Managing personal finances can be a daunting task, especially when your money seems to disappear before you can even blink. But with the right personal budget app, you can take control of your spending and start saving for the things that matter most.

From budget tracking to bill reminders, there are countless personal budget apps on the market. But with so many options to choose from, it can be challenging to determine which one is the best fit for you. In this article, we’ll explore some of the top personal budget apps available and help you find the perfect solution for your financial needs.

Looking for the best personal budget app? Mint is one of the most popular budgeting apps available, allowing you to set budgets and track your spending in different categories. You Need A Budget (YNAB) is another great option, using the zero-based budgeting method to help you stay on top of your finances. Personal Capital offers a free app that not only helps you budget, but also tracks your investments and retirement accounts.

What is the Best Personal Budget App?

Managing personal finances can be a daunting task, but with the advancements in technology, it has become much easier. Personal budget apps have become increasingly popular, and for a good reason. They offer a convenient and easy-to-use way to track your expenses, keep an eye on your spending habits, and save money. But with so many personal budget apps available in the market, which one is the best for you? In this article, we will discuss the best personal budget app options available to help you make an informed choice.

1. Mint

Mint is a free personal budget app that syncs with your bank accounts, credit cards, and other financial institutions to track your spending. It is a comprehensive budgeting app that gives you a clear view of your finances, including your income, expenses, and investments. Mint also offers personalized budgeting advice based on your spending habits and financial goals.

One of the key benefits of using Mint is that it automatically categorizes your spending, so you can easily see where your money is going. It also alerts you when you go over your budget and provides tips on how to save money. Additionally, Mint provides free credit score monitoring, so you can keep tabs on your credit health.

2. YNAB

YNAB (You Need a Budget) is a personal budget app that focuses on helping you create a budget and stick to it. It offers a unique approach to budgeting that involves giving every dollar a job, which means assigning each dollar you earn to a specific category, such as rent, groceries, or savings.

YNAB also offers features like goal tracking, debt paydown, and syncing with your bank accounts and credit cards. It is a paid app, but it offers a free trial so you can try it out before committing to a subscription.

3. Personal Capital

Personal Capital is a personal finance app that offers a comprehensive view of your financial life. It syncs with your bank accounts, investments, and credit cards to provide a clear picture of your net worth, expenses, and investments.

One of the key benefits of using Personal Capital is that it offers investment management services, so you can get personalized investment advice based on your financial goals. It also offers retirement planning tools and a fee analyzer to help you save money on investment fees.

