Crowdfunding real estate investing is a new and innovative way for investors to invest in property without having to purchase the entire property themselves. Instead, investors can pool their funds with others to purchase a property and share in the profits. This method of investing has become increasingly popular in recent years, providing investors with a unique opportunity to diversify their portfolio and potentially earn higher returns.

With the rise of technology and the internet, crowdfunding has become a popular way for individuals to invest in various projects, including real estate. Crowdfunding real estate investing allows investors to access more deals, invest in smaller amounts, and diversify their portfolio without having to deal with the traditional hassles of property ownership. In this article, we will explore what crowdfunding real estate investing is, how it works, and the benefits and risks of this investment strategy.

Crowdfunding real estate investing is a new way for individuals to invest in real estate without the traditional barriers of entry. It allows investors to pool their money together to invest in a particular real estate venture. Investors can participate with as little as $500 to $1,000, and they typically receive a share of the profits based on their investment amount. Crowdfunding real estate investing is an opportunity to diversify one’s investment portfolio with a potentially high return on investment.

Contents

- What is Crowdfunding Real Estate Investing?

- Frequently Asked Questions

- How does Crowdfunding Real Estate Investing work?

- What are the benefits of Crowdfunding Real Estate Investing?

- What are the risks of Crowdfunding Real Estate Investing?

- What types of real estate projects can be funded through Crowdfunding Real Estate Investing?

- How do I get started with Crowdfunding Real Estate Investing?

- What is Real Estate Crowdfunding?

What is Crowdfunding Real Estate Investing?

Crowdfunding real estate investing is the process of pooling funds from multiple investors to invest in real estate projects. In the past, investing in real estate was only accessible to wealthy individuals and institutions due to high minimum investment requirements. However, crowdfunding has opened up the real estate market to a wider range of investors by allowing them to invest smaller amounts in real estate projects through online platforms.

How Does Crowdfunding Real Estate Investing Work?

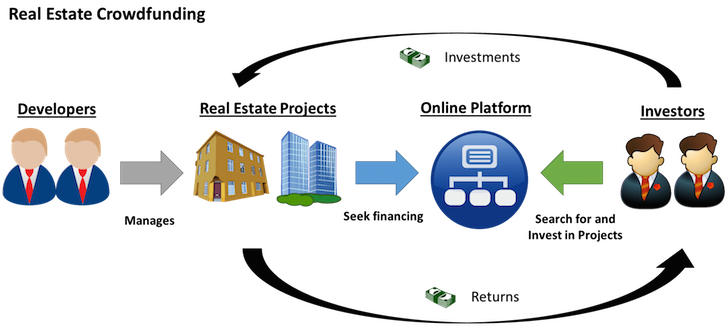

Crowdfunding real estate investing typically involves three parties: the real estate developer, the crowdfunding platform, and the investors. The real estate developer identifies a project and presents it to the crowdfunding platform, which then lists the project on its website. Investors can browse through the available projects and select the ones they want to invest in.

Once the project is fully funded, the real estate developer uses the funds to purchase and develop the property. As the property generates income, the profits are distributed among the investors according to the terms of the investment agreement.

Types of Crowdfunding Real Estate Investing

There are two main types of crowdfunding real estate investing: debt and equity. Debt crowdfunding involves investors lending money to a real estate developer, who then pays them back with interest. Equity crowdfunding, on the other hand, involves investors owning a share of the property and receiving a portion of the profits.

Debt Crowdfunding

In debt crowdfunding, investors provide loans to real estate developers, typically with fixed interest rates and repayment terms. This type of crowdfunding is less risky than equity crowdfunding as investors receive fixed returns regardless of the project’s success. However, the returns are also lower than equity crowdfunding.

Some benefits of debt crowdfunding include:

- Lower risk compared to equity crowdfunding

- Fixed returns

- Shorter investment periods

Equity Crowdfunding

In equity crowdfunding, investors own a share of the property and receive a portion of the profits. The returns are typically higher than debt crowdfunding, but the risk is also higher as investors’ returns are tied to the success of the project.

