Starting a business can be an exciting and promising venture, but it often requires a significant amount of capital. If you don’t have the funds readily available, you may be wondering if a personal loan is a viable option for financing your business.

While personal loans can be a great way to access quick cash, using them to start a business can be a risky decision. In this article, we will explore the pros and cons of using a personal loan to fund your new venture and provide you with the information you need to make an informed decision.

Yes, you can use a personal loan to start a business. However, it’s important to note that personal loans typically come with higher interest rates than traditional business loans. Additionally, using a personal loan for business purposes can put your personal assets at risk if the business fails. Consider consulting with a financial advisor and exploring other funding options before taking out a personal loan.

Can I Use a Personal Loan to Start a Business?

Starting a new business can be an exciting and challenging experience. However, the biggest challenge is often the lack of funds to get your business off the ground. One way to finance your new business is by using a personal loan. But is this a good idea? In this article, we will explore the pros and cons of using a personal loan to start a business.

Pros of Using a Personal Loan to Start a Business

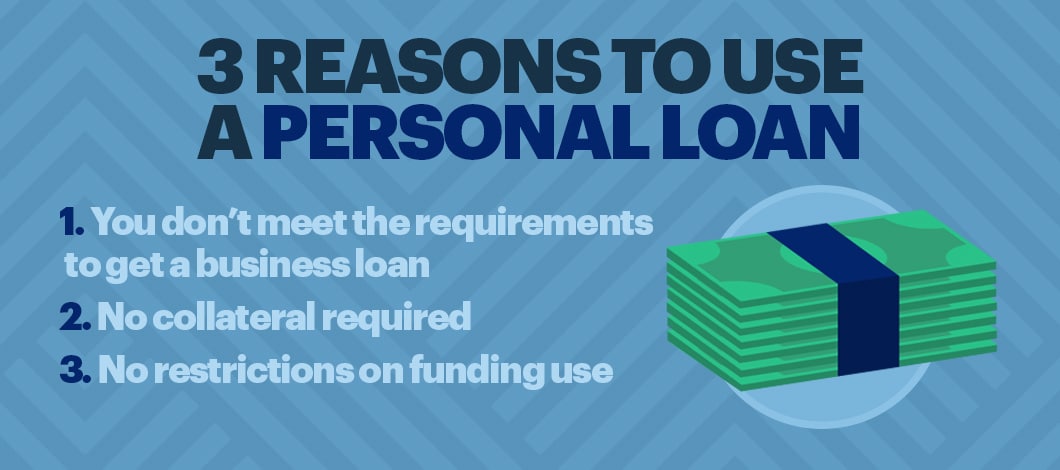

Using a personal loan to start a business has its advantages. Here are some of the pros:

- Lower interest rates: Personal loans usually have lower interest rates than business loans, which can save you money in the long run.

- Flexible repayment terms: Personal loans typically have flexible repayment terms, which can help you manage your cash flow better.

- No collateral required: Personal loans are unsecured, which means you don’t have to put up any collateral to secure the loan.

However, there are also some cons to using a personal loan to start a business.

Cons of Using a Personal Loan to Start a Business

- Lower loan amounts: Personal loans usually have lower loan amounts than business loans, which may not be enough to cover all your business expenses.

- Personal liability: If your business fails, you are personally liable for the loan, which can lead to financial ruin.

- Impact on credit score: Taking out a personal loan can impact your credit score, which can affect your ability to get future loans.

Benefits of Using a Business Loan to Start a Business

While using a personal loan to start a business has its advantages, using a business loan may be a better option. Here are some of the benefits of using a business loan:

- Higher loan amounts: Business loans usually have higher loan amounts than personal loans, which can help you cover all your business expenses.

- Separate liability: With a business loan, your business is liable for the loan, not you personally.

- Tax benefits: Business loans may have tax benefits that can help you save money on your taxes.

Personal Loan vs. Business Loan

When deciding between a personal loan and a business loan, it’s important to consider your business needs and financial situation. Here are some factors to consider:

- Loan amount: If you need a large loan amount, a business loan may be a better option.

- Repayment terms: If you need flexible repayment terms, a personal loan may be a better option.

- Interest rates: If you can qualify for a low interest rate on a business loan, it may be a better option than a personal loan.

- Liability: If you want to protect your personal assets, a business loan may be a better option.

Conclusion

In conclusion, using a personal loan to start a business has its pros and cons. While it may be a good option for some, it’s important to consider the potential risks before taking out a personal loan. If you need a large loan amount, a business loan may be a better option. However, if you need flexible repayment terms, a personal loan may be a better fit. Ultimately, the decision comes down to your business needs and financial situation.

Contents

Frequently Asked Questions

What is a personal loan?

A personal loan is a type of loan that is granted to an individual for personal use. It is usually unsecured, meaning that the borrower does not need to put up any collateral to secure the loan. Personal loans can be used for a variety of expenses, such as consolidating debt, paying for medical expenses, or making a large purchase.

What are the requirements for getting a personal loan?

The requirements for getting a personal loan vary depending on the lender. Generally, lenders will look at your credit score, income, and debt-to-income ratio to determine your eligibility for a loan. You may also be required to provide proof of income, such as pay stubs or tax returns, and other financial information.

How much can I borrow with a personal loan?

The amount you can borrow with a personal loan varies depending on the lender and your financial situation. Generally, personal loans range from a few thousand dollars to tens of thousands of dollars. The amount you can borrow will depend on factors such as your credit score, income, and debt-to-income ratio.

Can I use a personal loan to start a business?

While it is possible to use a personal loan to start a business, it may not be the best option. Personal loans are typically unsecured and have higher interest rates than business loans. It may be more beneficial to explore other financing options, such as a business loan or a line of credit, which are specifically designed for business expenses.

What are the risks of using a personal loan to start a business?

There are several risks associated with using a personal loan to start a business. The biggest risk is that if the business fails, you will still be responsible for repaying the loan. Additionally, using a personal loan for business expenses can affect your personal credit score and financial stability. It is important to carefully consider all financing options before making a decision.

Only A Moron Starts A Business On A Loan

In conclusion, using a personal loan to start a business can be a viable option for some individuals. However, it is important to carefully consider the potential risks and benefits before making a decision. It is also crucial to have a solid business plan in place and to use the funds responsibly in order to increase the chances of success.

While a personal loan may provide the necessary funding to get a business off the ground, it is important to remember that it is still a debt that must be repaid. Defaulting on the loan can have serious consequences for both personal finances and the business itself. Therefore, it is important to carefully assess one’s ability to repay the loan before taking on the debt.

Ultimately, the decision to use a personal loan to start a business should be made after careful consideration and consultation with financial professionals. With the right planning and execution, however, a personal loan can provide the necessary funding to turn a business idea into a successful reality.