Managing your personal finances may seem like an overwhelming task, but it is essential for a secure future. Whether you are just starting out in your career or nearing retirement, these 10 personal finance tips can help you achieve your financial goals and build a solid foundation for your future.

From creating a budget to investing in your retirement, these tips cover all aspects of personal finance and can help you take control of your financial future. So, let’s dive in and discover the 10 essential personal finance tips for a secure future.

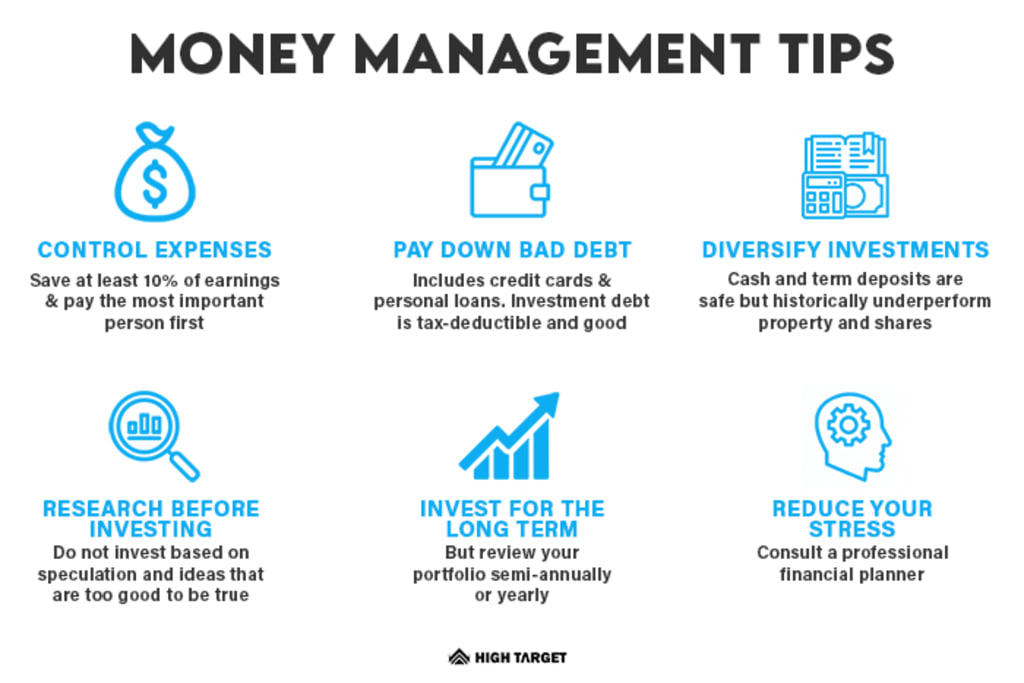

Securing your financial future is important, and these 10 essential personal finance tips can help. 1) Create a budget and track your expenses. 2) Build an emergency fund. 3) Pay off high-interest debt. 4) Save for retirement. 5) Invest wisely. 6) Protect your credit score. 7) Review your insurance coverage. 8) Set financial goals. 9) Learn to say no to unnecessary expenses. 10) Seek the help of a financial advisor.

10 Essential Personal Finance Tips for a Secure Future

Managing personal finances can be a daunting task, but it is crucial to ensure a secure future. Financial planning can help you achieve your goals, whether it’s saving for retirement, buying a home, or paying off debt. Here are ten essential personal finance tips to help you secure your financial future.

1. Create a Budget

A budget is a crucial tool for managing your finances. It allows you to track your income, expenses, and savings. Start by listing all your expenses, including rent/mortgage, utilities, groceries, transportation, and entertainment. Then, prioritize your spending, and set limits on discretionary expenses. Try to save at least 20% of your income each month.

Creating a budget can help you live within your means, reduce debt, and avoid overspending. Use budgeting software or apps to make the process easier.

2. Build an Emergency Fund

An emergency fund is a savings account set aside for unexpected expenses, such as a medical emergency or job loss. It should cover at least three to six months of living expenses. Start by setting up automatic transfers to your savings account each month. Consider a high-yield savings account to earn more interest.

Having an emergency fund can provide peace of mind and protect you from financial hardship.

3. Pay off Debt

Debt can be a significant obstacle to financial security. Start by prioritizing high-interest debt, such as credit cards, and pay them off as quickly as possible. Consider consolidating debt with a low-interest personal loan or balance transfer credit card.

Paying off debt can improve your credit score, reduce stress, and free up funds for savings and investments.

4. Invest for Retirement

Saving for retirement is critical to ensure financial security in your golden years. Start by contributing to a 401(k) or IRA account. Consider investing in low-cost index funds or target-date funds.

