Are you trying to decide whether to open a personal or business bank account? This is an important decision to make as it will have a direct impact on your financial future. While both types of accounts have their benefits and drawbacks, it is important to understand the differences between a personal bank account and a business bank account in order to make an informed decision on which account is right for you. In this article, we’ll explore the differences between these two types of accounts so that you can make the right choice for your financial needs.

| Personal Bank Account | Business Bank Account |

|---|---|

| Checks are usually not available | Checks are usually available |

| Designed for individual use | Designed for commercial use |

| Generally doesn’t require a minimum balance | Generally requires a minimum balance |

| Typically lower fees and interest rates | Typically higher fees and interest rates |

| Interest is paid to the account holder | Interest is paid to the business |

Personal Bank Account Vs Business Bank Account: In-Depth Comparison Chart

| Features | Personal Bank Account | Business Bank Account |

|---|---|---|

| Account Type | A personal bank account is operated by an individual for personal use. | A business bank account is operated by a business entity such as a corporation, partnership, or limited liability company. |

| Signatories | A personal bank account is typically operated by one signatory. | A business bank account typically requires two or more signatories. |

| Interest Rates | Personal bank accounts often have lower interest rates than business bank accounts. | Business bank accounts often have higher interest rates than personal bank accounts. |

| Minimum Balance Requirements | Most personal bank accounts do not require a minimum balance. | Most business bank accounts require a minimum balance. |

| Fees | Personal bank accounts often have lower fees than business bank accounts. | Business bank accounts often have higher fees than personal bank accounts. |

| Transaction Limits | Personal bank accounts typically have lower transaction limits than business bank accounts. | Business bank accounts typically have higher transaction limits than personal bank accounts. |

| Services Offered | Personal bank accounts typically offer basic banking services such as deposits, withdrawals, and transfers. | Business bank accounts typically offer more advanced services such as merchant accounts, payroll services, and check cashing. |

Contents

- Personal Bank Account Vs Business Bank Account

- Personal Bank Account Vs Business Bank Account Pros & Cons

- Which is Better – Personal Bank Account Vs Business Bank Account?

- Frequently Asked Questions:

- What is the difference between a personal bank account and a business bank account?

- What documents do I need to open a business bank account?

- What are the advantages of having a business bank account?

- What are the disadvantages of having a business bank account?

- What is the best way to manage a business bank account?

- Business Bank Account vs. Personal Bank Account

Personal Bank Account Vs Business Bank Account

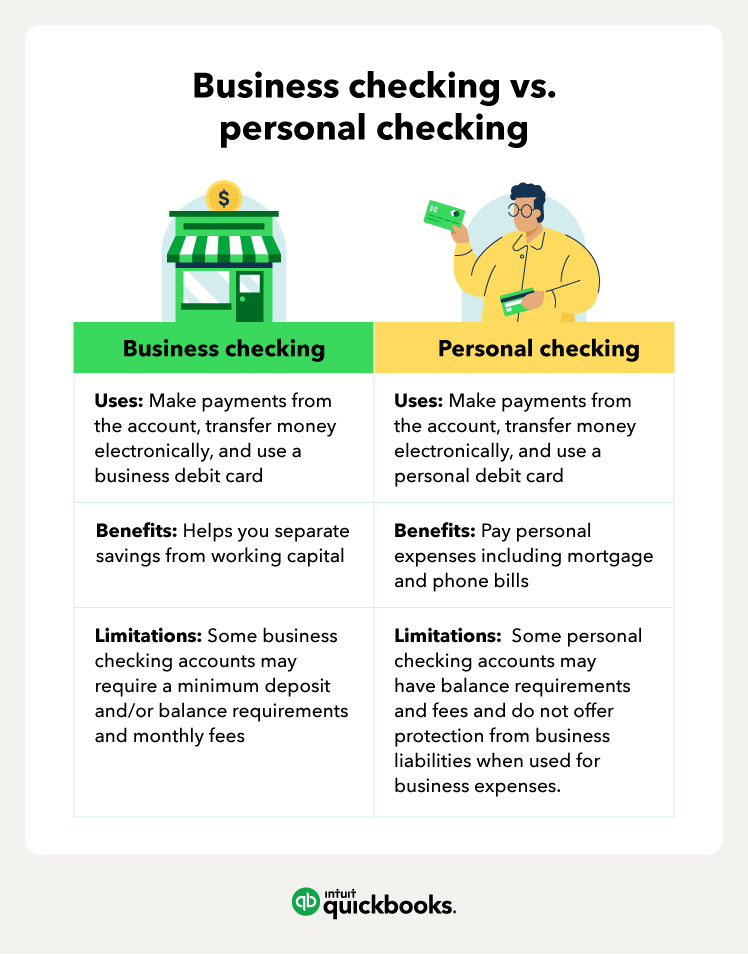

A personal bank account is a general purpose account that is used to manage and safeguard a person’s finances. Business bank accounts are specific accounts that are used to manage and safeguard a business’s finances. There are several key differences between these two types of accounts that are important to understand when deciding which type of account is right for managing your financial needs.

