Having a good credit score can unlock a world of financial opportunities. It can be the key to getting approved for loans, credit cards, and mortgages with favorable terms and interest rates. But what exactly is a credit score, and why is it so important?

In short, a credit score is a number that represents your creditworthiness. It’s calculated based on your credit history, including things like your payment history, credit utilization, and the length of your credit history. A higher score indicates to lenders that you’re a low-risk borrower, which can lead to better financial options and savings in the long run. In this article, we’ll explore the specific benefits of having a good credit score and how you can work to improve yours.

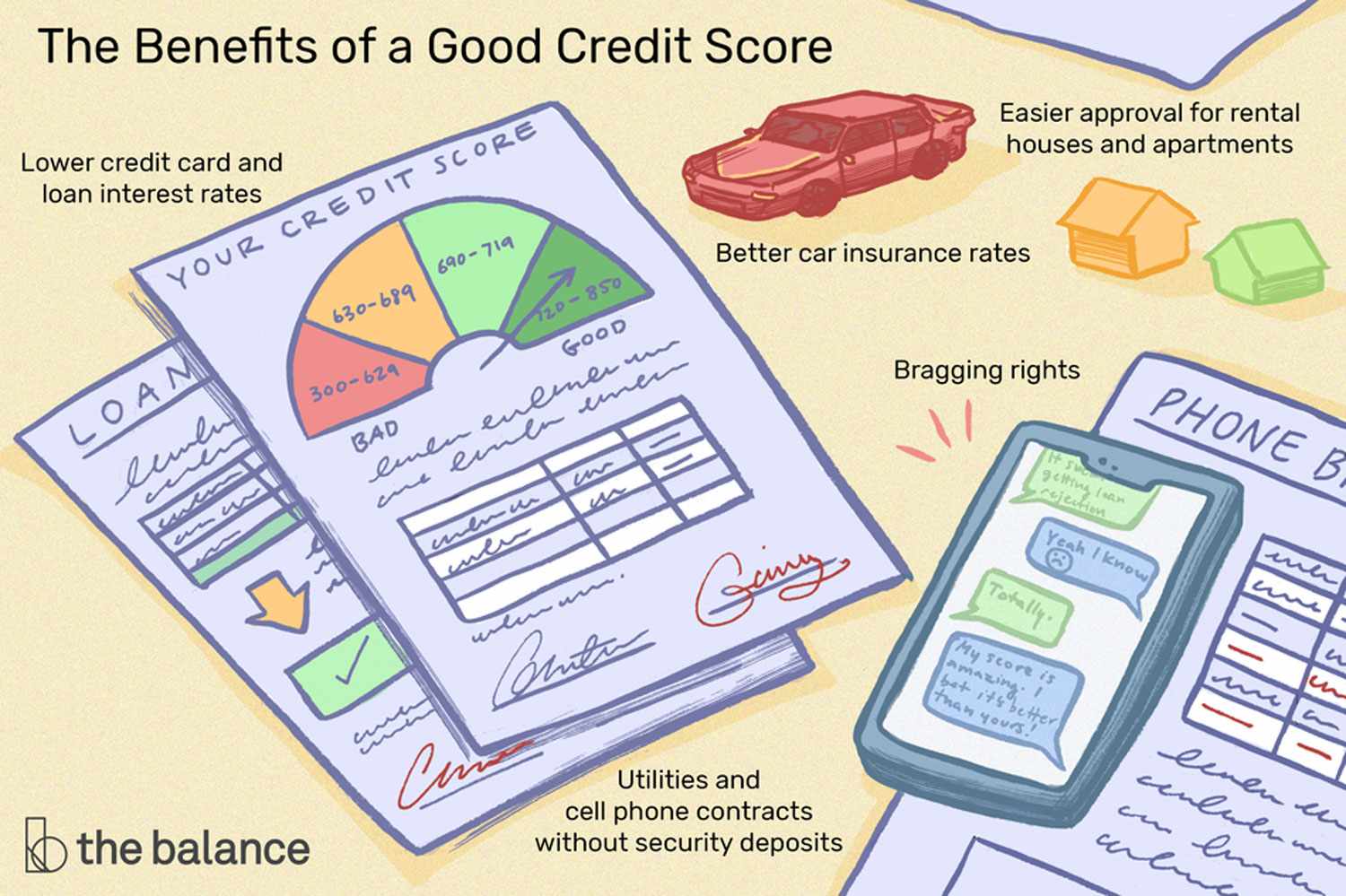

Having a good credit score can provide several benefits, including easier access to loans, lower interest rates, and better credit card offers. A good credit score also shows that you are financially responsible and can increase your chances of getting approved for rental applications, cell phone contracts, and even job offers. It’s important to maintain a good credit score by paying bills on time, keeping credit card balances low, and monitoring your credit report regularly.

