Credit unions are alternative financial institutions that offer a range of benefits to their members. Unlike traditional banks, credit unions are member-owned, not-for-profit organizations that exist solely to serve their members’ financial needs.

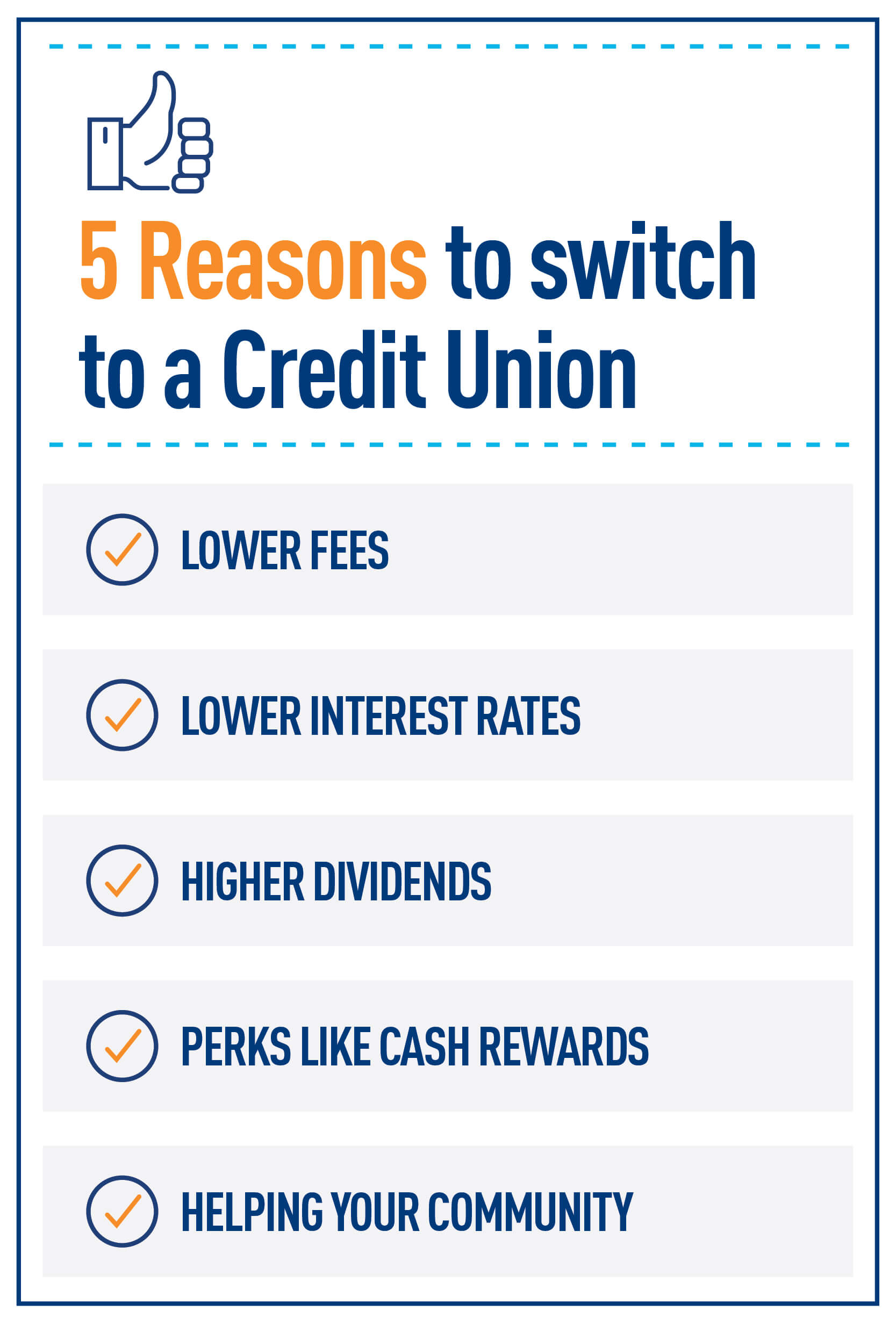

Credit unions offer many advantages, including lower fees, higher interest rates on savings, and more personalized customer service. In this article, we explore the benefits of using a credit union and why it could be a smart financial decision for you.

Credit unions offer numerous benefits over traditional banks, such as lower interest rates on loans and credit cards, higher interest rates on savings accounts, and lower fees. Credit unions are also member-owned and operated, meaning they prioritize the needs of their members over profits. Additionally, credit unions offer personalized customer service and community involvement opportunities.

Contents

- Benefits of Using a Credit Union

- Frequently Asked Questions

- How do credit unions differ from traditional banks?

- What are the benefits of using a credit union for savings?

- How can credit unions help me with my loans?

- What are the benefits of using a credit union for small business banking?

- What are the eligibility requirements for joining a credit union?

- What Are the Benefits of Credit Unions

Benefits of Using a Credit Union

Credit unions are not-for-profit organizations that are owned by their members. Unlike banks, credit unions are focused on serving the financial needs of their members, rather than generating profits for shareholders. If you are looking for a more personalized and cost-effective financial solution, then a credit union may be the right fit for you. Here are some of the benefits of using a credit union.

Lower Fees and Interest Rates

One of the biggest advantages of using a credit union is the lower fees and interest rates. Since credit unions are not-for-profit organizations, they are able to offer lower fees and interest rates on loans and credit cards. This can save you a significant amount of money over time, especially if you have a high balance or carry a balance on your credit card.

In addition, credit unions often have lower account fees and minimum balance requirements than traditional banks. This means that you can keep more of your money in your account and avoid unnecessary fees.

