a fee for this service, but keep in mind that it can save you from potential financial loss.

It is important to regularly monitor your bank account to ensure that the check has been properly stopped and that no unauthorized transactions have occurred. If you have any further questions or concerns, do not hesitate to contact your bank for assistance.

By taking action promptly and staying vigilant, you can protect yourself and your finances from potential fraud or errors. Don’t let one lost or stolen check ruin your financial stability – take control and place a stop payment today.