Calculating your net worth is an essential step towards financial planning and achieving your long-term goals. Your net worth is the difference between your assets and liabilities, and it can give you a clear picture of your financial standing.

To determine your net worth, you need to take a comprehensive look at your finances, including your debts, savings, investments, and other assets. In this article, we will guide you through the process of calculating your net worth, so you can make informed decisions about your financial future.

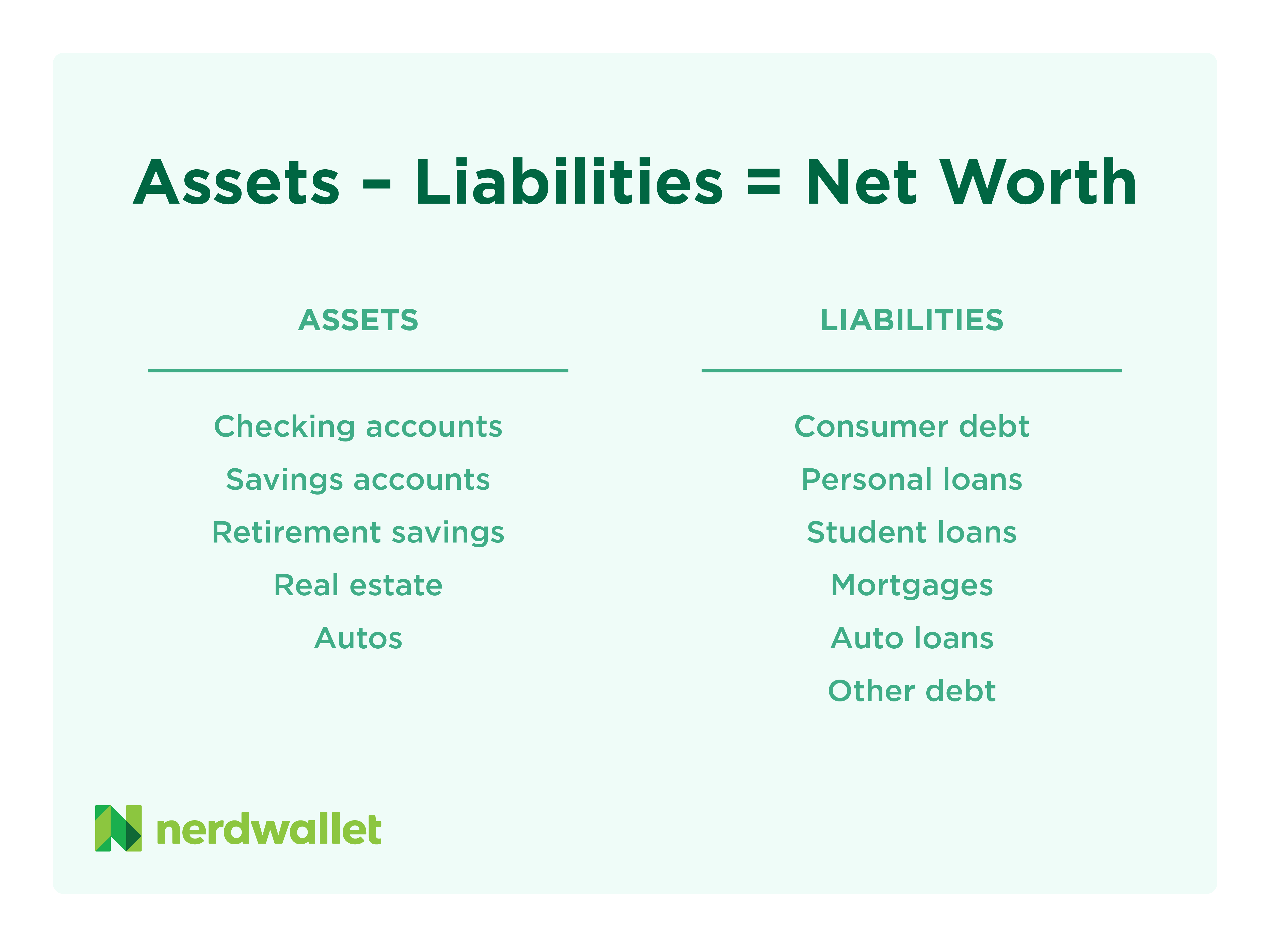

Calculating your net worth is important to understand your financial health. To calculate your net worth, you need to subtract your liabilities from your assets. Add up all your assets, including cash, investments, and property. Then, add up all your liabilities, such as loans, credit card debt, and mortgages. Finally, subtract your liabilities from your assets to get your net worth.

How Do I Calculate My Net Worth?

Calculating your net worth is one of the essential financial tasks you should undertake to understand your overall financial situation. Your net worth is the difference between what you own and what you owe. It provides an accurate picture of your financial health and helps you make informed decisions about your finances. In this article, we will guide you through the process of calculating your net worth.

What is Net Worth?

Net worth is the value of your assets minus your liabilities. In simple terms, it is the amount of money you would have left if you sold everything you own and paid off all your debts. Your net worth can be positive or negative, depending on the value of your assets and liabilities.

To calculate your net worth, you need to list down all your assets and liabilities. Your assets include everything you own, such as your home, car, investments, and savings. Your liabilities include all your debts, such as mortgages, loans, and credit card balances.

Assets

Your assets are anything you own that has value. It includes tangible items like your home, car, and personal belongings, as well as intangible assets like investments and savings.

To calculate the value of your assets, start by listing down all your assets and their current value. For example, if you own a home, you can use the current market value as the value of your home. If you have investments, you can get the current value from your investment statements.

