Are you feeling overwhelmed by your mortgage payments? Refinancing your mortgage can be the solution you need to lower your monthly payments and potentially save thousands of dollars in the long run. But where do you start?

In this article, we will guide you through the process of refinancing your mortgage. From understanding the benefits and risks to finding the right lender and completing the application process, you’ll have all the information you need to make a confident decision and save money on your mortgage. Let’s dive in!

Refinancing your mortgage involves replacing your current mortgage with a new one, ideally at a lower interest rate. Start by researching and comparing rates from different lenders. Next, gather the necessary documents such as income and credit score information. Then, submit an application to the lender of your choice. If approved, you’ll need to review and sign the new loan documents. Finally, your old mortgage will be paid off and your new mortgage will begin.

How Do I Refinance My Mortgage?

Refinancing a mortgage can be a smart financial move if done at the right time and under the right circumstances. It can help you save money, reduce your monthly payments, or even shorten the length of your loan. However, the process can be overwhelming, especially if you are doing it for the first time. Here’s a step-by-step guide on how to refinance your mortgage.

1. Determine Your Goal

The first step in refinancing your mortgage is to determine what you want to achieve. Do you want to lower your monthly payments, pay off your loan faster, or get a lower interest rate? Knowing your goal will help you choose the best refinance option for your needs.

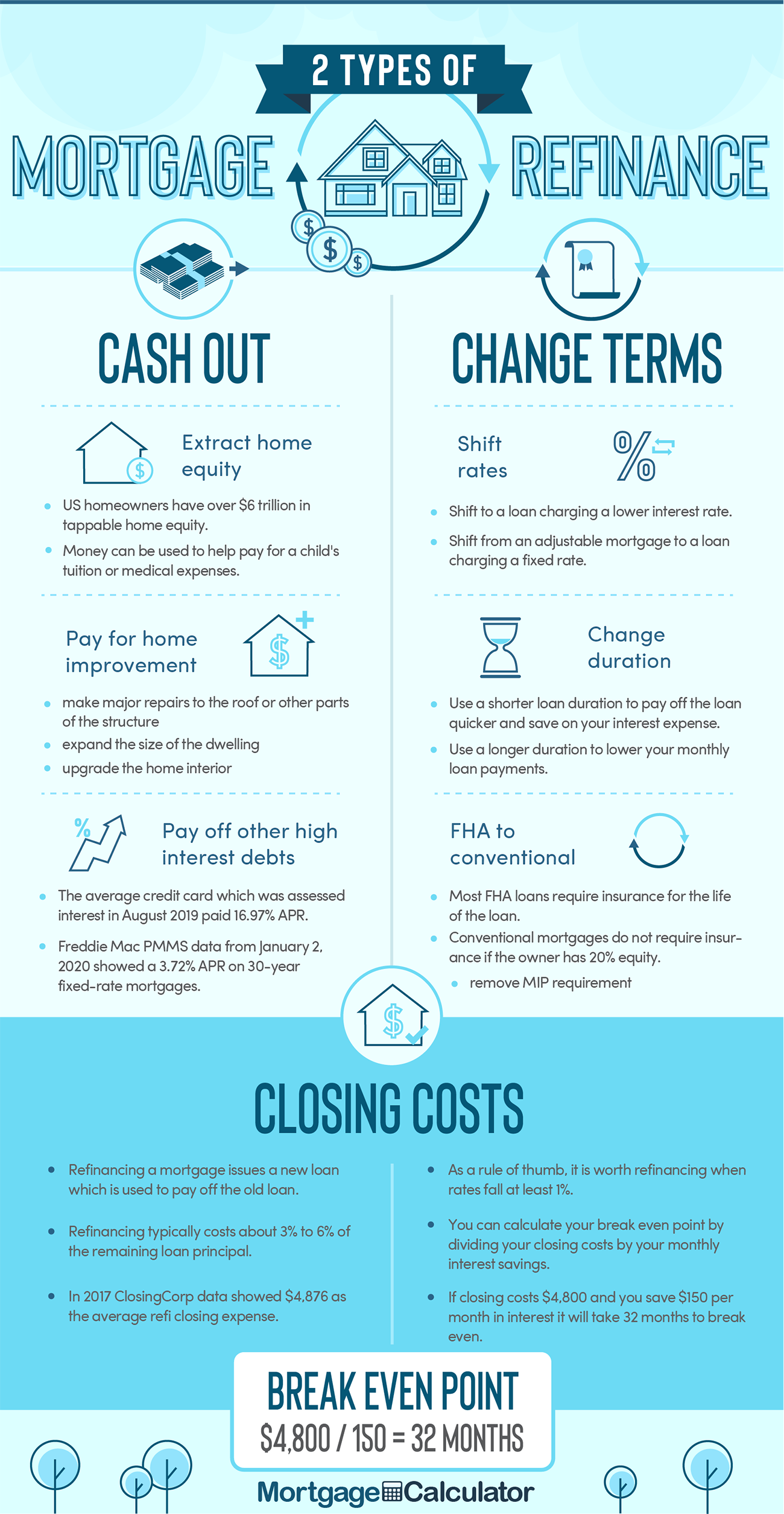

There are two main types of refinancing: rate-and-term and cash-out. Rate-and-term refinancing involves swapping your current mortgage for a new one with better terms, such as a lower interest rate or shorter loan term. Cash-out refinancing, on the other hand, allows you to take out some of the equity in your home as cash.

