Financial planning is an important aspect of life that everyone should consider. However, one of the biggest concerns people have is the cost of financial planning services. It’s important to understand the different types of financial planning services available and how much they typically cost to ensure you’re making the best decision for your financial future. In this article, we’ll dive into the world of financial planning costs and give you a better understanding of what to expect.

The cost of financial planning varies depending on the advisor, the complexity of your financial situation and the services you require. Generally, financial advisors charge either a percentage of your assets under management or a flat fee. Some may charge an hourly rate. It’s important to ask about fees upfront and understand how they are calculated. A good financial plan can provide significant value and help you reach your financial goals, so it’s worth investing in.

How Much Does Financial Planning Cost?

As the saying goes, “money makes the world go round.” It’s an essential aspect of our lives, and we all want to ensure that we are financially secure. That’s where financial planning comes in. It’s a process that helps you manage your finances effectively, paving the way for a secure future. But the question remains – how much does financial planning cost? In this article, we’ll explore the cost of financial planning and what you can expect.

What is Financial Planning?

Financial planning is the process of creating a roadmap for your financial future. It involves evaluating your current financial situation, setting financial goals, and creating a plan to achieve those goals. A financial plan typically includes strategies for savings, investment, debt management, retirement planning, and risk management. It’s a comprehensive approach that takes into account your current financial situation, your goals, and your risk tolerance.

Benefits of Financial Planning

Financial planning provides several benefits, including:

- Helps you create a realistic budget

- Assists in identifying and prioritizing financial goals

- Provides a roadmap for achieving your financial goals

- Helps you make informed decisions regarding investments and other financial matters

- Provides a sense of security and peace of mind

What Does a Financial Planner Do?

A financial planner is a professional who can help you create a financial plan based on your goals and financial situation. They can provide guidance on investments, tax planning, retirement planning, and other financial matters. A financial planner can also help you evaluate your risk tolerance and make informed decisions regarding your finances.

How Much Does Financial Planning Cost?

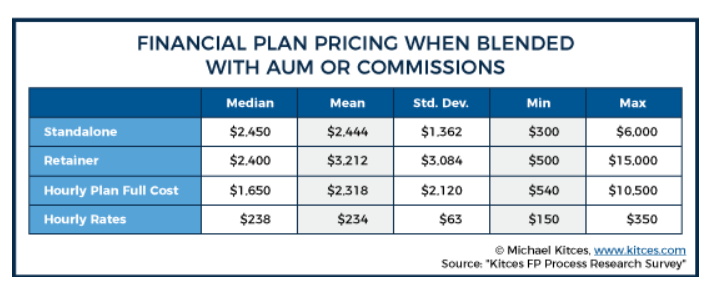

The cost of financial planning varies depending on several factors, including the complexity of your financial situation and the services you require. Financial planners typically charge either a flat fee, hourly rate, or a percentage of the assets they manage.

Flat Fee

A flat fee is a one-time fee charged for creating a financial plan. The cost typically ranges from $1,000 to $3,000, depending on the complexity of your financial situation.

Hourly Rate

An hourly rate is charged for the time spent on creating a financial plan. The cost typically ranges from $150 to $400 per hour, depending on the experience and expertise of the financial planner.

Percentage of Assets

Some financial planners charge a percentage of the assets they manage. The cost typically ranges from 0.5% to 2% of the assets under management. For example, if you have $500,000 in assets, the cost would be between $2,500 and $10,000 per year.

Financial Planning vs. Robo-Advisors

Robo-advisors are online platforms that use algorithms to provide investment advice and manage your portfolio. They typically charge lower fees than traditional financial planners but provide limited services. Here’s a comparison of financial planning vs. robo-advisors.

Financial Planning

- Comprehensive approach

- Personalized advice based on your goals and financial situation

- Assistance with tax planning, retirement planning, and other financial matters

- Higher fees

Robo-Advisors

- Limited services

- Lower fees

- Automated investment advice based on your risk tolerance

- No personalized advice

Conclusion

Financial planning is an essential aspect of securing your financial future. While the cost may vary depending on your financial situation and the services you require, the benefits of financial planning far outweigh the cost. Whether you choose a traditional financial planner or a robo-advisor, the key is to make informed decisions regarding your finances and create a plan that aligns with your goals.