Account Ownership

The primary difference between personal and business bank accounts is the ownership of the account. A personal bank account is owned solely by an individual, while a business bank account is owned by a business entity. This is important to understand when setting up a business bank account, as the business entity will need to be established and recognized by the government in order to open the account.

The ownership of the account also affects the fees and services associated with the account. Business bank accounts will typically have higher fees associated with them due to the added services and features that are associated with the account. These features are designed to help businesses manage their finances more effectively.

In addition, the ownership of the account will determine who is responsible for the account and any transactions that occur within it. For a personal bank account, the individual is solely responsible for any transactions that occur, while a business bank account may have multiple people responsible for the account and its transactions.

Account Permissions

Another key difference between personal and business bank accounts is the permissions associated with the account. For a personal bank account, the individual is the only person who has access to the account and can make transactions and deposits. For a business bank account, the business entity may have multiple people who have access to the account and can make transactions and deposits.

In addition, the permissions associated with a business bank account are typically more restrictive than those of a personal bank account. This is due to the fact that a business entity may have multiple people that need access to the account and need to be able to make transactions and deposits. Therefore, the permissions on a business bank account are typically more restrictive to ensure that the account is being used properly and the finances of the business are being managed efficiently.

When setting up a business bank account, it is important to understand the permissions associated with the account so that the account can be properly managed and the finances of the business are secure.

Account Services

Another major difference between personal and business bank accounts is the services associated with the account. Personal bank accounts typically come with basic services such as checking and savings accounts, debit cards, and online banking. Business bank accounts, on the other hand, will typically have a variety of additional services such as payroll services, merchant services, and loan products.

These additional services are designed to help businesses manage their finances more effectively and to provide access to the additional resources that a business may need. Therefore, it is important to understand the services associated with a business bank account before setting up the account and to ensure that the additional services are necessary for the business.

When deciding between a personal bank account and a business bank account, it is important to understand the differences between the two types of accounts in order to choose the right account for your financial needs.

Interest Rates

The interest rates associated with personal and business bank accounts are another key difference to consider. Personal bank accounts typically have lower interest rates than business bank accounts, as they are generally considered to be less risky. Business bank accounts, on the other hand, typically have higher interest rates due to the added risk associated with the account.

The interest rates associated with the account are important to consider when deciding which type of account is right for managing your finances. Personal bank accounts typically offer lower interest rates and lower fees, while business bank accounts typically offer higher interest rates and more features and services. Therefore, it is important to compare the interest rates and fees associated with both types of accounts before making a decision.

When deciding between a personal bank account and a business bank account, it is important to consider the interest rates and fees associated with each type of account in order to choose the right account for your financial needs.

Account Security

Finally, the security of the account is an important factor to consider when deciding between a personal bank account and a business bank account. Personal bank accounts typically have lower security features than business bank accounts, as the accounts are not typically used to manage large amounts of money or sensitive information. Business bank accounts, on the other hand, typically have higher security features due to the larger amounts of money and sensitive information that may be associated with the account.

When setting up a business bank account, it is important to understand the security features associated with the account and to ensure that the account is secure. This is especially important for businesses that handle large amounts of money or sensitive information, as it is important to ensure that the account is secure from outside threats.

When deciding between a personal bank account and a business bank account, it is important to consider the security features associated with each type of account in order to choose the right account for your financial needs.

Personal Bank Account Vs Business Bank Account Pros & Cons

Pros of Personal Bank Account

- Low cost of opening and maintaining the account.

- Simple and easy to open an account with minimal documentation.

- Having a personal account may help build credit score.

Cons of Personal Bank Account

- Low interest rate on savings.

- No tax deductions for contributions.

- No legal protection from financial losses.

Pros of Business Bank Account

- Higher interest rates on savings.

- Tax deductions for contributions.

- Legal protection from financial losses.

Cons of Business Bank Account

- High cost of opening and maintaining the account.

- Complicated and time consuming to open an account with extensive documentation.

