When it comes to estate planning, there are many terms and concepts that can be confusing. One of those is the beneficiary designation. Simply put, a beneficiary designation is a legal document that outlines who will receive a person’s assets after they pass away.

Designating beneficiaries is an essential part of estate planning, as it ensures that a person’s assets go to the individuals or organizations they choose. From retirement accounts to life insurance policies, understanding beneficiary designations is crucial for anyone looking to plan their estate effectively.

A beneficiary designation is a legal document that identifies who will receive your assets such as life insurance policies, retirement plans, or bank accounts after you pass away. It is important to keep your beneficiary designation up-to-date, especially after significant life events such as a marriage, divorce, or birth of a child. By naming a beneficiary, you can ensure that your assets will be distributed according to your wishes.

Understanding Beneficiary Designation: A Comprehensive Guide

What is a beneficiary designation?

A beneficiary designation is an essential legal document that enables you to name the person or entity that will receive your assets, such as life insurance proceeds, retirement savings, and investment accounts, after you pass away. It is an important part of your estate plan, and it helps ensure that your wishes are carried out and your loved ones are taken care of.

When you designate a beneficiary, you are essentially creating a contract between yourself and the receiver of your assets. The beneficiary designation overrides any other instructions in your will or trust, which is why it is essential to keep it updated and accurate.

Types of beneficiary designations

There are several types of beneficiary designations, including:

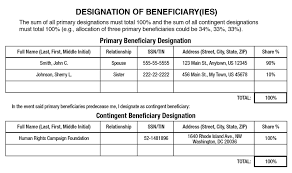

- Primary beneficiary: The person or entity that receives your assets upon your death.

- Contingent beneficiary: The person or entity that receives your assets if the primary beneficiary is unable or unwilling to accept them.

- Per stirpes beneficiary: This is a type of designation that allows you to designate multiple beneficiaries, such as your children, and their descendants. In the event that one of your designated children passes away before you do, their share of your assets will be divided among their own children.

Why is a beneficiary designation important?

A beneficiary designation is important for several reasons:

- It ensures that your assets are distributed according to your wishes.

- It helps avoid probate, which is the legal process of verifying a will and distributing assets.

- It allows you to avoid estate taxes on certain assets.

- It enables your family to receive your assets quickly, without having to wait for the probate process to be completed.

How to set up a beneficiary designation

Setting up a beneficiary designation is a straightforward process. Here are the steps you should take:

- Identify the assets that you want to designate a beneficiary for.

- Determine who you want to name as your beneficiary.

- Complete the beneficiary designation form provided by your financial institution or insurance company.

- Review and update your beneficiary designations regularly to ensure that they reflect your current wishes and circumstances.

Benefits of a beneficiary designation

There are several benefits to having a beneficiary designation:

- It enables you to control the distribution of your assets.

- It helps ensure that your assets are distributed quickly and efficiently.

- It helps avoid probate and the associated costs and delays.

- It can help reduce estate taxes on certain assets.

Beneficiary designation vs. will

While a will is an important part of your estate plan, it is not the same as a beneficiary designation. A will is a legal document that outlines your wishes for the distribution of your assets after you pass away. However, a will does not override a beneficiary designation. If you have conflicting instructions in your will and beneficiary designation, the beneficiary designation will take precedence.

Updating your beneficiary designation

It is essential to review and update your beneficiary designations regularly to ensure that they reflect your current wishes and circumstances. You should consider updating your beneficiary designation if:

- You get married or divorced.

- You have children or grandchildren.

- Your financial circumstances change.

- Your beneficiary passes away.

Conclusion

In conclusion, a beneficiary designation is an essential part of your estate plan. It enables you to control the distribution of your assets and ensure that your loved ones are taken care of after you pass away. By understanding the different types of beneficiary designations and how to set them up, you can ensure that your wishes are carried out and your family is protected. Remember to review and update your beneficiary designations regularly to ensure that they reflect your current wishes and circumstances.

Frequently Asked Questions:

Here are some commonly asked questions about beneficiary designations:

Why is a beneficiary designation important?

A beneficiary designation is important because it determines who will receive your assets upon your death. If you don’t have a beneficiary designation, your assets may have to go through probate, which can be a lengthy and expensive process. By designating beneficiaries, you can ensure that your assets are distributed according to your wishes and that your loved ones are taken care of.

It’s important to keep your beneficiary designations up to date, especially if your life circumstances change. For example, if you get married or divorced, have children, or if your designated beneficiary passes away, you’ll want to update your beneficiary designations accordingly.

What types of assets can have beneficiary designations?

Many types of assets can have beneficiary designations, including life insurance policies, retirement accounts (such as 401(k) plans and IRAs), annuities, and some bank and investment accounts. When you open these types of accounts, you’ll typically be asked to designate one or more beneficiaries.

It’s important to note that some types of assets, such as real estate and personal property, generally can’t have beneficiary designations. To ensure that these assets are distributed according to your wishes, you’ll need to include them in your will or trust.

What happens if I don’t designate a beneficiary?

If you don’t designate a beneficiary for an asset, it will generally have to go through probate. The probate process can be time-consuming and expensive, and your assets may not be distributed in the way that you would have wanted. If you want to ensure that your assets are distributed according to your wishes, it’s important to designate beneficiaries for all of your accounts.

If you don’t have any living beneficiaries and you don’t have a will or trust, your assets will generally be distributed according to state law. This means that your assets may not go to the people or organizations that you would have chosen.

Can I name multiple beneficiaries?

Yes, you can name multiple beneficiaries for an asset. When you do this, you’ll typically need to specify what percentage of the asset each beneficiary will receive. For example, you might designate two beneficiaries to receive 50% of your retirement account each.

If you name multiple beneficiaries, it’s important to keep your designations up to date if your life circumstances change. For example, if one of your beneficiaries passes away, you’ll need to update your beneficiary designations to ensure that your assets are distributed according to your current wishes.

How do I designate a beneficiary?

To designate a beneficiary for an asset, you’ll typically need to fill out a beneficiary designation form. This form will ask you to provide the name and contact information of your beneficiary or beneficiaries, as well as information about what percentage of the asset each beneficiary should receive.

It’s important to fill out beneficiary designation forms carefully and accurately, as mistakes can lead to your assets being distributed in a way that you didn’t intend. If you’re not sure how to fill out a beneficiary designation form, you may want to consult with an estate planning attorney or financial advisor.

What are Beneficiary Designations and Why Do They Matter?

In conclusion, a beneficiary designation is a crucial aspect of estate planning that ensures your assets are distributed according to your wishes after your death. Making a beneficiary designation can help avoid probate and ensure a smooth transfer of assets to your loved ones. It is also important to regularly review and update your beneficiary designations to ensure they reflect any changes in your life circumstances. With careful consideration and planning, you can ensure that your assets are distributed in the way you intend, leaving a lasting legacy for your loved ones.