Are you tired of living paycheck to paycheck? Do you struggle to keep your finances in order? The solution may lie in creating a personal budget.

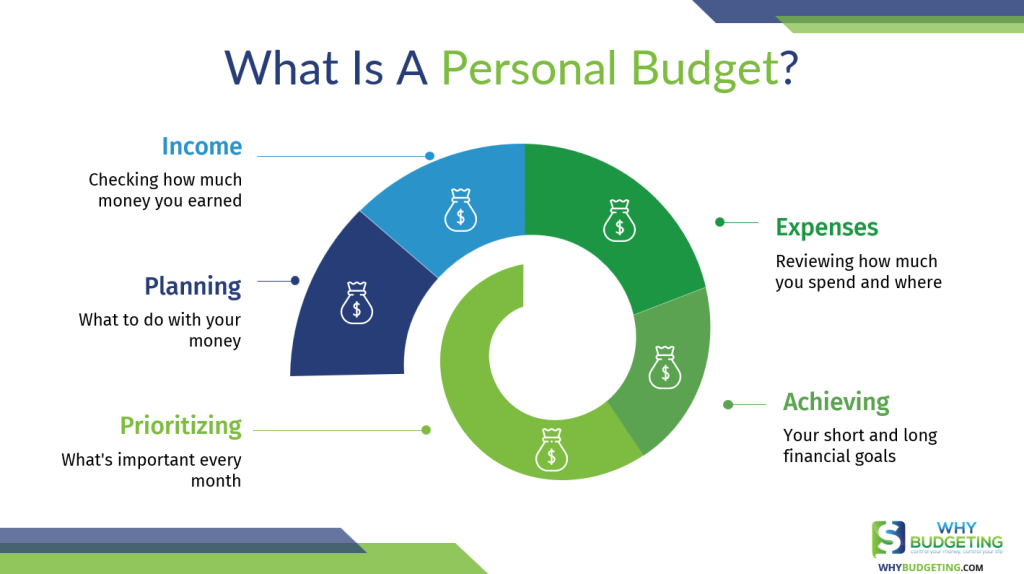

A personal budget is a tool that can help you take control of your finances, plan for the future, and achieve your financial goals. By tracking your income and expenses, you can identify areas where you can cut back on spending, save more money, and ultimately improve your financial well-being. So, what is the main reason to use a personal budget? Let’s dive in.

The main reason to use a personal budget is to gain control of your finances. With a budget, you can track your income and expenses, identify areas where you can cut back, and prioritize your spending. By sticking to a budget, you can avoid overspending, reduce debt, and save money for future goals. It may take some effort to create and maintain a budget, but the benefits are worth it in the long run.

What is the Main Reason to Use a Personal Budget?

Managing your personal finances can be a daunting task, but creating and following a personal budget can help you take control of your financial situation. A personal budget is a plan that outlines your income and expenses, allowing you to make informed decisions about your money. Here are ten reasons why you should consider using a personal budget:

1. Get a Clear Picture of Your Finances

Creating a personal budget can help you get a clear picture of your finances. By tracking your income and expenses, you can see where your money is going and identify areas where you can cut back. This can help you make better financial decisions and take control of your spending.

One way to get started with your personal budget is to gather all of your financial statements, including bank statements, credit card statements, and bills. You can then use a budgeting tool or spreadsheet to create a plan that outlines your income and expenses.

2. Set Financial Goals

Another reason to use a personal budget is to set financial goals. A budget can help you prioritize your spending and save money for the things that matter most to you. For example, if you want to save for a down payment on a house or pay off debt, you can create a budget that reflects these goals and make sure you’re setting aside enough money each month to reach them.

3. Avoid Overspending

A personal budget can help you avoid overspending. When you have a plan for your money, you’re less likely to make impulse purchases or spend money on things you don’t need. By tracking your expenses and sticking to your budget, you can stay on track and avoid overspending.

4. Reduce Debt

If you have debt, a personal budget can help you reduce it. By prioritizing your debt payments and cutting back on unnecessary expenses, you can free up more money to put towards paying off your debt. This can help you reduce your overall debt faster and save money on interest charges.

5. Improve Your Credit Score

A personal budget can also help you improve your credit score. By making your payments on time and reducing your debt, you can show lenders that you’re responsible with your money. This can help you qualify for better interest rates and save money on loans and credit cards.