Contents

- Frequently Asked Questions

- What factors influence the cost of financial planning?

- What is the average cost of financial planning?

- Are there any hidden costs associated with financial planning?

- Is it worth paying for financial planning services?

- How can I find a financial planner that fits my needs and budget?

- How Much Do Financial Advisors Cost?

Frequently Asked Questions

Financial planning is an essential part of managing your money, but many people are unsure about the cost of these services. Here are some common questions and answers about how much financial planning typically costs.

What factors influence the cost of financial planning?

The cost of financial planning can vary depending on several factors, including the complexity of your financial situation, the types of services you require, and the experience and qualifications of the financial planner. Some financial planners charge a flat fee for their services, while others charge a percentage of the assets they manage for you. It’s important to discuss fees with your planner upfront and understand exactly what services you’ll be receiving for your money.

Additionally, some planners may charge more for specialized services, such as estate planning or tax preparation. If you have unique financial needs or goals, it’s important to find a planner who has experience in those areas, even if it means paying a higher fee.

What is the average cost of financial planning?

There is no one-size-fits-all answer to this question, as the cost of financial planning can vary widely depending on your needs and the expertise of the planner you choose. However, according to a survey by the Financial Planning Association, the average cost of financial planning is around $2,500 per year for ongoing services. For one-time consultations or specific projects, the cost may be lower, typically ranging from $1,000 to $3,000.

Keep in mind that these are just averages, and your individual costs may be higher or lower depending on your specific situation and the services you need. It’s important to get a clear understanding of fees upfront and compare costs among different planners to find the best fit for your budget and needs.

Good financial planners should be transparent about their fees and any associated costs upfront. However, it’s still important to ask questions and read the fine print carefully to avoid any surprises later on. Some planners may charge additional fees for certain types of investments or transactions, while others may require a minimum account balance or charge a penalty for early withdrawal.

As with any financial service, it’s important to do your research and ask plenty of questions before committing to a specific planner or investment strategy. Look for a planner who is open and honest about their fees and any potential costs, and who is willing to work with you to find a solution that fits your needs and budget.

Is it worth paying for financial planning services?

Ultimately, the decision to pay for financial planning services depends on your individual needs and goals. If you have a complex financial situation or are unsure about the best investment strategy for your needs, a qualified financial planner can provide valuable insights and guidance. Additionally, a planner can help you stay on track with your financial goals and make adjustments as needed to keep you on the right path.

However, if you have a relatively simple financial situation and feel confident in your ability to manage your own investments, paying for financial planning services may not be necessary. It’s important to weigh the potential benefits against the cost and make a decision that makes sense for your individual situation.

How can I find a financial planner that fits my needs and budget?

There are many resources available to help you find a qualified financial planner who can meet your needs and budget. Start by asking for recommendations from friends or family members who have worked with a planner and had a positive experience. You can also search for local financial planners online or through professional organizations like the Financial Planning Association.

Once you have a list of potential planners, schedule consultations to discuss your needs and goals and get a sense of their fees and services. Don’t be afraid to ask questions and compare costs among different planners before making a decision. Remember, the goal is to find a planner who can provide the guidance and support you need to achieve your financial goals, without breaking the bank.

How Much Do Financial Advisors Cost?

In conclusion, the cost of financial planning varies depending on several factors, including the complexity of an individual’s financial situation and the level of expertise required. While some financial planners may charge a flat fee, others may charge a percentage of the assets they manage or receive commissions from the products they sell. It’s essential to understand the fee structure and the services provided before hiring a financial planner to ensure that you are getting the best value for your money.

As the saying goes, “You get what you pay for.” When it comes to financial planning, it’s essential to invest in a reputable and experienced financial planner who can help you achieve your financial goals. While the cost may seem high at first, the benefits of having a solid financial plan in place can far outweigh the cost in the long run. With the right guidance, you can create a financial plan that will help you achieve financial freedom and security.

In summary, financial planning is an investment in your future. The cost of financial planning varies, but it’s essential to choose a financial planner who has your best interests in mind and can help you achieve your financial goals. By working with a financial planner, you can create a personalized plan that will help you manage your finances, minimize risk, and achieve financial security. Remember, the cost of financial planning is a small price to pay for the peace of mind that comes with having a solid financial plan in place.