Some benefits of equity crowdfunding include:

- Potentially higher returns compared to debt crowdfunding

- Investors have ownership in the property

- Long-term investment periods

Benefits of Crowdfunding Real Estate Investing

Crowdfunding real estate investing offers several benefits to investors, including:

- Lower minimum investment requirements

- Diversification of investment portfolio

- Access to a wider range of real estate projects

- Passive income from real estate investments

Crowdfunding Real Estate Investing vs. Traditional Real Estate Investing

Crowdfunding real estate investing differs from traditional real estate investing in several ways. Traditional real estate investing typically involves purchasing a property outright, which requires a large amount of capital. Crowdfunding real estate investing, on the other hand, allows investors to invest smaller amounts in multiple real estate projects.

Some other differences between crowdfunding real estate investing and traditional real estate investing include:

| Crowdfunding Real Estate Investing | Traditional Real Estate Investing |

|---|---|

| Investments made through online platforms | Investments made directly in properties |

| Investors have less control over the property | Investors have more control over the property |

| Lower minimum investment requirements | Higher minimum investment requirements |

| Diversification of investment portfolio | Investments tied to a single property |

Conclusion

Crowdfunding real estate investing has revolutionized the real estate market by allowing a wider range of investors to invest in real estate projects. Investors can choose between debt and equity crowdfunding, both of which offer their own benefits and risks. Crowdfunding real estate investing offers several benefits compared to traditional real estate investing, including lower minimum investment requirements and diversification of investment portfolio.

Frequently Asked Questions

Crowdfunding Real Estate Investing has become a popular way for investors to enter the real estate market without the traditional barriers to entry like large amounts of capital. Here are some frequently asked questions about Crowdfunding Real Estate Investing:

How does Crowdfunding Real Estate Investing work?

Crowdfunding Real Estate Investing involves pooling together small amounts of capital from a large group of people to fund a real estate project. The project is usually run by a professional real estate developer or company who is responsible for managing the project and ensuring that investors receive their returns.

Investors can choose which projects they want to invest in and how much they want to invest. In exchange for their investment, they receive a share of the profits from the project, usually in the form of rental income or a share of the profits when the property is sold.

What are the benefits of Crowdfunding Real Estate Investing?

One of the main benefits of Crowdfunding Real Estate Investing is that it allows investors to enter the real estate market with smaller amounts of capital. This means that more people can access the potentially high returns that come with real estate investing.

Additionally, Crowdfunding Real Estate Investing can provide investors with diversification. By investing in multiple projects, investors can spread their risk and reduce the impact of any one project performing poorly.

What are the risks of Crowdfunding Real Estate Investing?

As with any investment, there are risks associated with Crowdfunding Real Estate Investing. One of the main risks is the potential for the project to fail, which could result in a loss of the investor’s capital. Additionally, the real estate market can be unpredictable, which could impact the performance of the project.

It’s important for investors to thoroughly research the project and the company behind it before investing. Investors should also be aware of the fees associated with the investment, as these can impact overall returns.

What types of real estate projects can be funded through Crowdfunding Real Estate Investing?

There are a variety of real estate projects that can be funded through Crowdfunding Real Estate Investing. These can include residential properties, commercial properties, and even large-scale developments like hotels or shopping centers.

Investors can choose which projects they want to invest in based on their personal investment goals and risk tolerance.

How do I get started with Crowdfunding Real Estate Investing?

To get started with Crowdfunding Real Estate Investing, investors can research and select a Crowdfunding platform that matches their investment goals. They can then browse the available projects and choose which ones they want to invest in.

It’s important to read the platform’s terms and conditions carefully and understand the fees associated with the investment. Investors should also consult with a financial advisor to ensure that Crowdfunding Real Estate Investing is a suitable investment for their portfolio.

What is Real Estate Crowdfunding?

In conclusion, crowdfunding real estate investing is a relatively new way for investors to pool their funds together to invest in real estate projects. This type of investment allows for smaller investors to participate in larger projects that they may not have been able to otherwise. Crowdfunding also allows for diversification in investment portfolios and the potential for higher returns.

One of the key benefits of crowdfunding real estate investing is the potential for passive income. Investors can earn a return on their investment without having to actively manage the property. Additionally, crowdfunding platforms often provide transparency and access to information about the investment, giving investors more control over their investment decisions.

Overall, crowdfunding real estate investing is a promising alternative to traditional real estate investing. With the potential for higher returns, diversification, and passive income, it’s no wonder that more and more investors are turning to this innovative investment strategy. As the industry continues to grow and evolve, it will be exciting to see what new opportunities arise for investors.