6. Build an Emergency Fund

Having an emergency fund is important for unexpected expenses or job loss. A personal budget can help you build an emergency fund by setting aside money each month for this purpose. This can give you peace of mind knowing that you have a financial cushion in case of an emergency.

7. Plan for Retirement

A personal budget can also help you plan for retirement. By setting aside money each month for retirement savings, you can build a nest egg that will help you maintain your lifestyle after you stop working. This can help you avoid relying solely on social security or other retirement benefits.

8. Track Your Progress

Another benefit of using a personal budget is that you can track your progress over time. By tracking your income and expenses each month, you can see how you’re doing and make adjustments as needed. This can help you stay motivated and on track with your financial goals.

9. Teach Good Financial Habits

Using a personal budget can also help you teach good financial habits to your children or others in your household. By involving them in the budgeting process, you can help them learn about money management and develop healthy financial habits.

10. Reduce Stress

Finally, using a personal budget can help you reduce stress. When you have a plan for your money and feel in control of your finances, you’re less likely to feel stressed or anxious about your financial situation. This can help you enjoy a better quality of life and focus on the things that matter most to you.

In conclusion, creating and following a personal budget can have many benefits, including getting a clear picture of your finances, setting financial goals, avoiding overspending, reducing debt, improving your credit score, building an emergency fund, planning for retirement, tracking your progress, teaching good financial habits, and reducing stress. So, start creating your personal budget today and take control of your financial future!

Frequently Asked Questions

Managing personal finances can be challenging, and many people struggle to keep track of their spending. However, creating a personal budget can help you take control of your finances and achieve your financial goals. Here are some common questions about personal budgets and their benefits.

What are the benefits of using a personal budget?

A personal budget can help you achieve your financial goals and stay on track with your spending. It allows you to see where your money is going and identify areas where you can cut back. With a budget, you can prioritize your spending, save for emergencies and big purchases, and avoid overspending and debt. In addition, having a clear understanding of your finances can reduce stress and improve your overall financial wellbeing.

How do I create a personal budget?

To create a personal budget, start by tracking your income and expenses for a month. Then, categorize your expenses into fixed and variable costs, such as rent, utilities, groceries, and entertainment. Next, determine your financial goals, such as paying off debt or saving for a vacation. Finally, allocate your income towards your expenses and goals, making sure to prioritize your needs over your wants. You can use a spreadsheet or budgeting app to help you create and track your budget.

What if my expenses exceed my income?

If your expenses exceed your income, you may need to adjust your budget and find ways to reduce your spending or increase your income. Look for areas where you can cut back, such as eating out less or canceling subscriptions. You can also consider finding ways to earn more money, such as taking on a side job or freelance work. It may take time to balance your budget, but with persistence and discipline, you can achieve your financial goals.

How often should I review and adjust my budget?

You should review and adjust your budget regularly, such as monthly or quarterly. This allows you to track your progress towards your goals and make changes as needed. If your income or expenses change significantly, such as getting a raise or experiencing a major life event, you may need to adjust your budget accordingly. Additionally, it’s a good idea to review your budget at the end of each year to plan for the upcoming year and set new financial goals.

What are some tips for sticking to a personal budget?

Sticking to a personal budget requires discipline and commitment. Here are some tips to help you stay on track:

- Track your spending regularly and adjust your budget as needed.

- Avoid impulse purchases and stick to your budgeted amounts.

- Find ways to save money, such as using coupons or buying in bulk.

- Use cash instead of credit cards to avoid overspending.

- Stay motivated by focusing on your financial goals and celebrating your progress.

The Importance of Budgeting

In conclusion, there are several reasons why using a personal budget is crucial. Firstly, it helps you keep track of your spending and income, making it easier to plan for future expenses. Secondly, it allows you to identify areas where you can cut back on unnecessary expenses and save more money. Lastly, having a personal budget can help you achieve your financial goals, whether it’s paying off debt, saving for a down payment on a house, or planning for retirement.

By creating a personal budget, you are taking control of your finances and making informed decisions about your spending. It may take some time and effort to set up and maintain, but the benefits are worth it in the long run. With a personal budget, you can live within your means, avoid debt, and achieve financial stability.

In conclusion, the main reason to use a personal budget is to take control of your finances and achieve your financial goals. By creating a budget, you can track your spending and income, identify areas where you can save money, and make informed decisions about your finances. So, start creating your budget today and take the first step towards financial freedom.