Debt and investing are two concepts that often go hand in hand. While having debt can be a burden, investing in your future is crucial. However, finding the best strategy to pay off debt while investing can be a daunting task. How can one balance the two and come out on top? In this article, we will explore different strategies for paying off debt while investing to help you make informed decisions and achieve financial freedom.

The best strategy for paying off debt while investing is to prioritize high-interest debt first and then focus on investing. Start by paying off credit card debt, followed by personal loans or other high-interest debt. Once you have paid off these debts, start investing in a retirement account or other investment vehicles. It is important to balance paying off debt and investing, but focusing on high-interest debt first will save you money in the long run.

Best Strategy for Paying Off Debt While Investing

When it comes to paying off debt while investing, it can be challenging to decide which strategy to follow. On one hand, paying off your debt as quickly as possible can save you money in interest payments, while on the other hand, investing your money can grow your wealth over time. So, what’s the best strategy? In this article, we’ll explore the different approaches and help you determine the best one for you.

1. Prioritize High-Interest Debt

The first step in paying off debt while investing is to prioritize your debt. Start by focusing on high-interest debt, such as credit card balances, personal loans, and payday loans. These types of debt typically have higher interest rates than other types, which means that they are costing you more money in the long run.

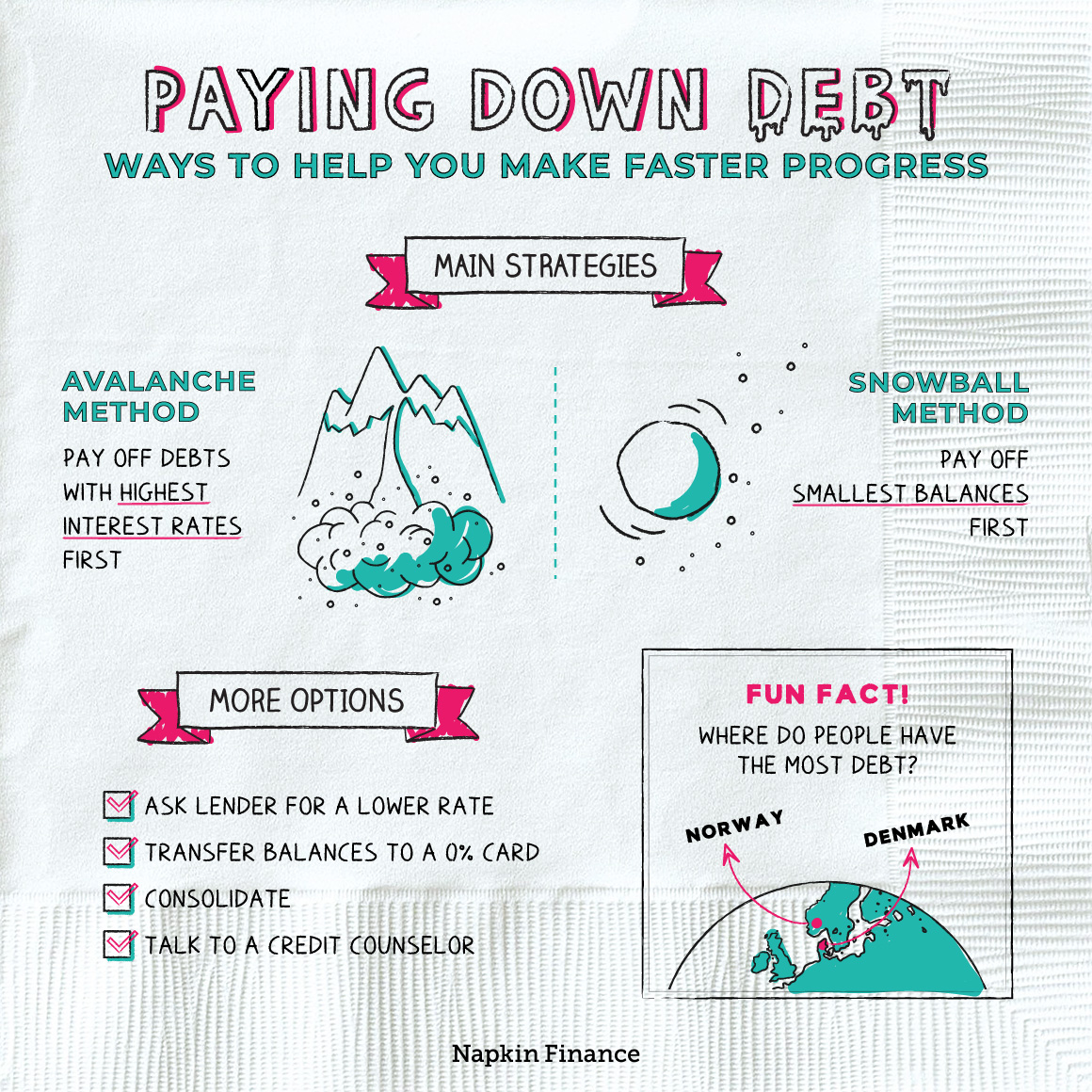

One strategy to pay off high-interest debt is the debt avalanche method. This involves paying off your debts in order of the highest interest rate to the lowest. By doing so, you’ll pay less interest over time and be able to pay off your debts faster.

2. Create a Budget

Creating a budget is essential when paying off debt while investing. A budget helps you track your income and expenses, which allows you to see where your money is going. By creating a budget, you can identify areas where you can cut back on expenses and redirect that money towards paying off your debt and investing.

One way to create a budget is to use a budgeting app or spreadsheet. These tools help you track your income and expenses, and some even categorize your expenses so you can see where your money is going.

3. Build an Emergency Fund