- Having a business account may not help build credit score.

Which is Better – Personal Bank Account Vs Business Bank Account?

When it comes to personal bank accounts and business bank accounts, it really depends on what your needs are and what you plan to do with the money. Both personal and business bank accounts have their advantages and disadvantages when it comes to money management and security.

For individuals and businesses, the personal bank account is often the better option. Personal bank accounts allow for more flexibility in terms of transactions and withdrawals. They also provide a low-cost way for individuals to manage their money. Additionally, personal bank accounts are not subject to the same regulations and taxes that business bank accounts are.

On the other hand, business bank accounts are a great way for businesses to manage their finances. Business bank accounts are more secure than personal bank accounts, as they are subject to more regulations. Additionally, business bank accounts can provide businesses with more options for investments, loans and other financial services.

When deciding between a personal bank account and a business bank account, it is important to consider your needs and the financial situation of your business. Ultimately, the best option for you will depend on your specific circumstances.

In conclusion, the personal bank account is usually the better choice for individuals and businesses. It provides more flexibility, low-cost money management, and is not subject to the same regulations and taxes that business bank accounts are. The following are some of the reasons why a personal bank account is often the better choice:

- More flexibility for transactions and withdrawals

- Low-cost money management

- Not subject to regulations and taxes

Frequently Asked Questions:

Are you considering setting up a bank account for your business? Are you unsure of the differences between a personal bank account and a business bank account? Here are the answers to some frequently asked questions about personal bank accounts and business bank accounts.

What is the difference between a personal bank account and a business bank account?

The primary difference between a personal bank account and a business bank account is the type of transactions that can be done. Personal bank accounts are meant for everyday banking activities such as depositing paychecks and making bill payments. Business bank accounts are designed for business-related activities such as depositing revenue and making payments to vendors.

Business bank accounts also have features not available with personal accounts. These features may include the ability to accept payments from customers, conveniently manage payroll, and pay taxes. Additionally, business accounts typically offer higher withdrawal and deposit limits, as well as access to business banking services such as loans, lines of credit, and merchant services.

What documents do I need to open a business bank account?

The documents you need to open a business bank account depend on the type of business you are operating. Generally speaking, you will need to provide a government-issued identification, such as a driver’s license or passport, as well as your business’s tax identification number. Additionally, you may need to provide documents that prove the existence of your business, such as a business license, articles of incorporation, or a certificate of formation.

Depending on the bank, you may also need to provide additional documents such as a business plan, financial statements, or a resume. You may also need to provide references from vendors or customers. Make sure to contact your bank ahead of time to determine the specific requirements for setting up a business bank account.

What are the advantages of having a business bank account?

Having a business bank account offers a variety of advantages. By separating your business finances from your personal finances, it is easier to track expenses and keep accurate records for tax purposes. Additionally, having a business bank account can help you establish a line of credit, which offers an additional source of financing for your business.

Finally, having a business bank account can help you establish a professional reputation with customers and vendors. With a business bank account, you can accept payment from customers via checks, debit cards, and credit cards, as well as make payments to vendors without having to use your personal bank account.

What are the disadvantages of having a business bank account?

The main disadvantage of having a business bank account is the associated fees. Many banks charge a monthly fee for business accounts, as well as additional fees for services such as wire transfers and check deposits. Additionally, some banks require a minimum balance in order to avoid fees, which can be difficult to maintain.

Additionally, business accounts are typically more complex than personal accounts. You may need to pay close attention to the terms and conditions of your account, as well as keep track of any changes in account fees. Make sure to compare different banks and accounts before opening a business bank account.

What is the best way to manage a business bank account?

The best way to manage a business bank account is to set up a budget and stick to it. This will help you avoid overspending and make sure that you have enough money in the account to cover any upcoming payments or expenses. Additionally, it is important to keep accurate records of transactions and reconcile your account regularly.

You should also take advantage of features that are available with business bank accounts such as online bill pay and payroll services. These features can help you save time and money, as well as reduce the risk of errors. Finally, it is important to review your bank statements regularly and watch for any unauthorized transactions.

Business Bank Account vs. Personal Bank Account

In conclusion, personal and business bank accounts offer different benefits and drawbacks, depending on the individual’s needs. Personal accounts are better suited for individuals who only need to manage a small amount of money, while business accounts are more suitable for companies who need to manage large amounts of money. Both accounts provide security and convenience, but the features and fees vary depending on the type of account. Before selecting a bank account, it’s important to weigh the pros and cons and determine which type of account is best for your needs.