Contents

- Benefits of Having a Good Credit Score

- 1. Lower Interest Rates

- 2. Easier Approval for Loans and Credit Cards

- 3. Better Insurance Rates

- 4. More Negotiating Power

- 5. Higher Credit Limits

- 6. Access to Better Rewards Programs

- 7. Easier Approval for Rental Applications

- 8. Better Job Opportunities

- 9. Less Stress and More Peace of Mind

- 10. Building a Strong Financial Future

- Conclusion

- Frequently Asked Questions

- 1. How does having a good credit score benefit me?

- 2. How can I improve my credit score?

- 3. What credit score range is considered “good”?

- 4. How does a good credit score impact my ability to get a loan?

- 5. How can a good credit score benefit me in the long run?

- True Benefits Of Having A GOOD Credit Score

Benefits of Having a Good Credit Score

Having a good credit score is essential for a healthy financial life. Not only does it make it easier to obtain loans and credit cards, but it can also save you money in the long run. Here are some of the benefits of having a good credit score.

1. Lower Interest Rates

A good credit score can help you obtain lower interest rates on loans and credit cards. This means you will pay less in interest over the life of the loan, which can save you thousands of dollars. Lenders see borrowers with good credit scores as less risky, which makes them more willing to offer lower interest rates.

For example, if you have a credit score of 780, you may be able to qualify for a mortgage with an interest rate of 3%, while someone with a credit score of 620 may only qualify for a mortgage with an interest rate of 5%. Over the life of a $300,000 mortgage, this could mean a difference of over $100,000 in interest payments.

2. Easier Approval for Loans and Credit Cards

Borrowers with good credit scores are more likely to be approved for loans and credit cards. Lenders see them as less risky and more responsible with their finances. This means you will have more options when it comes to borrowing money, and you may be able to qualify for higher loan amounts and credit limits.

For example, if you have a credit score of 750, you may be able to qualify for a credit card with a $10,000 limit, while someone with a credit score of 600 may only qualify for a credit card with a $1,000 limit.

3. Better Insurance Rates

Many insurance companies use credit scores to determine the rates they offer for auto and home insurance. Borrowers with good credit scores are seen as less risky and may be offered lower insurance rates. This can save you hundreds of dollars each year on insurance premiums.

For example, if you have a credit score of 800, you may be able to qualify for an auto insurance rate of $1,000 per year, while someone with a credit score of 600 may be offered a rate of $2,000 per year.

4. More Negotiating Power

If you have a good credit score, you have more negotiating power when it comes to borrowing money. You may be able to negotiate lower interest rates, higher loan amounts, and better repayment terms. This can save you money over the life of the loan and make it easier to manage your finances.

For example, if you have a credit score of 750, you may be able to negotiate a lower interest rate on a car loan, which could save you thousands of dollars over the life of the loan.

5. Higher Credit Limits

Borrowers with good credit scores may be offered higher credit limits on their credit cards. This can make it easier to make large purchases and manage your finances. However, it’s important to use credit responsibly and avoid overspending.

For example, if you have a credit score of 800, you may be offered a credit card with a $20,000 limit, while someone with a credit score of 600 may only be offered a credit card with a $5,000 limit.

6. Access to Better Rewards Programs

Borrowers with good credit scores may have access to better rewards programs on their credit cards. This can include cash back, travel rewards, and other perks. However, it’s important to use credit responsibly and avoid overspending.

For example, if you have a credit score of 750, you may be able to qualify for a credit card with a cash back rewards program, which could save you money on everyday purchases.

7. Easier Approval for Rental Applications

Many landlords and property managers use credit scores to screen potential tenants. Borrowers with good credit scores are seen as more responsible and may be more likely to be approved for rental applications. This can make it easier to find a place to live and avoid costly application fees.

For example, if you have a credit score of 700, you may be more likely to be approved for a rental application, while someone with a credit score of 500 may be denied.