2. Check Your Credit Score

Your credit score plays a crucial role in determining the interest rate and terms of your refinance loan. Before applying for a refinance, check your credit report and score. If your score is lower than you’d like, take steps to improve it, such as paying down debt and correcting errors on your report.

3. Gather Your Financial Information

To refinance your mortgage, you’ll need to provide your lender with a range of financial information, including your income, debts, and assets. Gather all the necessary documentation, such as tax returns, pay stubs, and bank statements, before you start the application process.

4. Shop Around for Lenders

Not all lenders offer the same refinance options or interest rates. Shop around and compare offers from multiple lenders to find the best deal for your needs. Be sure to look at the interest rate, closing costs, and any other fees associated with the loan.

5. Apply for the Loan

Once you’ve found a lender, you’ll need to apply for the refinance loan. Be prepared to provide all the necessary documentation and answer any questions the lender may have. The application process may take several weeks, so be patient and stay in touch with your lender throughout the process.

6. Get an Appraisal

Most lenders require an appraisal of your home before approving a refinance loan. The appraisal will determine the current value of your home and ensure that you have enough equity to qualify for the loan.

7. Review the Loan Terms

Before accepting a refinance loan, review the terms carefully. Make sure you understand the interest rate, monthly payments, and any fees associated with the loan. If you have any questions or concerns, don’t hesitate to ask your lender.

8. Close the Loan

If you’re satisfied with the terms of the refinance loan, it’s time to close the deal. This involves signing a new mortgage agreement and paying any closing costs associated with the loan. The process usually takes a few hours, and you’ll need to bring a government-issued ID and any other required documentation.

9. Start Making Payments

Once the refinance loan is closed, you’ll start making payments according to the new terms. Make sure you understand when your first payment is due and how much it will be. If you have any questions or issues with your payments, contact your lender right away.

10. Enjoy the Benefits

Refinancing your mortgage can have several benefits, such as lower monthly payments, a shorter loan term, and a lower interest rate. Enjoy the benefits of your new loan and make sure to stay on top of your payments to avoid any issues down the road.

In conclusion, refinancing your mortgage can be a smart financial move if done properly. Follow these steps to refinance your mortgage and achieve your financial goals.

Frequently Asked Questions

If you’re thinking about refinancing your mortgage, you probably have a lot of questions about the process. Here are some answers to some of the most common questions people have about refinancing their mortgage.

What does it mean to refinance a mortgage?

Refinancing a mortgage means replacing your current mortgage with a new one. The new mortgage pays off the old one, and you start making payments on the new mortgage. People refinance their mortgages for a variety of reasons, including to get a lower interest rate, to lower their monthly payment, or to change the terms of their mortgage.

To refinance your mortgage, you’ll need to apply for a new mortgage with a lender. The lender will consider your credit score, income, and other factors to determine if you qualify for a new mortgage and what your interest rate will be.

When should I consider refinancing my mortgage?

You might consider refinancing your mortgage if you can get a lower interest rate than you currently have. A lower interest rate can save you money over the life of your loan. You might also consider refinancing if you want to change the terms of your mortgage, such as switching from an adjustable-rate mortgage to a fixed-rate mortgage.

It’s important to weigh the costs of refinancing against the potential savings. Refinancing can come with closing costs and other fees, so make sure you understand all the costs involved before you decide to refinance.

What do I need to do to prepare for refinancing my mortgage?

Before you apply for a new mortgage, you should review your credit report and credit score. Make sure there are no errors on your credit report that could affect your ability to qualify for a new mortgage. You should also gather documentation of your income, such as pay stubs and tax returns, and make sure you have enough money saved for closing costs and other fees.

It’s also a good idea to shop around and compare mortgage rates from different lenders. This can help you find the best interest rate and terms for your new mortgage.

How long does it take to refinance a mortgage?

The refinancing process can take anywhere from a few weeks to a few months, depending on the lender and the complexity of your mortgage. You’ll need to fill out an application and provide documentation of your income and other financial information. The lender will also order an appraisal of your home to determine its value.

Once you’re approved for a new mortgage, you’ll need to sign the loan documents and pay closing costs before the new mortgage can be funded and your old mortgage paid off.

What are the costs associated with refinancing a mortgage?

Refinancing a mortgage can come with several costs, including application fees, appraisal fees, title search fees, and other closing costs. These costs can vary depending on the lender and the type of mortgage you’re getting.

It’s important to understand all the costs involved in refinancing before you decide to move forward. You can ask your lender for a breakdown of all the costs associated with your new mortgage.

In conclusion, refinancing your mortgage can be a great way to save money and make your monthly payments more manageable. By following the steps outlined above, you can take control of your finances and make sure that you’re getting the best possible deal on your home loan.

Whether you’re looking to reduce your interest rate, lower your monthly payments, or simply pay off your mortgage sooner, refinancing can be a powerful tool in achieving your financial goals. So why wait? Start exploring your options today and see how refinancing could benefit you and your family in the long run.

In the end, the key to successful refinancing is to do your research, weigh your options carefully, and work with a reputable lender who can help guide you through the process. With a little patience and persistence, you can be well on your way to enjoying the many benefits of a more affordable mortgage. So don’t delay – start exploring your refinancing options today and see how much you could save!