Before you start investing, it’s important to build an emergency fund. An emergency fund is a savings account that you can use to cover unexpected expenses, such as car repairs, medical bills, or job loss. Having an emergency fund can prevent you from going into debt if an unexpected expense arises.

Aim to save at least three to six months’ worth of living expenses in your emergency fund. You can start by setting aside a small amount each month and gradually increasing it over time.

4. Consider a Debt Consolidation Loan

If you have multiple high-interest debts, you may want to consider consolidating them into one loan. A debt consolidation loan combines all your debts into one loan with a lower interest rate. This can make it easier to manage your debt payments and save you money in interest.

Before taking out a debt consolidation loan, make sure to shop around and compare rates from different lenders. Also, be sure to read the terms and conditions carefully to understand any fees or penalties associated with the loan.

5. Make Extra Payments

Making extra payments towards your debt can help you pay it off faster and save you money in interest. One strategy is to make bi-weekly payments instead of monthly payments. By doing so, you’ll make an extra payment each year, which can help you pay off your debt faster.

Another strategy is to use any extra money you receive, such as a bonus or tax refund, towards your debt. By doing so, you’ll make a significant dent in your debt and save money in interest.

6. Start Investing

Once you have a plan for paying off your debt, it’s time to start investing. Investing can help you grow your wealth over time and achieve your long-term financial goals. One strategy is to start with a small amount and gradually increase your investment over time.

Consider investing in a diversified portfolio of stocks, bonds, and mutual funds. This can help reduce your risk and maximize your returns. You can also consider working with a financial advisor to help you create an investment plan that aligns with your financial goals.

7. Consider a Roth IRA

A Roth IRA is a retirement account that allows you to contribute after-tax dollars and withdraw tax-free in retirement. It’s a great option for those who want to save for retirement while paying off debt.

One strategy is to contribute to a Roth IRA while paying off high-interest debt. By doing so, you’ll take advantage of the tax-free growth and have the flexibility to withdraw your contributions penalty-free if needed.

8. Don’t Neglect Your Retirement Savings

While paying off debt is important, it’s also essential to continue saving for retirement. Don’t neglect your retirement savings while paying off debt. Aim to contribute at least enough to your employer’s retirement plan to receive the full match.