Personalized Service

Credit unions are known for their personalized service. Since they are focused on serving their members, credit unions are able to provide more personalized attention and assistance. You can expect to be treated like a person and not just a number.

Credit unions also offer a range of financial products and services that are tailored to the needs of their members. This includes everything from checking and savings accounts to home loans and investment products. You can speak with a credit union representative to find out what product or service would be best for your financial situation.

Community Focus

Credit unions are deeply rooted in the communities they serve. They are often involved in local events and charities, and they focus on investing in the local economy. This means that when you use a credit union, you are supporting your local community.

In addition, credit unions are often more flexible and willing to work with members who may have unique financial needs or challenges. This can include offering financial education and counseling to help members improve their financial literacy and achieve their financial goals.

Federally Insured

Credit unions are federally insured by the National Credit Union Administration (NCUA). This means that your deposits are insured up to $250,000, just like they would be at a traditional bank. This provides peace of mind and ensures that your money is safe and secure.

Unlike banks, credit unions are not focused on generating profits for shareholders. Instead, they are focused on serving the needs of their members. This means that credit unions are able to make decisions that are in the best interest of their members, rather than shareholders.

Member Ownership

Credit unions are owned by their members. This means that you have a say in how the credit union operates and how profits are used. You can attend annual meetings and vote on important decisions, such as electing the board of directors.

In addition, credit unions often offer rewards programs and other benefits to their members. This can include discounts on products and services, as well as special rates on loans and credit cards.

Accessibility

Credit unions often have a smaller network of branches and ATMs than traditional banks. However, many credit unions are part of a shared network that allows members to access their accounts at thousands of locations across the country.

In addition, many credit unions offer online banking and mobile apps that make it easy to manage your accounts from anywhere, at any time. This can help you save time and stay on top of your finances.

Financial Education

Credit unions are committed to helping their members improve their financial literacy and achieve their financial goals. Many credit unions offer financial education and counseling services to their members. This can include workshops, seminars, and one-on-one counseling sessions.

In addition, credit unions often provide resources and tools to help members manage their finances. This can include online calculators, budgeting tools, and financial planning services.

Flexible Lending Criteria

Credit unions often have more flexible lending criteria than traditional banks. This means that they may be more willing to work with members who have less-than-perfect credit or unique financial situations. This can be especially helpful for members who are just starting out or who may have had financial challenges in the past.

In addition, credit unions often offer lower interest rates on loans than traditional banks. This can make it easier and more affordable to borrow money when you need it.

Member Discounts

Credit unions often offer discounts to their members on a variety of products and services. This can include everything from car rentals and hotel bookings to home security systems and insurance policies. These discounts can help you save money on everyday expenses and major purchases.

In addition, credit unions often offer special rates on loans and credit cards to their members. This can help you save money on interest charges and pay off your debts more quickly.

Using a credit union can provide many benefits, including lower fees and interest rates, personalized service, community focus, and more. If you are looking for a financial institution that puts your needs first, then a credit union may be the right choice for you.

Frequently Asked Questions

Here are some common questions people ask about the benefits of using a credit union.

How do credit unions differ from traditional banks?

Credit unions are not-for-profit financial institutions that are owned and operated by their members. This means that credit unions are able to offer lower fees and better interest rates on loans and savings accounts. Additionally, credit unions are often more community-focused and offer personalized service to their members.

Traditional banks, on the other hand, are for-profit institutions that are focused on generating profits for shareholders. This can sometimes result in higher fees and less personalized service for customers.

What are the benefits of using a credit union for savings?

Credit unions often offer higher interest rates on savings accounts than traditional banks. This means that you can earn more money on your savings without having to take on additional risk. Additionally, credit unions are often more flexible when it comes to the types of savings accounts they offer, allowing you to choose an account that best fits your needs.

Furthermore, when you save money at a credit union, you are also supporting a not-for-profit institution that is focused on benefiting its members rather than generating profits for shareholders.

How can credit unions help me with my loans?

Credit unions are often able to offer lower interest rates on loans than traditional banks. This means that you can save money on interest over the life of your loan. Additionally, credit unions are often more flexible when it comes to loan terms and repayment options, allowing you to choose a loan that best fits your needs and budget.

Credit unions also tend to be more focused on their members’ financial well-being, and may offer financial counseling or other resources to help you manage your debt and improve your credit score.

What are the benefits of using a credit union for small business banking?

Credit unions often offer a variety of services for small business owners, including business loans, business checking accounts, and merchant services. Additionally, credit unions are often more community-focused and may have a better understanding of the local business environment.

Using a credit union for small business banking can also help you build relationships with other local business owners and community leaders, which can be valuable for networking and growing your business.

What are the eligibility requirements for joining a credit union?

Each credit union has its own eligibility requirements, but many credit unions are based on a specific community or industry. For example, there may be credit unions that serve employees of a particular company or members of a certain profession.

To join a credit union, you will typically need to meet the eligibility requirements and open an account by depositing a small amount of money. Once you are a member, you will be able to take advantage of the benefits of using a credit union for your financial needs.

What Are the Benefits of Credit Unions

In conclusion, there are numerous benefits to using a credit union. Firstly, credit unions often offer lower fees and interest rates compared to traditional banks. This can save you money in the long run and help you manage your finances more effectively. Secondly, credit unions are typically member-owned, meaning that you have a say in how the credit union is run and can benefit from any profits. Lastly, credit unions prioritize customer service and offer personalized support, ensuring that you receive the help you need whenever you need it.

Overall, joining a credit union can be a smart financial decision. Not only do you have access to competitive rates and fees, but you also become part of a community that values its members. With personalized support and a focus on member satisfaction, credit unions offer a unique banking experience that can help you achieve your financial goals. So why not consider joining a credit union today and start experiencing the benefits for yourself?