If you need to pay someone but don’t have a personal check or cash on hand, a money order can be a great alternative. It’s a secure way to send money, and it’s easy to obtain. In this article, we’ll walk you through the process of obtaining a money order, including where to go and what information you’ll need.

To obtain a money order, follow these steps:

- Visit a location that offers money orders, such as a post office, bank, or grocery store.

- Fill out the money order with the recipient’s name and your own name and address.

- Pay for the money order plus any fees.

- Keep the receipt for your records and to track the money order.

How Do I Obtain a Money Order?

Money orders are a popular payment method that is commonly used in situations where cash or checks are not accepted. If you are new to using money orders, you may be wondering how to obtain one. In this article, we will discuss the steps involved in obtaining a money order.

1. Determine the Amount of the Money Order

Before obtaining a money order, you need to determine the amount of money you want to send. Money orders typically have a maximum limit of $1,000. If you need to send more than $1,000, you will need to purchase additional money orders.

Once you have determined the amount of the money order, you can proceed to the next step.

2. Choose a Provider

There are several providers that offer money orders, including banks, credit unions, post offices, and retail stores. Each provider may have different fees and restrictions, so it is important to compare your options.

Some providers may require you to have an account with them, while others may allow you to purchase a money order with cash.

3. Gather the Necessary Information

To obtain a money order, you will need to provide certain information, such as your name and address, the recipient’s name and address, and the amount of the money order. You may also need to provide identification, such as a driver’s license or passport.

Make sure you have all the necessary information and identification before heading to the provider.

4. Pay for the Money Order

Once you have gathered all the necessary information, you can pay for the money order. The provider may charge a fee for the money order, which can vary depending on the provider and the amount of the money order.

You can pay for the money order with cash, a check, or a debit or credit card, depending on the provider’s policies.

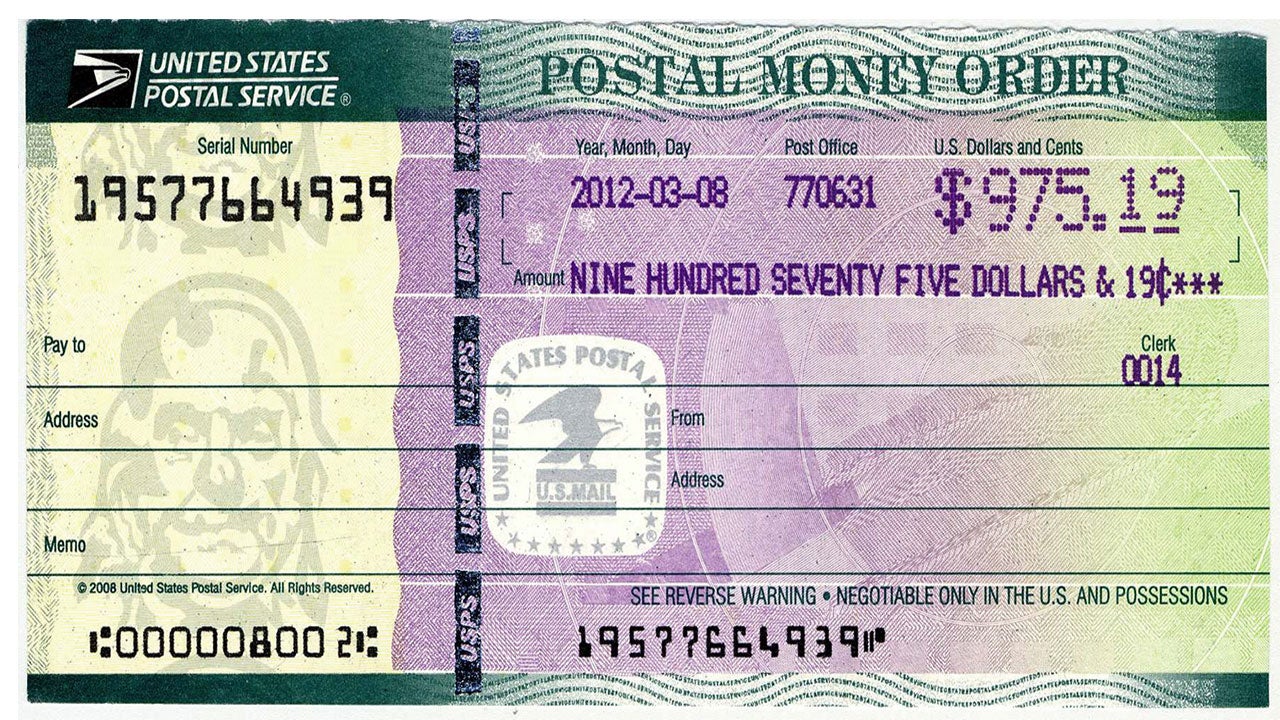

5. Fill Out the Money Order

After paying for the money order, you will need to fill it out. The money order will typically have a section for your information, the recipient’s information, and the amount of the money order.