If you don’t have an employer-sponsored retirement plan, consider opening an individual retirement account (IRA). You can contribute up to $6,000 per year ($7,000 if you’re 50 or older) and take advantage of the tax benefits.

9. Consider the Benefits vs. Risks

When deciding on the best strategy for paying off debt while investing, it’s essential to consider the benefits vs. risks. Paying off debt can save you money in interest and improve your credit score, while investing can grow your wealth over time.

Consider your financial goals, risk tolerance, and timeline when deciding on a strategy. It’s also important to seek advice from a financial advisor before making any major financial decisions.

10. Stay Committed

Paying off debt while investing can be a long and challenging journey. It’s essential to stay committed to your plan and stay motivated along the way. Celebrate small wins, such as paying off a credit card balance or reaching a savings goal.

Remember, paying off debt and investing are both long-term strategies. It takes time, patience, and consistency to achieve your financial goals. Stay committed, and you’ll be on your way to financial freedom.

Contents

Frequently Asked Questions

Can I pay off debt and invest at the same time?

Yes, it is possible to pay off debt and invest at the same time. However, it is important to prioritize your debt payments first to avoid accumulating more interest and fees. Once your debt is under control, you can start investing with the extra money you have available.

It is also important to consider the type of debt you have. High-interest debt, such as credit card debt, should be paid off first before investing. Low-interest debt, such as a mortgage or student loan, can be paid off over time while investing for the future.

Should I focus on paying off debt before investing?

It is generally recommended to focus on paying off debt before investing. This is because the interest rates on debt are usually higher than the returns on investments. By paying off your debt first, you can save money in the long run and reduce your financial stress.

However, it is important to have a balance between paying off debt and investing. It can be beneficial to start investing small amounts while still paying off debt to take advantage of compound interest and start building your savings.

What is the debt avalanche method?

The debt avalanche method is a strategy for paying off debt that involves prioritizing debt with the highest interest rate first. By focusing on paying off high-interest debt first, you can save money on interest and pay off your debt faster. Once the high-interest debt is paid off, you can move on to the next highest interest rate debt and continue the process until all debt is paid off.

The debt avalanche method can be an effective way to pay off debt, but it requires discipline and patience. It is important to continue making minimum payments on all debts while focusing on paying off the highest interest debt first.

What is the debt snowball method?

The debt snowball method is a strategy for paying off debt that involves prioritizing debt with the lowest balance first. By focusing on paying off small debts first, you can build momentum and motivation to continue paying off larger debts. Once the small debts are paid off, you can move on to the next lowest balance debt and continue the process until all debt is paid off.

The debt snowball method can be a good option for those who need motivation to pay off debt. However, it may not be the most cost-effective strategy since it does not prioritize high-interest debt first.

What are some tips for paying off debt while investing?

Some tips for paying off debt while investing include creating a budget, prioritizing high-interest debt, and starting small with investments. By creating a budget, you can see where your money is going and find areas to cut back on expenses. Prioritizing high-interest debt can save you money on interest and fees.

Starting small with investments can help you get comfortable with the process and take advantage of compound interest. It is also important to have an emergency fund in place to cover unexpected expenses and avoid going into more debt.

Which One of These is the BEST Debt Payoff Strategy?!

In conclusion, paying off debt while investing can be a tricky balancing act, but with the right strategy, it can be done effectively. The best approach is to first prioritize paying off high-interest debt, such as credit card debt, while also setting aside some money for emergencies. Once that is taken care of, it’s important to create a solid investment plan that aligns with your financial goals and risk tolerance.

Remember that paying off debt and investing are both important steps towards achieving financial freedom, but it’s important to find the right balance that works for you. Don’t be afraid to seek out professional help or advice if you’re unsure about the best strategy for your personal situation. With dedication and perseverance, you can successfully pay off debt while also building a secure financial future for yourself and your family.