8. Better Job Opportunities

Some employers use credit scores as part of their hiring process. Borrowers with good credit scores are seen as more responsible and may be more likely to be offered job opportunities. This can help you advance your career and earn more money over the long run.

For example, if you have a credit score of 750, you may be more likely to be offered a job with a higher salary, while someone with a credit score of 600 may be passed over for the position.

9. Less Stress and More Peace of Mind

Having a good credit score can give you less stress and more peace of mind when it comes to managing your finances. You will have more options when it comes to borrowing money, and you may be able to save money on interest rates and insurance premiums. This can help you achieve your financial goals and live a happier life.

10. Building a Strong Financial Future

Having a good credit score is essential for building a strong financial future. It shows that you are responsible with your finances and can manage debt effectively. This can help you qualify for better loans and credit cards in the future, and it can also help you achieve your long-term financial goals.

For example, if you have a good credit score, you may be able to qualify for a mortgage to buy a home, which can be a great investment for your future.

Conclusion

Having a good credit score is essential for a healthy financial life. It can save you money on interest rates, insurance premiums, and other financial products, and it can also give you more options when it comes to borrowing money. By building and maintaining a good credit score, you can achieve your financial goals and live a happier life.

Frequently Asked Questions

Learn more about the benefits of having a good credit score by reading these frequently asked questions.

1. How does having a good credit score benefit me?

Having a good credit score can benefit you in a number of ways. It can make it easier to get approved for loans, credit cards, and rental applications. Additionally, having a good credit score can lead to lower interest rates, which can save you money in the long run. Lastly, a good credit score can improve your overall financial health, making it easier to achieve your financial goals.

Overall, having a good credit score is an important part of maintaining a healthy financial life. It can open up opportunities and provide financial stability that may not be possible with a poor credit score.

2. How can I improve my credit score?

If you have a poor credit score, there are steps you can take to improve it. One of the most important things you can do is pay your bills on time. Late payments can negatively impact your credit score, so it’s important to make payments on time every month. Additionally, paying down credit card balances and keeping credit utilization low can also help improve your score. Lastly, checking your credit report regularly and disputing any errors you find can also help boost your score.

Improving your credit score takes time and effort, but the benefits are worth it. With a good credit score, you may be able to save money on interest rates and improve your financial opportunities.

3. What credit score range is considered “good”?

The credit score range considered “good” is typically between 670 and 739. However, this can vary depending on the scoring model used by lenders. Generally, the higher your credit score, the more opportunities you will have for loans and credit cards with favorable interest rates and terms.

It’s important to know your credit score and work towards improving it if it falls below the “good” range. A higher credit score can provide financial stability and opportunities that may not be possible with a poor credit score.

4. How does a good credit score impact my ability to get a loan?

A good credit score can positively impact your ability to get a loan. Lenders use credit scores to determine the likelihood that you will repay the loan, so a higher credit score can make you a more attractive borrower. Additionally, a good credit score may lead to lower interest rates, which can save you money in the long run.

If you have a poor credit score, it may be more difficult to get approved for a loan or you may be offered less favorable terms. This is why it’s important to work towards improving your credit score if you plan on applying for a loan in the future.

5. How can a good credit score benefit me in the long run?

A good credit score can benefit you in the long run by providing financial stability and opportunities. With a good credit score, you may be able to get approved for loans and credit cards with lower interest rates, which can save you money over time. Additionally, a good credit score can lead to better rental and job opportunities, as some landlords and employers may check credit scores as part of the application process.

Overall, a good credit score is an important part of maintaining a healthy financial life. It can provide stability and opportunities that may not be possible with a poor credit score.

True Benefits Of Having A GOOD Credit Score

In conclusion, having a good credit score can bring a multitude of benefits to your financial life. First and foremost, it can give you access to better interest rates and loan offers from lenders. This means that you can save money in the long run by paying less interest on loans, mortgages, and credit cards.

A good credit score can also make it easier for you to get approved for credit and loans in the first place. This is because lenders see you as a lower risk borrower, and are more likely to trust you with their money. This can be especially helpful if you’re looking to make a big purchase, such as a car or a home.

Finally, having a good credit score can improve your overall financial well-being. It can help you to establish a positive financial reputation, which can lead to better opportunities for credit and financial stability in the future. So if you’re looking to improve your financial situation, focusing on improving your credit score is a great place to start.