4. PocketGuard

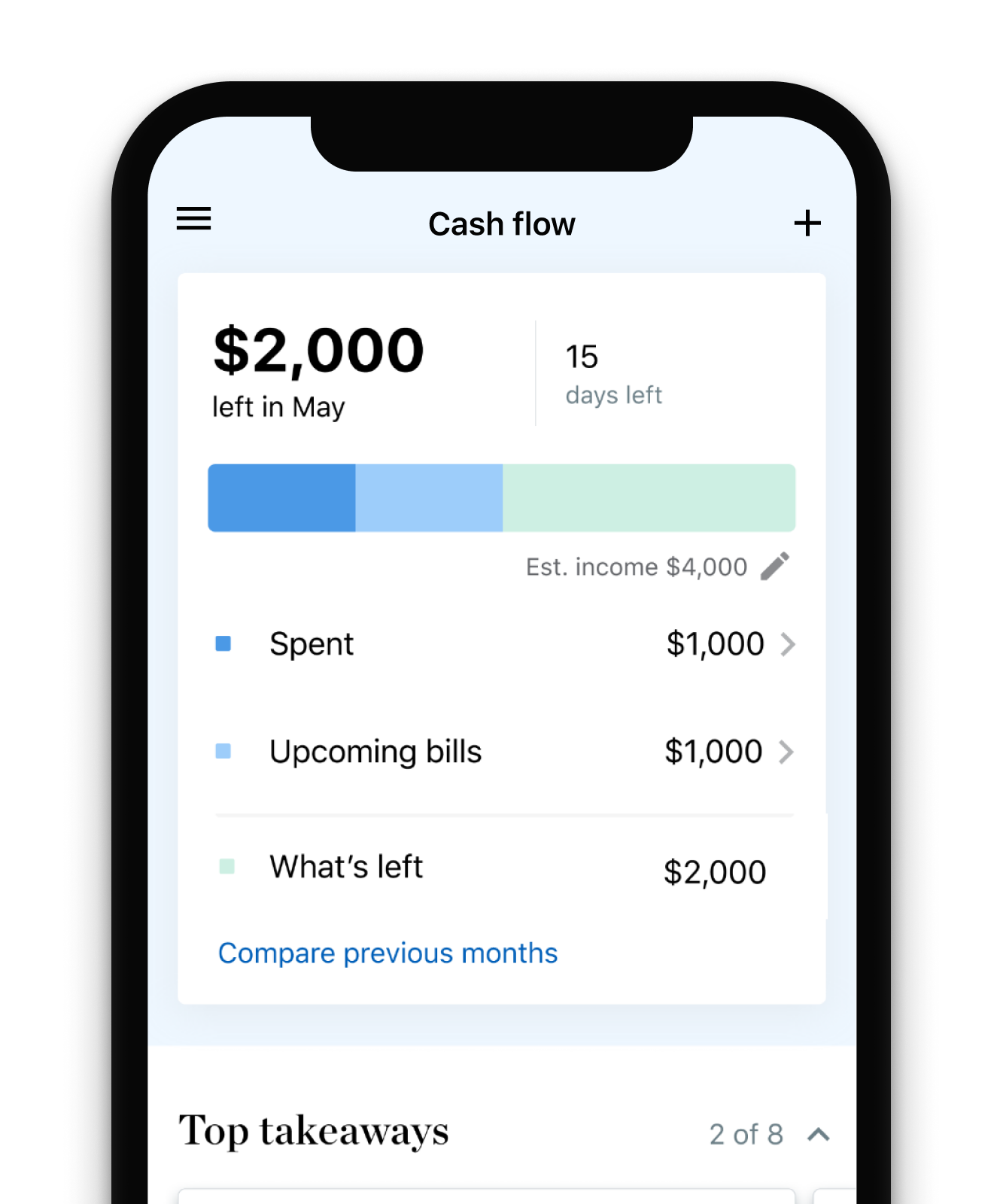

PocketGuard is a personal budget app that focuses on helping you save money. It syncs with your bank accounts and credit cards to track your spending, and it offers a unique feature called “In My Pocket,” which shows you how much money you have left to spend after you’ve paid your bills and set aside money for savings.

PocketGuard also offers personalized spending advice and alerts you when you’re overspending in a particular category. It is a free app, but it offers a premium version with additional features like unlimited categories and custom categories.

5. Clarity Money

Clarity Money is a free personal budget app that offers a range of features to help you manage your finances. It syncs with your bank accounts and credit cards to track your spending, and it offers personalized budgeting advice based on your financial goals.

One of the key benefits of using Clarity Money is that it offers a feature called “Cancel Subscriptions,” which shows you all the subscriptions you’re paying for and allows you to cancel them with a single click. It also offers a savings account with a competitive interest rate and a credit score monitoring service.

6. Goodbudget

Goodbudget is a personal budget app that uses the envelope budgeting method to help you manage your finances. It allows you to create virtual envelopes for each category of spending, such as groceries, rent, or entertainment, and allocate a certain amount of money to each envelope.

Goodbudget also offers features like syncing with your bank accounts and credit cards, goal tracking, and reports to help you see how you’re doing. It is a free app, but it offers a paid version with additional features like unlimited envelopes and syncing with more accounts.

7. Wally

Wally is a personal budget app that offers a range of features to help you track your spending and save money. It allows you to scan receipts to track your expenses, and it offers personalized budgeting advice based on your spending habits.

Wally also offers a feature called “Wally Gold,” which is a paid version of the app that offers additional features like bill tracking, custom categories, and exportable data. It is a free app, but the Wally Gold version costs $5.99 per month or $24.99 per year.

8. Spendee

Spendee is a personal budget app that offers a range of features to help you track your spending and save money. It allows you to sync with your bank accounts and credit cards to track your expenses, and it offers personalized budgeting advice based on your spending habits.