Tangible Assets

Tangible assets are physical assets that have a monetary value. They include your home, car, and personal belongings.

To calculate the value of your tangible assets, you need to determine their current market value. If you own a home, you can use online tools like Zillow or Redfin to estimate the value of your home. For your car, you can use websites like Kelley Blue Book to determine its value.

Personal Belongings

Personal belongings are items that you own for personal use, such as jewelry, electronics, and furniture. When calculating the value of your personal belongings, you need to determine their fair market value. You can do this by researching the prices of similar items online or consulting with an appraiser.

Intangible Assets

Intangible assets are assets that do not have a physical form but have a monetary value. They include investments, savings, and retirement accounts.

To calculate the value of your intangible assets, you need to determine their current value. For example, if you have a savings account, you can check your account statement to determine your current balance. If you have investments, you can get their current value from your investment statements.

Liabilities

Your liabilities are all your debts, including mortgages, loans, and credit card balances. Liabilities reduce your net worth because they represent money that you owe to others.

To calculate the value of your liabilities, start by listing down all your debts and their current balances. For example, if you have a mortgage, you can use your current mortgage statement to determine the outstanding balance.

Mortgages and Loans

Mortgages and loans are long-term debts that you pay off over time. To determine the value of your mortgages and loans, you need to consider the outstanding balance and any interest that you owe.

Mortgages

Mortgages are loans that you take out to buy a home. To calculate the value of your mortgage, you need to determine the outstanding balance and any interest that you owe.

Loans

Loans are debts that you take out for various purposes, such as buying a car or funding a business. To calculate the value of your loans, you need to determine the outstanding balance and any interest that you owe.

Credit Card Balances

Credit card balances are short-term debts that you pay off each month. To determine the value of your credit card balances, you need to consider the outstanding balance and any interest that you owe.

Calculating Your Net Worth

Once you have determined the value of your assets and liabilities, you can calculate your net worth by subtracting your liabilities from your assets. If your assets are greater than your liabilities, your net worth is positive. If your liabilities are greater than your assets, your net worth is negative.

Calculating your net worth is an essential step in understanding your financial situation. It helps you make informed decisions about your finances and provides insight into your overall financial health. By tracking your net worth over time, you can monitor your progress and make adjustments to your financial plan as needed.

Benefits of Calculating Your Net Worth

Calculating your net worth has several benefits, including:

– Understanding your overall financial situation

– Identifying areas where you can reduce your debt

– Tracking your progress towards financial goals

– Making informed decisions about your finances

Net Worth vs. Income

Net worth and income are two different financial concepts. Income is the amount of money you earn from your job or business, while net worth is the value of your assets minus your liabilities.

While income is important, it does not provide an accurate picture of your overall financial health. Your net worth takes into account all your assets and liabilities and provides a more comprehensive view of your financial situation.

Conclusion

Calculating your net worth is an essential financial task that provides insight into your overall financial health. By listing down all your assets and liabilities and subtracting your liabilities from your assets, you can determine your net worth. Tracking your net worth over time can help you monitor your progress and make informed decisions about your finances.

Contents

Frequently Asked Questions

Here are some of the frequently asked questions about calculating net worth:

1. What is net worth?

Net worth is the difference between your total assets and total liabilities. Assets refer to everything you own that has value, such as property, investments, and cash. Liabilities refer to everything you owe, such as loans, mortgages, and credit card debt. To calculate your net worth, subtract your total liabilities from your total assets.

For example, if you have $500,000 in assets and $200,000 in liabilities, your net worth would be $300,000.

2. What are some examples of assets?

Assets can include anything that has value and can be sold for cash. Some examples of assets include:

- Real estate

- Investments (stocks, bonds, mutual funds, etc.)

- Cash and savings accounts

- Jewelry and other valuables

- Business interests

When calculating your net worth, make sure to include all of your assets and their current market value.

3. What are some examples of liabilities?

Liabilities refer to any debt or financial obligation that you owe. Some examples of liabilities include:

- Mortgages

- Car loans

- Credit card debt

- Student loans

- Personal loans

Make sure to include all of your liabilities when calculating your net worth. Subtracting your total liabilities from your total assets will give you an accurate picture of your financial standing.

4. Why is it important to calculate your net worth?

Calculating your net worth is important because it gives you a clear understanding of your financial situation. It can help you identify areas where you may need to improve your financial health, such as paying off debt or increasing your savings. Additionally, knowing your net worth can help you set financial goals and track your progress over time.

By regularly calculating your net worth, you can stay on top of your finances and make informed decisions about your money.

5. How often should I calculate my net worth?

It’s a good idea to calculate your net worth at least once a year. This will give you a clear picture of your financial progress over time. However, you may want to calculate your net worth more frequently if you have significant changes in your financial situation, such as buying a new home or receiving a large inheritance.

By keeping track of your net worth on a regular basis, you can stay on top of your finances and make adjustments as needed.

How To Calculate Your Net Worth

In conclusion, calculating your net worth is a crucial step in understanding your financial health. By subtracting your liabilities from your assets, you can get a clearer picture of your financial situation and make better decisions about your money.

Remember, your net worth is not a measure of your self-worth. It is simply a tool to help you track your progress towards your financial goals. Don’t be discouraged if your net worth is not where you want it to be yet – with time and dedication, you can improve it.

Finally, don’t forget to regularly update your net worth as your financial situation changes. This will help you stay on top of your finances and make informed decisions about your future. So, start calculating your net worth today and take control of your financial future!