Investing for retirement can provide compound interest growth, tax benefits, and a reliable income stream in retirement.

5. Protect Your Assets

Protecting your assets is critical to ensure financial security. Consider purchasing insurance policies, such as health, life, auto, and home insurance. Review your policies annually to ensure adequate coverage.

Protecting your assets can prevent financial loss and provide peace of mind.

6. Live Below Your Means

Living below your means is a key strategy for financial security. Try to avoid lifestyle inflation, and resist the temptation to overspend on discretionary expenses. Consider downsizing your home or vehicle, or reducing dining out and entertainment expenses.

Living below your means can free up funds for savings and investments, reduce debt, and improve financial stability.

7. Diversify Your Investments

Diversifying your investments is a crucial strategy for reducing risk and maximizing returns. Consider investing in a mix of stocks, bonds, and alternative investments, such as real estate or commodities. Rebalance your portfolio annually to ensure adequate diversification.

Diversifying your investments can reduce risk, improve returns, and provide a stable income stream.

8. Educate Yourself

Educating yourself about personal finance is critical to making informed decisions. Read books, attend seminars, and consult with financial professionals to improve your knowledge. Consider taking online courses or earning certifications in financial planning or investing.

Education can provide valuable insights, improve decision-making, and increase financial confidence.

9. Avoid Impulse Purchases

Impulse purchases can derail your financial goals and lead to overspending. Before making a purchase, ask yourself if it’s a need or a want. Consider waiting 24 hours before making a purchase, and avoid shopping when you’re emotional or stressed.

Avoiding impulse purchases can improve financial discipline, reduce debt, and increase savings.

10. Review Your Finances Regularly

Reviewing your finances regularly is critical to ensuring you’re on track to meet your goals. Review your budget, savings, investments, and debt regularly. Consider working with a financial planner to develop a comprehensive financial plan.

Regular reviews can ensure you stay on track, adjust your strategy as needed, and achieve your financial goals.

In conclusion, following these ten essential personal finance tips can help you achieve financial security and peace of mind. By creating a budget, building an emergency fund, paying off debt, investing for retirement, protecting your assets, living below your means, diversifying your investments, educating yourself, avoiding impulse purchases, and reviewing your finances regularly, you can improve your financial stability and achieve your goals.

Frequently Asked Questions

What is the importance of personal finance management?

Personal finance management is crucial as it helps you make informed decisions about your money. It involves creating a budget, tracking expenses, saving money, investing, and managing debt. Proper personal finance management helps you achieve financial goals such as buying a house, starting a business, or planning for retirement. It also helps you avoid financial stress and live a comfortable life.

How can I start managing my personal finances?

The first step in managing your personal finances is to create a budget. Determine your monthly income and expenses, and allocate funds accordingly. Track your expenses and identify areas where you can cut back. Set financial goals and create a plan to achieve them. Consider saving money, investing, and managing debt. It’s also important to regularly review and adjust your financial plan as your circumstances change.

How can I improve my credit score?

Improving your credit score requires consistent effort over time. Start by paying your bills on time and in full. Keep your credit utilization ratio low by using less than 30% of your available credit. Avoid opening too many new accounts at once and maintain a long credit history. Check your credit report regularly for errors and dispute any inaccuracies. Consider using a secured credit card or becoming an authorized user on someone else’s account to build credit.

What are some ways to save money?

There are many ways to save money, such as creating a budget and tracking expenses, cutting back on unnecessary expenses, and negotiating bills and contracts. You can also save money by shopping around for the best deals on everyday items and services, using coupons and promo codes, and taking advantage of loyalty programs. Another way to save money is to automate your savings by setting up automatic transfers from your checking account to a savings account.

Why is it important to invest for the future?

Investing is important for the future as it allows your money to grow over time. It helps you beat inflation and earn a higher return on your investment than you would with a savings account or CD. Investing also helps you achieve long-term financial goals such as retirement, buying a house, or paying for your children’s education. However, investing involves risk, so it’s important to do your research and work with a financial advisor to create a diversified investment portfolio.

Master Your Money: 10 Personal Finance Tips for a Secure Future

In conclusion, securing your future financially is crucial, and following these 10 essential personal finance tips can help you achieve this goal. By creating a budget, managing your debt, and investing in your future, you can take control of your finances and build a secure future. Remember to prioritize saving, track your spending, and plan for retirement. With these tips in mind, you can take steps towards financial stability and enjoy a more secure future. So, start implementing these tips today, and watch your financial future flourish!