Make sure to fill out the money order completely and accurately, as any mistakes may delay the processing of the money order.

6. Keep the Receipt

Once you have filled out the money order, the provider will give you a receipt. Make sure to keep the receipt in a safe place, as it will serve as proof of payment.

You may need the receipt if the money order is lost or if there are any issues with the processing of the money order.

7. Send the Money Order

After obtaining the money order and the receipt, you can send it to the recipient. You can send the money order through the mail or in person, depending on the provider’s policies.

Make sure to include any necessary information or instructions with the money order, such as a reference number or a specific address.

8. Wait for Confirmation

After sending the money order, you will need to wait for confirmation that it has been received and processed. This may take a few days, depending on the provider and the recipient’s location.

Once you receive confirmation that the money order has been processed, you can rest assured that your payment has been successfully sent.

9. Benefits of Using a Money Order

There are several benefits to using a money order. Money orders are a safe and secure way to send payments, as they cannot be canceled or altered once they have been issued.

Money orders also do not require a bank account, making them a convenient payment option for individuals who do not have access to traditional banking services.

10. Money Order Vs. Other Payment Methods

Compared to other payment methods, such as checks or cash, money orders offer greater security and protection. Money orders are also easier to track, as they have a unique identification number that can be used to verify the payment.

Overall, obtaining a money order is a simple and straightforward process that can offer peace of mind when sending payments. By following these steps, you can ensure that your payment is sent safely and securely.

Contents

Frequently Asked Questions

Here are some common questions and answers for obtaining a money order.

What is a money order?

A money order is a payment instrument that functions like a check. It’s a prepaid order that can be used to make payments or transfer funds to a specific recipient. Unlike checks, money orders are guaranteed by the issuer, which means they won’t bounce or get returned for insufficient funds.

You can purchase money orders from a variety of places, including post offices, banks, and convenience stores. They typically come in denominations ranging from $1 to $1,000, depending on the issuer.

How do I purchase a money order?

To purchase a money order, you’ll need to provide cash or a debit card to the issuer. You’ll also need to provide the name of the recipient and the amount you wish to send. The issuer will then provide you with a money order that you can give to the recipient. Some issuers may charge a fee for purchasing a money order, so be sure to ask about any associated costs before making your purchase.

If you need to send a money order by mail, be sure to keep the receipt and tracking number in case it gets lost or stolen. You should also consider using a secure mailing method to ensure that the money order arrives safely.

Can I cash a money order anywhere?

It depends on the issuer. Some issuers may require that the money order be cashed at a specific location, such as a post office or bank. Others may allow you to cash the money order at any location that accepts them. If you’re unsure where to cash your money order, you can contact the issuer or check their website for more information.

When cashing a money order, be sure to sign the back of the order and provide valid identification, such as a driver’s license or passport. You may also be asked to pay a fee for cashing the money order, so be sure to ask about any associated costs beforehand.

What should I do if my money order is lost or stolen?

If your money order is lost or stolen, you should contact the issuer as soon as possible. They may be able to stop payment on the money order and issue you a new one. You’ll need to provide the receipt and tracking number for the money order, so be sure to keep these documents in a safe place.

If you’re unable to recover the lost or stolen money order, you may be able to file a claim with the issuer to get your money back. However, this process can be time-consuming and may require you to provide additional documentation.

Can I use a money order to pay bills?

Yes, you can use a money order to pay bills just like you would use a check. Simply fill out the recipient’s information and the amount you wish to pay on the money order. Be sure to keep a copy of the money order and any associated receipts in case there are any issues with your payment.

Some companies may charge a fee for accepting money orders as payment, so be sure to check with the recipient beforehand to see if there are any associated costs. You should also make sure that the recipient accepts money orders before sending one as payment.

✅ How To Get A Money Order From 7/11 🔴

In conclusion, obtaining a money order is a simple and convenient process. First, identify where you can purchase a money order, such as at a bank, post office, or retail store. Next, gather the necessary information, including the recipient’s name and address, as well as the amount you wish to send. Finally, complete the money order form and pay the required fee.

It’s important to remember that money orders are a safe and secure method of payment, as they do not contain any personal banking information. This makes them an ideal option for sending money to friends, family, or businesses. Additionally, money orders can be tracked, providing peace of mind and ensuring that your payment reaches its intended recipient.

Overall, obtaining a money order is an easy and reliable way to send funds. By following these simple steps, you can ensure that your payment is sent quickly and securely. So, the next time you need to send money, consider using a money order for a hassle-free transaction.