Spendee also offers a feature called “Shared Wallets,” which allows you to share your budget with family or friends. It is a free app, but it offers a paid version with additional features like unlimited wallets and categories.

9. Money Lover

Money Lover is a personal budget app that offers a range of features to help you manage your finances. It allows you to sync with your bank accounts and credit cards to track your expenses, and it offers personalized budgeting advice based on your spending habits.

Money Lover also offers a feature called “Debt and Loan Manager,” which allows you to track your debts and loans and set reminders for payments. It is a free app, but it offers a paid version with additional features like unlimited wallets and categories.

10. Honeydue

Honeydue is a personal budget app that is designed for couples to manage their finances together. It allows you to sync with your bank accounts and credit cards to track your expenses, and it offers personalized budgeting advice based on your spending habits.

Honeydue also offers features like bill tracking, shared accounts, and a chat feature to help you communicate with your partner about your finances. It is a free app, but it offers a paid version with additional features like custom categories and exportable data.

In conclusion, choosing the best personal budget app depends on your personal financial needs and goals. It’s important to consider factors like cost, features, and ease of use before making a decision. With the right personal budget app, you can take control of your finances and achieve your financial goals.

Frequently Asked Questions

Managing personal finances is crucial to achieve financial stability and success. One of the best ways to control expenses is by using a personal budget app. Here are some frequently asked questions about the best personal budget app.

What features should I look for in a personal budget app?

When choosing a personal budget app, it is essential to look for features that suit your financial needs. The app should allow you to track your income and expenses, set financial goals, and create a budget plan. It should also provide you with detailed reports, reminders, and alerts to keep you on track.

Moreover, the app should be user-friendly, secure, and compatible with your device. It is also necessary to check if the app offers customer support and has positive reviews from other users.

Are there any free personal budget apps available?

Yes, there are several free personal budget apps available that offer basic features to help you manage your finances. These apps include Mint, PocketGuard, Goodbudget, and Wally. However, some of these apps may have limited features, and you may need to upgrade to a paid version to access advanced features.

It is also important to note that some free apps may display advertisements, and you need to be cautious when sharing your personal and financial information with the app.

Can a personal budget app help me save money?

Yes, a personal budget app can help you save money by tracking your expenses, identifying areas where you overspend, and providing you with a budget plan to follow. The app can also remind you of your financial goals and motivate you to save more money.

Additionally, some budget apps offer features such as bill negotiation, cashback rewards, and investment opportunities that can help you save money and earn more from your finances.

What is the best personal budget app for beginners?

For beginners, the best personal budget app is the one that is easy to use, has a simple interface, and offers basic features to help you manage your finances. Apps like Mint, PocketGuard, and Wally are great options for beginners as they offer automatic categorization of expenses, budget tracking, and financial reports.

These apps also provide educational resources, tips, and advice on how to improve your financial health and achieve your financial goals.

Is it safe to use a personal budget app?

Yes, it is safe to use a personal budget app as long as you choose a reliable and secure app. Make sure to read the app’s privacy policy, terms and conditions, and security measures before using it. Avoid sharing your personal and financial information with untrusted sources and always use a strong password and two-factor authentication to secure your account.

It is also recommended to update the app regularly, avoid using public Wi-Fi, and monitor your bank and credit card statements for any suspicious activities.

Best Budgeting Apps for 2023 [Save Thousands!]

In conclusion, finding the best personal budget app ultimately depends on your unique financial needs and goals. Some apps may offer advanced features for investment tracking and debt repayment, while others may prioritize simplicity and ease of use. It’s important to research and compare different options to find the one that aligns with your budgeting style.

Ultimately, the best personal budget app is one that you will consistently use and that helps you achieve your financial objectives. Whether you prefer a free or paid app, one with a user-friendly interface, or one with more advanced features, there is likely an option out there that will work well for you. Take the time to explore your options and choose the app that will best support your financial success.

Remember, budgeting is a crucial aspect of personal finance, and using a reliable budgeting app can help you stay on track and achieve your financial goals. Whether you’re saving for a down payment on a house or paying off debt, utilizing a personal budget app can help you make progress towards your financial objectives and ultimately improve your overall financial well-being.